How Can Investors Evaluate Cryptocurrencies Other Than Bitcoin?

Understanding the landscape of cryptocurrencies beyond Bitcoin is essential for investors seeking diversification and growth opportunities. With thousands of digital assets available, evaluating their potential requires a strategic approach grounded in key factors such as market metrics, technological innovation, regulatory context, and market dynamics. This guide aims to provide clarity on how to assess these digital assets effectively.

Assessing Market Capitalization and Liquidity

Market capitalization remains one of the most straightforward indicators of a cryptocurrency’s size and stability. It reflects the total value of all circulating coins or tokens and can signal investor confidence. Larger market caps often correlate with higher liquidity, meaning assets can be bought or sold quickly without causing significant price fluctuations. For example, Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) have experienced notable increases in market cap recently, making them more attractive options for investors looking for established projects with growth potential.

Liquidity is equally important because it affects trading flexibility. High liquidity reduces risks associated with large price swings during transactions and allows investors to enter or exit positions smoothly. The expansion of stablecoins like Tether (USDT) has contributed significantly to liquidity pools within crypto markets—offering a perceived safe haven amid volatility—and attracting both retail and institutional traders.

Evaluating Adoption Rates

Adoption rate measures how widely a cryptocurrency is being used by individuals, businesses, financial institutions, or governments. A high adoption rate indicates that the asset has practical utility beyond speculation—such as facilitating cross-border payments or powering decentralized applications—which enhances its long-term viability.

Recent developments show increasing corporate interest; for instance, Meta's exploration into integrating stablecoins into its platforms could dramatically boost adoption rates by enabling seamless international transactions for content creators worldwide. Such moves not only validate the technology but also expand user bases rapidly.

Understanding Regulatory Environments

The legal framework surrounding cryptocurrencies varies significantly across jurisdictions—and this variability influences investment decisions profoundly. Favorable regulations tend to attract more institutional participation by providing clarity on compliance requirements while reducing risks associated with legal uncertainties.

For example, BlackRock’s recent investment in Circle Internet—the issuer behind USDC stablecoin—signals growing institutional confidence supported by clearer regulatory pathways in certain regions like the United States. Conversely, ambiguous or restrictive policies can hinder growth prospects and lead to increased volatility due to sudden regulatory crackdowns or bans.

Technological Innovation: The Backbone of Growth

Technological advancements are crucial drivers shaping the future trajectory of cryptocurrencies other than Bitcoin. Innovations such as improved scalability solutions—like those seen with Solana’s high-throughput blockchain—or interoperability features exemplified by Polkadot enable different networks to communicate seamlessly.

These technological improvements enhance security protocols while expanding usability—for developers creating decentralized apps (dApps) or enterprises adopting blockchain solutions—making these assets more appealing from an investor perspective who values innovation-driven growth potential.

Recent Developments Impacting Market Dynamics

Partnerships between crypto projects and mainstream companies are increasingly common; they serve as validation points that can accelerate adoption rates further down the line.

- For instance: X partnered with Polymarket introduces real-time prediction markets that foster user engagement.

- Stablecoin markets have surged from $20 billion in 2020 to over $246 billion today according to Deutsche Bank research—a testament to their growing importance within crypto ecosystems.

- Institutional investments continue rising; BlackRock’s backing of USDC signals mainstream acceptance.

- Blockchain innovations like Solana's scalability improvements attract developers seeking efficient platforms capable of handling complex applications at scale.

These recent trends highlight an evolving ecosystem where strategic partnerships and technological progress play pivotal roles in shaping future opportunities but also introduce new challenges requiring careful analysis by investors aiming for sustainable gains.

Risks That Could Affect Cryptocurrency Valuations

While promising prospects exist outside Bitcoin’s dominance, several risks warrant attention:

- Regulatory Risks: Uncertain legal environments may lead to sudden restrictions impacting asset prices negatively.

- Market Volatility: Cryptocurrencies are known for sharp price swings driven by sentiment shifts or macroeconomic factors.

- Security Concerns: Hacks targeting exchanges or wallets undermine trust; recent breaches have caused significant losses across various projects.

- Competitive Landscape: Rapid technological advancements mean new entrants could disrupt existing leaders’ positions quickly if they offer superior features or better security measures.

Investors must weigh these risks carefully against potential rewards when diversifying into alternative cryptocurrencies.

Identifying Opportunities Through Due Diligence

To make informed decisions about investing outside Bitcoin:

- Analyze project fundamentals—including whitepapers detailing technology use cases

- Monitor development activity on repositories like GitHub

- Review community engagement levels across social media channels

- Stay updated on regulatory news affecting specific jurisdictions5.. Evaluate partnership announcements indicating industry validation

Combining technical analysis with fundamental insights ensures a balanced approach aligned with best practices recommended by financial experts specializing in digital assets.

Staying Ahead With Continuous Learning

The cryptocurrency space evolves rapidly; therefore,investors should commit ongoing education through reputable sources such as industry reports,regulatory updates,and expert analyses from trusted voices within blockchain communities.This proactive stance helps mitigate risks associated with misinformation while identifying emerging trends early enough for strategic positioning.

Final Thoughts on Evaluating Non-Bitcoin Cryptocurrencies

Assessing alternative cryptocurrencies involves examining multiple dimensions—from market metrics like capitalization and liquidity—to innovative aspects such as technology upgrades and real-world adoption initiatives—all within an evolving regulatory landscape that influences overall stability and growth prospects.

By maintaining diligent research practices combined with awareness of current developments—including partnerships fostering mainstream acceptance—and understanding inherent risks—investors can better navigate this dynamic environment toward making informed investment choices aligned with their risk tolerance levels.

Lo

2025-06-09 05:09

How can investors evaluate cryptocurrencies other than Bitcoin?

How Can Investors Evaluate Cryptocurrencies Other Than Bitcoin?

Understanding the landscape of cryptocurrencies beyond Bitcoin is essential for investors seeking diversification and growth opportunities. With thousands of digital assets available, evaluating their potential requires a strategic approach grounded in key factors such as market metrics, technological innovation, regulatory context, and market dynamics. This guide aims to provide clarity on how to assess these digital assets effectively.

Assessing Market Capitalization and Liquidity

Market capitalization remains one of the most straightforward indicators of a cryptocurrency’s size and stability. It reflects the total value of all circulating coins or tokens and can signal investor confidence. Larger market caps often correlate with higher liquidity, meaning assets can be bought or sold quickly without causing significant price fluctuations. For example, Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) have experienced notable increases in market cap recently, making them more attractive options for investors looking for established projects with growth potential.

Liquidity is equally important because it affects trading flexibility. High liquidity reduces risks associated with large price swings during transactions and allows investors to enter or exit positions smoothly. The expansion of stablecoins like Tether (USDT) has contributed significantly to liquidity pools within crypto markets—offering a perceived safe haven amid volatility—and attracting both retail and institutional traders.

Evaluating Adoption Rates

Adoption rate measures how widely a cryptocurrency is being used by individuals, businesses, financial institutions, or governments. A high adoption rate indicates that the asset has practical utility beyond speculation—such as facilitating cross-border payments or powering decentralized applications—which enhances its long-term viability.

Recent developments show increasing corporate interest; for instance, Meta's exploration into integrating stablecoins into its platforms could dramatically boost adoption rates by enabling seamless international transactions for content creators worldwide. Such moves not only validate the technology but also expand user bases rapidly.

Understanding Regulatory Environments

The legal framework surrounding cryptocurrencies varies significantly across jurisdictions—and this variability influences investment decisions profoundly. Favorable regulations tend to attract more institutional participation by providing clarity on compliance requirements while reducing risks associated with legal uncertainties.

For example, BlackRock’s recent investment in Circle Internet—the issuer behind USDC stablecoin—signals growing institutional confidence supported by clearer regulatory pathways in certain regions like the United States. Conversely, ambiguous or restrictive policies can hinder growth prospects and lead to increased volatility due to sudden regulatory crackdowns or bans.

Technological Innovation: The Backbone of Growth

Technological advancements are crucial drivers shaping the future trajectory of cryptocurrencies other than Bitcoin. Innovations such as improved scalability solutions—like those seen with Solana’s high-throughput blockchain—or interoperability features exemplified by Polkadot enable different networks to communicate seamlessly.

These technological improvements enhance security protocols while expanding usability—for developers creating decentralized apps (dApps) or enterprises adopting blockchain solutions—making these assets more appealing from an investor perspective who values innovation-driven growth potential.

Recent Developments Impacting Market Dynamics

Partnerships between crypto projects and mainstream companies are increasingly common; they serve as validation points that can accelerate adoption rates further down the line.

- For instance: X partnered with Polymarket introduces real-time prediction markets that foster user engagement.

- Stablecoin markets have surged from $20 billion in 2020 to over $246 billion today according to Deutsche Bank research—a testament to their growing importance within crypto ecosystems.

- Institutional investments continue rising; BlackRock’s backing of USDC signals mainstream acceptance.

- Blockchain innovations like Solana's scalability improvements attract developers seeking efficient platforms capable of handling complex applications at scale.

These recent trends highlight an evolving ecosystem where strategic partnerships and technological progress play pivotal roles in shaping future opportunities but also introduce new challenges requiring careful analysis by investors aiming for sustainable gains.

Risks That Could Affect Cryptocurrency Valuations

While promising prospects exist outside Bitcoin’s dominance, several risks warrant attention:

- Regulatory Risks: Uncertain legal environments may lead to sudden restrictions impacting asset prices negatively.

- Market Volatility: Cryptocurrencies are known for sharp price swings driven by sentiment shifts or macroeconomic factors.

- Security Concerns: Hacks targeting exchanges or wallets undermine trust; recent breaches have caused significant losses across various projects.

- Competitive Landscape: Rapid technological advancements mean new entrants could disrupt existing leaders’ positions quickly if they offer superior features or better security measures.

Investors must weigh these risks carefully against potential rewards when diversifying into alternative cryptocurrencies.

Identifying Opportunities Through Due Diligence

To make informed decisions about investing outside Bitcoin:

- Analyze project fundamentals—including whitepapers detailing technology use cases

- Monitor development activity on repositories like GitHub

- Review community engagement levels across social media channels

- Stay updated on regulatory news affecting specific jurisdictions5.. Evaluate partnership announcements indicating industry validation

Combining technical analysis with fundamental insights ensures a balanced approach aligned with best practices recommended by financial experts specializing in digital assets.

Staying Ahead With Continuous Learning

The cryptocurrency space evolves rapidly; therefore,investors should commit ongoing education through reputable sources such as industry reports,regulatory updates,and expert analyses from trusted voices within blockchain communities.This proactive stance helps mitigate risks associated with misinformation while identifying emerging trends early enough for strategic positioning.

Final Thoughts on Evaluating Non-Bitcoin Cryptocurrencies

Assessing alternative cryptocurrencies involves examining multiple dimensions—from market metrics like capitalization and liquidity—to innovative aspects such as technology upgrades and real-world adoption initiatives—all within an evolving regulatory landscape that influences overall stability and growth prospects.

By maintaining diligent research practices combined with awareness of current developments—including partnerships fostering mainstream acceptance—and understanding inherent risks—investors can better navigate this dynamic environment toward making informed investment choices aligned with their risk tolerance levels.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Risks Associated with USDC?

Understanding the risks linked to USD Coin (USDC) is essential for investors, traders, and users of stablecoins. While USDC is designed to offer stability by pegging its value to the US dollar, it is not immune to various vulnerabilities that could impact its reliability and trustworthiness. This article explores these risks in detail, providing a comprehensive overview based on recent developments and industry insights.

Market Volatility and Depegging Risks

Although USDC aims to maintain a 1:1 peg with the US dollar, market volatility can still pose significant threats. Stablecoins rely heavily on their reserves and mechanisms for maintaining price stability. If confidence in the peg diminishes—due to economic shocks or systemic issues—USDC could experience a depegging event where its value drops below or rises above $1.

Such events can be triggered by liquidity crises, sudden market sell-offs, or loss of trust among users. A depegging not only affects individual investors but can also have ripple effects across the broader cryptocurrency ecosystem by undermining confidence in stablecoins as a whole.

Regulatory Scrutiny and Legal Risks

Regulatory environments around stablecoins like USDC are evolving rapidly. Governments worldwide are scrutinizing these digital assets more closely due to concerns over money laundering, fraud prevention, consumer protection, and financial stability. Increased regulation could lead to stricter compliance requirements such as enhanced KYC (Know Your Customer) procedures or reserve transparency mandates.

While regulation aims to improve legitimacy and reduce illicit activities associated with cryptocurrencies, it also introduces operational challenges for issuers like Circle and Coinbase—the entities behind USDC. Regulatory actions might restrict certain uses of stablecoins or impose limits that affect their liquidity pools or issuance processes.

Liquidity Challenges

The core strength of any stablecoin lies in its ability to quickly convert between fiat currency and digital tokens without significant price slippage. However, if there is a sudden surge in demand or an unexpected withdrawal from reserves—perhaps during market stress—it could strain liquidity pools backing USDC.

A lack of sufficient fiat reserves would threaten its peg stability; this risk underscores why transparent reserve management practices are critical for maintaining user trust. Any doubts about reserve adequacy can lead users to withdraw en masse—a classic bank run scenario—that may result in depegging.

Operational Failures

Technical glitches or operational failures represent another layer of risk for stablecoins like USDC. These issues might include smart contract bugs, security breaches targeting custodial wallets holding reserves, or infrastructure outages disrupting transaction processing.

Such failures can temporarily impair redemption processes or cause delays that erode user confidence. In worst-case scenarios involving security breaches leading to thefts from reserve accounts—or compromised smart contracts—the integrity of the entire system could be questioned.

Impact of External Events on Stability

External factors such as macroeconomic shifts—including inflation rates—and geopolitical tensions may indirectly influence stablecoin stability by affecting investor sentiment toward cryptocurrencies overall. For instance:

- Market downturns may prompt panic selling.

- Regulatory crackdowns might limit usage.

- Banking restrictions on crypto-related transactions could hinder access points for converting between fiat currencies and stablecoins like USDC.

These external pressures highlight how interconnected global financial systems are with cryptocurrency markets—and why vigilance remains crucial when dealing with assets pegged closely but not perfectly aligned with traditional currencies.

Recent Developments That Influence Risk Profile

Recent news highlights both opportunities and challenges facing USDC:

- Meta’s exploration into integrating stablecoins such as USDC into social media platforms signals potential growth avenues but also raises questions about regulatory oversight.

- Ongoing regulatory scrutiny emphasizes compliance risks; failure here could result in restrictions impacting usability.

- The possibility of depegging events remains an ever-present concern amid market volatility episodes—especially if confidence wanes due to unforeseen operational issues or regulatory interventions.

These developments underscore that while innovation drives adoption forward—for example through corporate integrations—they also introduce new layers of risk requiring careful monitoring by stakeholders involved with USDC holdings.

Managing Risks When Using Stablecoins Like USDC

Given these vulnerabilities—from market fluctuations through regulatory changes—it’s vital for users engaged with USD Coin (USDC) to adopt robust risk management strategies:

- Regularly monitor reserve disclosures issued by issuers such as Circle.

- Stay informed about evolving regulations affecting crypto assets within your jurisdiction.

- Use reputable exchanges offering secure redemption options during periods of high volatility.

- Diversify holdings across different asset classes beyond just cryptocurrencies.

By understanding potential pitfalls ahead—and actively managing exposure—users can better safeguard their investments against unforeseen disruptions related specifically—or indirectly—to stablecoin operations.

Final Thoughts: Navigating Stability Amid Uncertainty

While USD Coin offers numerous advantages—including ease of transferability within crypto markets—it carries inherent risks tied primarily to external shocks rather than intrinsic flaws alone. Its reliance on adequate reserves combined with ongoing regulatory oversight makes it susceptible at times despite being designed for stability purposes.

Staying informed about recent developments—from corporate initiatives like Meta’s exploration into blockchain payments—to emerging regulatory frameworks helps users anticipate possible impacts before they materialize fully online . As always when engaging with digital assets rooted partly in traditional finance structures , prudent risk assessment remains essential — especially given how swiftly this landscape continues evolving.

JCUSER-IC8sJL1q

2025-05-29 09:17

What are the risks associated with USDC?

What Are the Risks Associated with USDC?

Understanding the risks linked to USD Coin (USDC) is essential for investors, traders, and users of stablecoins. While USDC is designed to offer stability by pegging its value to the US dollar, it is not immune to various vulnerabilities that could impact its reliability and trustworthiness. This article explores these risks in detail, providing a comprehensive overview based on recent developments and industry insights.

Market Volatility and Depegging Risks

Although USDC aims to maintain a 1:1 peg with the US dollar, market volatility can still pose significant threats. Stablecoins rely heavily on their reserves and mechanisms for maintaining price stability. If confidence in the peg diminishes—due to economic shocks or systemic issues—USDC could experience a depegging event where its value drops below or rises above $1.

Such events can be triggered by liquidity crises, sudden market sell-offs, or loss of trust among users. A depegging not only affects individual investors but can also have ripple effects across the broader cryptocurrency ecosystem by undermining confidence in stablecoins as a whole.

Regulatory Scrutiny and Legal Risks

Regulatory environments around stablecoins like USDC are evolving rapidly. Governments worldwide are scrutinizing these digital assets more closely due to concerns over money laundering, fraud prevention, consumer protection, and financial stability. Increased regulation could lead to stricter compliance requirements such as enhanced KYC (Know Your Customer) procedures or reserve transparency mandates.

While regulation aims to improve legitimacy and reduce illicit activities associated with cryptocurrencies, it also introduces operational challenges for issuers like Circle and Coinbase—the entities behind USDC. Regulatory actions might restrict certain uses of stablecoins or impose limits that affect their liquidity pools or issuance processes.

Liquidity Challenges

The core strength of any stablecoin lies in its ability to quickly convert between fiat currency and digital tokens without significant price slippage. However, if there is a sudden surge in demand or an unexpected withdrawal from reserves—perhaps during market stress—it could strain liquidity pools backing USDC.

A lack of sufficient fiat reserves would threaten its peg stability; this risk underscores why transparent reserve management practices are critical for maintaining user trust. Any doubts about reserve adequacy can lead users to withdraw en masse—a classic bank run scenario—that may result in depegging.

Operational Failures

Technical glitches or operational failures represent another layer of risk for stablecoins like USDC. These issues might include smart contract bugs, security breaches targeting custodial wallets holding reserves, or infrastructure outages disrupting transaction processing.

Such failures can temporarily impair redemption processes or cause delays that erode user confidence. In worst-case scenarios involving security breaches leading to thefts from reserve accounts—or compromised smart contracts—the integrity of the entire system could be questioned.

Impact of External Events on Stability

External factors such as macroeconomic shifts—including inflation rates—and geopolitical tensions may indirectly influence stablecoin stability by affecting investor sentiment toward cryptocurrencies overall. For instance:

- Market downturns may prompt panic selling.

- Regulatory crackdowns might limit usage.

- Banking restrictions on crypto-related transactions could hinder access points for converting between fiat currencies and stablecoins like USDC.

These external pressures highlight how interconnected global financial systems are with cryptocurrency markets—and why vigilance remains crucial when dealing with assets pegged closely but not perfectly aligned with traditional currencies.

Recent Developments That Influence Risk Profile

Recent news highlights both opportunities and challenges facing USDC:

- Meta’s exploration into integrating stablecoins such as USDC into social media platforms signals potential growth avenues but also raises questions about regulatory oversight.

- Ongoing regulatory scrutiny emphasizes compliance risks; failure here could result in restrictions impacting usability.

- The possibility of depegging events remains an ever-present concern amid market volatility episodes—especially if confidence wanes due to unforeseen operational issues or regulatory interventions.

These developments underscore that while innovation drives adoption forward—for example through corporate integrations—they also introduce new layers of risk requiring careful monitoring by stakeholders involved with USDC holdings.

Managing Risks When Using Stablecoins Like USDC

Given these vulnerabilities—from market fluctuations through regulatory changes—it’s vital for users engaged with USD Coin (USDC) to adopt robust risk management strategies:

- Regularly monitor reserve disclosures issued by issuers such as Circle.

- Stay informed about evolving regulations affecting crypto assets within your jurisdiction.

- Use reputable exchanges offering secure redemption options during periods of high volatility.

- Diversify holdings across different asset classes beyond just cryptocurrencies.

By understanding potential pitfalls ahead—and actively managing exposure—users can better safeguard their investments against unforeseen disruptions related specifically—or indirectly—to stablecoin operations.

Final Thoughts: Navigating Stability Amid Uncertainty

While USD Coin offers numerous advantages—including ease of transferability within crypto markets—it carries inherent risks tied primarily to external shocks rather than intrinsic flaws alone. Its reliance on adequate reserves combined with ongoing regulatory oversight makes it susceptible at times despite being designed for stability purposes.

Staying informed about recent developments—from corporate initiatives like Meta’s exploration into blockchain payments—to emerging regulatory frameworks helps users anticipate possible impacts before they materialize fully online . As always when engaging with digital assets rooted partly in traditional finance structures , prudent risk assessment remains essential — especially given how swiftly this landscape continues evolving.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Place a Limit Order on TradingView: A Step-by-Step Guide

Placing a limit order is a fundamental strategy for traders looking to execute trades at specific prices. Whether you are trading stocks, cryptocurrencies, or other assets on TradingView, understanding how to effectively set and manage limit orders can significantly improve your trading outcomes. This guide provides a clear overview of the process, recent platform updates, and potential risks involved.

What Is a Limit Order?

A limit order is an instruction to buy or sell an asset at a predetermined price or better. Unlike market orders that execute immediately at the current market price, limit orders only trigger when the asset reaches your specified price point. For example, if you want to buy Bitcoin at $30,000 but not higher, you would place a buy limit order with that exact price. The order remains pending until the market hits that level or your specified expiration time.

Limit orders are especially useful in volatile markets like cryptocurrencies where prices can fluctuate rapidly within short periods. They allow traders to control entry and exit points more precisely while avoiding unfavorable execution prices often associated with market orders.

Accessing TradingView for Limit Orders

TradingView offers both web-based and mobile platforms designed for user-friendly navigation and comprehensive chart analysis. To place a limit order:

- Log into your TradingView account via their website or mobile app.

- Navigate through the interface to select your desired financial instrument—be it stocks, crypto assets, forex pairs, etc.

- Use the search bar by entering the asset’s symbol (e.g., BTCUSD) or browse through available markets.

Once you've selected an asset:

- Click on "Trade" or "Order" buttons typically located near charts.

- Open the order window where you'll specify trade details such as quantity and price.

This streamlined process ensures traders can quickly move from analysis to execution without unnecessary delays.

How To Set Up Your Limit Order

After accessing the trading interface:

1. Choose 'Limit' as Your Order Type

Most platforms default to 'Market' orders; ensure you switch this setting explicitly to 'Limit.' This indicates you're setting specific conditions under which your trade will execute rather than accepting current market prices.

2. Enter Quantity

Specify how many units of an asset you'd like to buy or sell—this could be shares in stocks or units in cryptocurrencies.

3. Set Your Price

Input your desired execution price—the maximum you're willing (for buys) or minimum you're willing (for sells). Be precise here; small differences can impact whether your order gets filled quickly.

4. Select Time-in-Force Options

Decide how long your limit order remains active:

- GTC (Good Till Cancelled): Remains until manually canceled.

- GTD (Good Till Date): Expires after set date/time.

- Day: Cancels automatically if not filled during trading day.

Review all details carefully before submitting because once placed, these parameters govern how and when your trade executes.

Recent Platform Enhancements & Market Dynamics

TradingView has continually upgraded its features over recent years—adding advanced charting tools like drawing tools for technical analysis and improved risk management options such as stop-loss/take-profit settings integrated directly into their platform interface. These enhancements help traders make more informed decisions when placing limit orders based on real-time data insights rather than guesswork alone.

The cryptocurrency sector has experienced heightened volatility lately due to macroeconomic factors and regulatory shifts worldwide—a situation that amplifies reliance on strategic entry/exit points provided by limit orders for managing risk effectively amid rapid swings in prices across exchanges globally.

Additionally, regulatory changes have influenced how exchanges handle different types of orders including limits; some jurisdictions now impose stricter rules around execution times which may affect overall trading strategies involving these instructions.

Risks Associated With Limit Orders

While placing limits offers precision control over trades:

Market Liquidity: Large volumes of pending limit orders can temporarily distort supply-demand dynamics within certain assets’ markets leading potentially unpredictable short-term movements.

Order Execution Failures: If market conditions do not reach specified levels before expiration—or if they change suddenly—you might miss out entirely on intended trades resulting in opportunity costs.

Technological Glitches: Technical issues such as server outages during high-volatility periods could prevent timely placement/execution of critical trades—highlighting importance of choosing reliable platforms like TradingView with robust infrastructure.

Understanding these risks helps traders develop contingency plans—for example using alerts alongside limits—to mitigate potential downsides effectively.

Managing Expectations When Using Limit Orders

Successful use of limited instructions requires patience and strategic planning:

- Always monitor broader market trends alongside individual asset behavior before setting target prices.

- Use supplementary tools such as alerts so you're notified when assets approach desired levels—even if initial limits aren’t triggered immediately.

- Regularly review open positions; adjust limits based on evolving technical signals or fundamental news events impacting markets.

By combining disciplined planning with real-time data insights offered by platforms like TradingView—and staying aware of potential pitfalls—you enhance chances for successful trade executions aligned with personal investment goals.

Placing a limit order via TradingView is straightforward once familiarized with its interface features—from selecting appropriate assets and specifying precise parameters down to understanding recent platform updates and inherent risks involved in this strategy type. Mastery over this tool empowers traders seeking greater control over their entries/exits while navigating complex financial landscapes efficiently—and ultimately supports building resilient trading practices grounded in informed decision-making processes.

kai

2025-05-26 21:38

How do I place a limit order via TradingView?

How to Place a Limit Order on TradingView: A Step-by-Step Guide

Placing a limit order is a fundamental strategy for traders looking to execute trades at specific prices. Whether you are trading stocks, cryptocurrencies, or other assets on TradingView, understanding how to effectively set and manage limit orders can significantly improve your trading outcomes. This guide provides a clear overview of the process, recent platform updates, and potential risks involved.

What Is a Limit Order?

A limit order is an instruction to buy or sell an asset at a predetermined price or better. Unlike market orders that execute immediately at the current market price, limit orders only trigger when the asset reaches your specified price point. For example, if you want to buy Bitcoin at $30,000 but not higher, you would place a buy limit order with that exact price. The order remains pending until the market hits that level or your specified expiration time.

Limit orders are especially useful in volatile markets like cryptocurrencies where prices can fluctuate rapidly within short periods. They allow traders to control entry and exit points more precisely while avoiding unfavorable execution prices often associated with market orders.

Accessing TradingView for Limit Orders

TradingView offers both web-based and mobile platforms designed for user-friendly navigation and comprehensive chart analysis. To place a limit order:

- Log into your TradingView account via their website or mobile app.

- Navigate through the interface to select your desired financial instrument—be it stocks, crypto assets, forex pairs, etc.

- Use the search bar by entering the asset’s symbol (e.g., BTCUSD) or browse through available markets.

Once you've selected an asset:

- Click on "Trade" or "Order" buttons typically located near charts.

- Open the order window where you'll specify trade details such as quantity and price.

This streamlined process ensures traders can quickly move from analysis to execution without unnecessary delays.

How To Set Up Your Limit Order

After accessing the trading interface:

1. Choose 'Limit' as Your Order Type

Most platforms default to 'Market' orders; ensure you switch this setting explicitly to 'Limit.' This indicates you're setting specific conditions under which your trade will execute rather than accepting current market prices.

2. Enter Quantity

Specify how many units of an asset you'd like to buy or sell—this could be shares in stocks or units in cryptocurrencies.

3. Set Your Price

Input your desired execution price—the maximum you're willing (for buys) or minimum you're willing (for sells). Be precise here; small differences can impact whether your order gets filled quickly.

4. Select Time-in-Force Options

Decide how long your limit order remains active:

- GTC (Good Till Cancelled): Remains until manually canceled.

- GTD (Good Till Date): Expires after set date/time.

- Day: Cancels automatically if not filled during trading day.

Review all details carefully before submitting because once placed, these parameters govern how and when your trade executes.

Recent Platform Enhancements & Market Dynamics

TradingView has continually upgraded its features over recent years—adding advanced charting tools like drawing tools for technical analysis and improved risk management options such as stop-loss/take-profit settings integrated directly into their platform interface. These enhancements help traders make more informed decisions when placing limit orders based on real-time data insights rather than guesswork alone.

The cryptocurrency sector has experienced heightened volatility lately due to macroeconomic factors and regulatory shifts worldwide—a situation that amplifies reliance on strategic entry/exit points provided by limit orders for managing risk effectively amid rapid swings in prices across exchanges globally.

Additionally, regulatory changes have influenced how exchanges handle different types of orders including limits; some jurisdictions now impose stricter rules around execution times which may affect overall trading strategies involving these instructions.

Risks Associated With Limit Orders

While placing limits offers precision control over trades:

Market Liquidity: Large volumes of pending limit orders can temporarily distort supply-demand dynamics within certain assets’ markets leading potentially unpredictable short-term movements.

Order Execution Failures: If market conditions do not reach specified levels before expiration—or if they change suddenly—you might miss out entirely on intended trades resulting in opportunity costs.

Technological Glitches: Technical issues such as server outages during high-volatility periods could prevent timely placement/execution of critical trades—highlighting importance of choosing reliable platforms like TradingView with robust infrastructure.

Understanding these risks helps traders develop contingency plans—for example using alerts alongside limits—to mitigate potential downsides effectively.

Managing Expectations When Using Limit Orders

Successful use of limited instructions requires patience and strategic planning:

- Always monitor broader market trends alongside individual asset behavior before setting target prices.

- Use supplementary tools such as alerts so you're notified when assets approach desired levels—even if initial limits aren’t triggered immediately.

- Regularly review open positions; adjust limits based on evolving technical signals or fundamental news events impacting markets.

By combining disciplined planning with real-time data insights offered by platforms like TradingView—and staying aware of potential pitfalls—you enhance chances for successful trade executions aligned with personal investment goals.

Placing a limit order via TradingView is straightforward once familiarized with its interface features—from selecting appropriate assets and specifying precise parameters down to understanding recent platform updates and inherent risks involved in this strategy type. Mastery over this tool empowers traders seeking greater control over their entries/exits while navigating complex financial landscapes efficiently—and ultimately supports building resilient trading practices grounded in informed decision-making processes.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is a Cryptocurrency Trading Platform?

A cryptocurrency trading platform, often referred to as a crypto exchange, is an online marketplace where individuals and institutions can buy, sell, and trade digital currencies. These platforms serve as the primary interface for accessing the rapidly growing world of cryptocurrencies like Bitcoin, Ethereum, Ripple, and many others. They provide a secure environment that facilitates transactions while offering tools for managing digital assets efficiently.

Understanding how these platforms work is essential for anyone interested in investing or trading cryptocurrencies. They operate similarly to traditional stock exchanges but are tailored specifically for digital assets. Users create accounts on these platforms, deposit funds—either fiat currency or cryptocurrencies—and execute trades through user-friendly interfaces or advanced trading tools.

Types of Cryptocurrency Trading Platforms

There are three main categories of cryptocurrency trading platforms:

Centralized Exchanges (CEXs):

These are the most prevalent type of crypto exchanges. Centralized exchanges act as intermediaries that hold users’ funds and facilitate trades between buyers and sellers. They typically offer high liquidity, fast transaction speeds, and user-friendly interfaces suitable for beginners. Examples include Coinbase, Binance, Kraken, and Bitstamp.Decentralized Exchanges (DEXs):

Operating directly on blockchain networks without an intermediary authority distinguishes DEXs from CEXs. They enable peer-to-peer trading where users retain control over their private keys until they execute a trade. While DEXs generally offer enhanced security due to their decentralized nature—reducing risks like hacking—they tend to have steeper learning curves and lower liquidity levels compared to centralized counterparts. Notable examples include Uniswap and SushiSwap.Hybrid Exchanges:

Combining features from both CEXs and DEXs, hybrid platforms aim to balance security with usability by offering some centralized features alongside decentralized elements such as non-custodial wallets or smart contract-based transactions.

Key Features Offered by Crypto Trading Platforms

Most cryptocurrency exchanges provide several core features designed to enhance user experience:

Trading Pairs:

Platforms support various pairs allowing traders to swap one cryptocurrency for another—for example BTC/USDT or ETH/BTC—enabling diverse trading strategies based on market conditions.Fiat Currency Support:

Many exchanges allow direct fiat-to-crypto transactions using currencies like USD, EUR, JPY etc., making it easier for new investors to enter the market without needing prior crypto holdings.Derivatives & Margin Trading:

Advanced traders can access derivatives such as futures contracts or options which enable speculation on price movements with leverage—though this involves higher risk levels requiring careful risk management strategies.Security Measures:

To protect assets against theft or hacking incidents—which have occurred historically—platform providers implement robust security protocols including two-factor authentication (2FA), cold storage solutions (offline wallets), encryption standards,and insurance policies where applicable.

Regulatory Environment & Challenges

The regulatory landscape surrounding cryptocurrency trading platforms remains complex worldwide due to varying legal frameworks across jurisdictions; this influences how these entities operate legally within different countries.In regions like the United States , authorities such as the Securities and Exchange Commission (SEC) actively scrutinize operations—including recent enforcement actions against firms involved in alleged fraud—to ensure compliance with financial laws.Other nations like Japan , Singapore ,and Switzerland have established clearer guidelines aimed at fostering innovation while safeguarding consumers through licensing requirementsand anti-money laundering measures.However , regulatory uncertainty continues to pose challenges: stricter rules could lead some unregulated platforms out of business while also increasing compliance costs even among compliant operators.

Recent Industry Developments & Risks

The industry has experienced notable events impacting trustworthiness:

- Data breaches remain a significant concern; Coinbase disclosed in May 2025 that cybercriminals bribed support agents overseas leading to sensitive customer data being compromised—a reminder of ongoing cybersecurity threats.

- Market volatility persists; rapid price swings can result in substantial gains but also severe losses if traders do not employ proper risk management techniques.

- Technological advancements such as blockchain upgrades improve transaction efficiency but also introduce new vulnerabilities if not properly implemented.These developments underscore why users must prioritize security practices—including enabling two-factor authentication—and stay informed about industry news.

Potential Risks Facing Traders & Platforms

While cryptocurrency trading offers lucrative opportunities,it carries inherent risks:• Regulatory changes may restrict accessor impose additional compliance burdens• Security breaches could leadto lossof fundsor personal information• Market volatility increases unpredictabilityand potential financial losses• Lack of transparencyin some unregulated markets heightens exposureto scamsor fraudulent schemesTo mitigate these risks,the best approach involves thorough research before engaging with any platform,persistent vigilance regarding cybersecurity,and adherenceto sound investment principles.

Future Outlook & Industry Trends

Industry forecasts suggest continued growth driven by mainstream adoption,favorable regulation,and technological innovations:By 2025,the price of Bitcoin might double reaching $200000 amid increased institutional interestand ETF approvals[2]. Such developments could further legitimizecryptocurrency markets,making them more accessiblefor retail investors.Moreover,the integrationof artificial intelligence(AI) into trading algorithms,predictive analytics,and improved blockchain scalability will likely enhance platform performanceand security measures[4].However,such progress must be balanced against evolving regulatory scrutinyand persistent cybersecurity threats,to ensure sustainable growth within this dynamic sector.

Who Should Use Cryptocurrency Trading Platforms?

Cryptocurrency trading platforms cater primarily tohobbyist investors,securities traders seeking diversification,and institutional players exploring digital asset portfolios.They are suitablefor those willingto learn about blockchain technology,risk-tolerant individuals aimingfor high returns,and tech-savvy users comfortable navigating complex interfaces when necessary.

How To Choose The Right Platform?

Selecting an appropriate crypto exchange depends on several factors:1 . Security protocols: Ensure robust protection measuresare in place2 . Regulatory compliance: Verify licensing statusin your jurisdiction3 . User interface: Choose between beginner-friendlyor advanced tools basedon your experience level4 . Supported assets: Confirm availabilityof desired cryptocurrenciesand fiat pairs5 . Fees structure: Comparetransaction fees,taker/maker spreads,and withdrawal costs

Staying Informed Is Key

As the industry evolves rapidly,new regulations emerge,and technological improvements occur,it’s vital for users tomaintain awareness through reputable news sources,research reports,and community discussions.This proactive approach helps safeguard investmentswhile maximizing opportunities within this innovative financial landscape.

Optimizing Your Search Experience

For those seeking information about what constitutes a cryptocurrency trading platform,this guide provides comprehensive insights into its types,functionality,risk factors,current trends,and future prospects—all essential knowledge areas needed before entering this space confidently.

This detailed overview aims at equipping readers with foundational understanding along with practical considerations necessary when engaging with cryptocurrency markets via various types of online platforms.. Staying informed about ongoing developments ensures better decision-making amid an ever-changing environment marked by technological progress but also heightened risks associated with cyber threats and regulatory shifts

JCUSER-F1IIaxXA

2025-05-22 16:14

What is a cryptocurrency trading platform?

What Is a Cryptocurrency Trading Platform?

A cryptocurrency trading platform, often referred to as a crypto exchange, is an online marketplace where individuals and institutions can buy, sell, and trade digital currencies. These platforms serve as the primary interface for accessing the rapidly growing world of cryptocurrencies like Bitcoin, Ethereum, Ripple, and many others. They provide a secure environment that facilitates transactions while offering tools for managing digital assets efficiently.

Understanding how these platforms work is essential for anyone interested in investing or trading cryptocurrencies. They operate similarly to traditional stock exchanges but are tailored specifically for digital assets. Users create accounts on these platforms, deposit funds—either fiat currency or cryptocurrencies—and execute trades through user-friendly interfaces or advanced trading tools.

Types of Cryptocurrency Trading Platforms

There are three main categories of cryptocurrency trading platforms:

Centralized Exchanges (CEXs):

These are the most prevalent type of crypto exchanges. Centralized exchanges act as intermediaries that hold users’ funds and facilitate trades between buyers and sellers. They typically offer high liquidity, fast transaction speeds, and user-friendly interfaces suitable for beginners. Examples include Coinbase, Binance, Kraken, and Bitstamp.Decentralized Exchanges (DEXs):

Operating directly on blockchain networks without an intermediary authority distinguishes DEXs from CEXs. They enable peer-to-peer trading where users retain control over their private keys until they execute a trade. While DEXs generally offer enhanced security due to their decentralized nature—reducing risks like hacking—they tend to have steeper learning curves and lower liquidity levels compared to centralized counterparts. Notable examples include Uniswap and SushiSwap.Hybrid Exchanges:

Combining features from both CEXs and DEXs, hybrid platforms aim to balance security with usability by offering some centralized features alongside decentralized elements such as non-custodial wallets or smart contract-based transactions.

Key Features Offered by Crypto Trading Platforms

Most cryptocurrency exchanges provide several core features designed to enhance user experience:

Trading Pairs:

Platforms support various pairs allowing traders to swap one cryptocurrency for another—for example BTC/USDT or ETH/BTC—enabling diverse trading strategies based on market conditions.Fiat Currency Support:

Many exchanges allow direct fiat-to-crypto transactions using currencies like USD, EUR, JPY etc., making it easier for new investors to enter the market without needing prior crypto holdings.Derivatives & Margin Trading:

Advanced traders can access derivatives such as futures contracts or options which enable speculation on price movements with leverage—though this involves higher risk levels requiring careful risk management strategies.Security Measures:

To protect assets against theft or hacking incidents—which have occurred historically—platform providers implement robust security protocols including two-factor authentication (2FA), cold storage solutions (offline wallets), encryption standards,and insurance policies where applicable.

Regulatory Environment & Challenges

The regulatory landscape surrounding cryptocurrency trading platforms remains complex worldwide due to varying legal frameworks across jurisdictions; this influences how these entities operate legally within different countries.In regions like the United States , authorities such as the Securities and Exchange Commission (SEC) actively scrutinize operations—including recent enforcement actions against firms involved in alleged fraud—to ensure compliance with financial laws.Other nations like Japan , Singapore ,and Switzerland have established clearer guidelines aimed at fostering innovation while safeguarding consumers through licensing requirementsand anti-money laundering measures.However , regulatory uncertainty continues to pose challenges: stricter rules could lead some unregulated platforms out of business while also increasing compliance costs even among compliant operators.

Recent Industry Developments & Risks

The industry has experienced notable events impacting trustworthiness:

- Data breaches remain a significant concern; Coinbase disclosed in May 2025 that cybercriminals bribed support agents overseas leading to sensitive customer data being compromised—a reminder of ongoing cybersecurity threats.

- Market volatility persists; rapid price swings can result in substantial gains but also severe losses if traders do not employ proper risk management techniques.

- Technological advancements such as blockchain upgrades improve transaction efficiency but also introduce new vulnerabilities if not properly implemented.These developments underscore why users must prioritize security practices—including enabling two-factor authentication—and stay informed about industry news.

Potential Risks Facing Traders & Platforms

While cryptocurrency trading offers lucrative opportunities,it carries inherent risks:• Regulatory changes may restrict accessor impose additional compliance burdens• Security breaches could leadto lossof fundsor personal information• Market volatility increases unpredictabilityand potential financial losses• Lack of transparencyin some unregulated markets heightens exposureto scamsor fraudulent schemesTo mitigate these risks,the best approach involves thorough research before engaging with any platform,persistent vigilance regarding cybersecurity,and adherenceto sound investment principles.

Future Outlook & Industry Trends

Industry forecasts suggest continued growth driven by mainstream adoption,favorable regulation,and technological innovations:By 2025,the price of Bitcoin might double reaching $200000 amid increased institutional interestand ETF approvals[2]. Such developments could further legitimizecryptocurrency markets,making them more accessiblefor retail investors.Moreover,the integrationof artificial intelligence(AI) into trading algorithms,predictive analytics,and improved blockchain scalability will likely enhance platform performanceand security measures[4].However,such progress must be balanced against evolving regulatory scrutinyand persistent cybersecurity threats,to ensure sustainable growth within this dynamic sector.

Who Should Use Cryptocurrency Trading Platforms?

Cryptocurrency trading platforms cater primarily tohobbyist investors,securities traders seeking diversification,and institutional players exploring digital asset portfolios.They are suitablefor those willingto learn about blockchain technology,risk-tolerant individuals aimingfor high returns,and tech-savvy users comfortable navigating complex interfaces when necessary.

How To Choose The Right Platform?

Selecting an appropriate crypto exchange depends on several factors:1 . Security protocols: Ensure robust protection measuresare in place2 . Regulatory compliance: Verify licensing statusin your jurisdiction3 . User interface: Choose between beginner-friendlyor advanced tools basedon your experience level4 . Supported assets: Confirm availabilityof desired cryptocurrenciesand fiat pairs5 . Fees structure: Comparetransaction fees,taker/maker spreads,and withdrawal costs

Staying Informed Is Key

As the industry evolves rapidly,new regulations emerge,and technological improvements occur,it’s vital for users tomaintain awareness through reputable news sources,research reports,and community discussions.This proactive approach helps safeguard investmentswhile maximizing opportunities within this innovative financial landscape.

Optimizing Your Search Experience

For those seeking information about what constitutes a cryptocurrency trading platform,this guide provides comprehensive insights into its types,functionality,risk factors,current trends,and future prospects—all essential knowledge areas needed before entering this space confidently.

This detailed overview aims at equipping readers with foundational understanding along with practical considerations necessary when engaging with cryptocurrency markets via various types of online platforms.. Staying informed about ongoing developments ensures better decision-making amid an ever-changing environment marked by technological progress but also heightened risks associated with cyber threats and regulatory shifts

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is a New Highs–New Lows Chart?

A New Highs–New Lows (NH-NL) chart is a vital technical analysis tool used by traders and investors to assess the overall health and sentiment of financial markets, including stocks and cryptocurrencies. It visually represents the number of assets reaching new highs or lows within a specific period, offering insights into whether the market is trending upward, downward, or remaining neutral. This chart helps market participants gauge momentum and potential turning points, making it an essential component of comprehensive trading strategies.

The NH-NL chart simplifies complex market data into an easy-to-understand visual format. By tracking how many securities are hitting record high prices versus those hitting record lows, traders can quickly interpret prevailing investor sentiment. For example, a surge in new highs typically indicates bullish momentum, while an increase in new lows suggests bearish conditions. When both are balanced or declining simultaneously, it may signal indecision or consolidation in the market.

How Does the NH-NL Chart Work?

The core principle behind the NH-NL chart involves counting assets that reach new price extremes over a chosen timeframe—be it daily, weekly, or monthly—and plotting these counts on a graph. The two primary components are:

- New Highs: The number of stocks or cryptocurrencies that have surpassed their previous peak prices during the observed period.

- New Lows: The count of assets falling below their prior lowest prices within that same timeframe.

These figures are then plotted as separate lines on the chart—one representing new highs and another for new lows—allowing traders to observe their relative movements over time.

When analyzing this data:

- A rising line for new highs coupled with declining lows generally signals strong bullish sentiment.

- Conversely, increasing new lows alongside decreasing highs often indicates bearish trends.

- Equal levels suggest market neutrality with no clear directional bias.

This straightforward visualization enables quick assessment without delving into detailed individual asset analysis.

Why Use a New Highs–New Lows Chart?

Investors utilize NH-NL charts because they provide real-time insight into overall market strength and potential trend reversals. Unlike traditional price charts focusing solely on individual securities’ movements, this indicator offers macro-level information about collective investor behavior across multiple assets.

For example:

During periods of high volatility—such as economic uncertainty—the NH-NL chart can reveal whether investors remain confident (more highs) or become risk-averse (more lows).

In trending markets: sustained increases in new highs suggest continued upward momentum; persistent rises in new lows warn of deteriorating conditions ahead.

Furthermore, integrating this tool with other technical indicators like Relative Strength Index (RSI), Moving Averages (MA), or Bollinger Bands enhances its predictive power by confirming signals derived from multiple sources.

Recent Trends and Market Applications

In recent years—including 2023 and early 2024—the NH-NL chart has gained prominence among traders navigating volatile environments like cryptocurrency markets. During 2023’s crypto crash—a period marked by sharp declines—the chart reflected heightened bearish sentiment through increased numbers of cryptocurrencies hitting fresh lows while fewer reached record highs. This pattern served as an early warning sign for investors to reduce exposure or tighten risk controls.

Conversely, early 2024 saw signs of recovery across major stock indices where the NH-NL indicator showed more assets achieving new highs than lows—a positive signal pointing toward bullish momentum amid broader economic optimism. Such shifts underscore how dynamic this tool can be when monitoring evolving market conditions.

In addition to traditional equities and digital currencies, institutional investors increasingly incorporate NH-NL charts into their analytical frameworks alongside volume analysis and macroeconomic data to refine entry/exit points and manage portfolio risks effectively.

Limitations And Risks Of Relying On This Indicator

While highly informative when used correctly, relying solely on New Highs–New Lows charts carries certain limitations:

- Lagging Nature: Like most technical indicators based on historical data; they reflect past activity rather than predicting future moves directly.

- Market Noise: Short-term fluctuations might produce misleading signals if not interpreted within context; sudden spikes could be temporary rather than indicative of long-term trends.

- Asset Class Variability: Different markets behave uniquely; what works well for equities might not translate seamlessly to cryptocurrencies due to differing volatility patterns.

- Complementary Tools Needed: To improve accuracy — combining NH-NL charts with volume metrics or trend-following indicators enhances decision-making quality.

Practical Tips For Using The Chart Effectively

To maximize its utility:

Use multiple timeframes: Short-term views help identify immediate shifts; longer periods provide broader trend confirmation.

Watch for divergences: When one line diverges significantly from another—for instance ,new highs rise sharply while low counts remain stable—it could signal weakening momentum before reversal occurs.

Combine with other indicators: Confirm signals using RSI levels indicating overbought/oversold conditions or moving averages showing trend directionality.

By applying these best practices consistently within your trading plan—whether you’re managing stocks or digital currencies—you improve your ability to anticipate changes before they fully materialize.

How To Incorporate Into Your Trading Strategy

Integrating an NH–NL chart into your investment approach involves understanding its role as part of a broader analytical toolkit:

- Identify prevailing trends by observing whether more assets hit records high versus low points regularly.

- Use divergence signals as early warnings for potential reversals—especially when combined with volume spikes indicating increased trader activity.

- Adjust position sizes accordingly during periods where imbalance between high/low counts suggests heightened volatility risks.

- Monitor ongoing shifts over different timeframes to confirm emerging patterns before executing trades based on these insights.

Final Thoughts

The New Highs–New Lows chart remains one of the most accessible yet powerful tools available for assessing overall market health at a glance . Its ability to distill complex collective asset movements into simple visual cues makes it invaluable across various asset classes—from traditional stocks to volatile cryptocurrencies . As part of diligent technical analysis practice—and complemented by other tools—it helps traders make informed decisions rooted in real-time sentiment rather than speculation alone.

Note: Always remember that no single indicator guarantees success; combining multiple analyses along with sound risk management principles is essential for sustainable trading performance.

JCUSER-WVMdslBw

2025-05-19 05:37

What is New Highs–New Lows Chart?

What Is a New Highs–New Lows Chart?

A New Highs–New Lows (NH-NL) chart is a vital technical analysis tool used by traders and investors to assess the overall health and sentiment of financial markets, including stocks and cryptocurrencies. It visually represents the number of assets reaching new highs or lows within a specific period, offering insights into whether the market is trending upward, downward, or remaining neutral. This chart helps market participants gauge momentum and potential turning points, making it an essential component of comprehensive trading strategies.

The NH-NL chart simplifies complex market data into an easy-to-understand visual format. By tracking how many securities are hitting record high prices versus those hitting record lows, traders can quickly interpret prevailing investor sentiment. For example, a surge in new highs typically indicates bullish momentum, while an increase in new lows suggests bearish conditions. When both are balanced or declining simultaneously, it may signal indecision or consolidation in the market.

How Does the NH-NL Chart Work?

The core principle behind the NH-NL chart involves counting assets that reach new price extremes over a chosen timeframe—be it daily, weekly, or monthly—and plotting these counts on a graph. The two primary components are:

- New Highs: The number of stocks or cryptocurrencies that have surpassed their previous peak prices during the observed period.

- New Lows: The count of assets falling below their prior lowest prices within that same timeframe.

These figures are then plotted as separate lines on the chart—one representing new highs and another for new lows—allowing traders to observe their relative movements over time.

When analyzing this data:

- A rising line for new highs coupled with declining lows generally signals strong bullish sentiment.

- Conversely, increasing new lows alongside decreasing highs often indicates bearish trends.

- Equal levels suggest market neutrality with no clear directional bias.

This straightforward visualization enables quick assessment without delving into detailed individual asset analysis.

Why Use a New Highs–New Lows Chart?

Investors utilize NH-NL charts because they provide real-time insight into overall market strength and potential trend reversals. Unlike traditional price charts focusing solely on individual securities’ movements, this indicator offers macro-level information about collective investor behavior across multiple assets.

For example:

During periods of high volatility—such as economic uncertainty—the NH-NL chart can reveal whether investors remain confident (more highs) or become risk-averse (more lows).

In trending markets: sustained increases in new highs suggest continued upward momentum; persistent rises in new lows warn of deteriorating conditions ahead.

Furthermore, integrating this tool with other technical indicators like Relative Strength Index (RSI), Moving Averages (MA), or Bollinger Bands enhances its predictive power by confirming signals derived from multiple sources.

Recent Trends and Market Applications

In recent years—including 2023 and early 2024—the NH-NL chart has gained prominence among traders navigating volatile environments like cryptocurrency markets. During 2023’s crypto crash—a period marked by sharp declines—the chart reflected heightened bearish sentiment through increased numbers of cryptocurrencies hitting fresh lows while fewer reached record highs. This pattern served as an early warning sign for investors to reduce exposure or tighten risk controls.

Conversely, early 2024 saw signs of recovery across major stock indices where the NH-NL indicator showed more assets achieving new highs than lows—a positive signal pointing toward bullish momentum amid broader economic optimism. Such shifts underscore how dynamic this tool can be when monitoring evolving market conditions.

In addition to traditional equities and digital currencies, institutional investors increasingly incorporate NH-NL charts into their analytical frameworks alongside volume analysis and macroeconomic data to refine entry/exit points and manage portfolio risks effectively.

Limitations And Risks Of Relying On This Indicator

While highly informative when used correctly, relying solely on New Highs–New Lows charts carries certain limitations:

- Lagging Nature: Like most technical indicators based on historical data; they reflect past activity rather than predicting future moves directly.

- Market Noise: Short-term fluctuations might produce misleading signals if not interpreted within context; sudden spikes could be temporary rather than indicative of long-term trends.

- Asset Class Variability: Different markets behave uniquely; what works well for equities might not translate seamlessly to cryptocurrencies due to differing volatility patterns.

- Complementary Tools Needed: To improve accuracy — combining NH-NL charts with volume metrics or trend-following indicators enhances decision-making quality.

Practical Tips For Using The Chart Effectively

To maximize its utility:

Use multiple timeframes: Short-term views help identify immediate shifts; longer periods provide broader trend confirmation.

Watch for divergences: When one line diverges significantly from another—for instance ,new highs rise sharply while low counts remain stable—it could signal weakening momentum before reversal occurs.

Combine with other indicators: Confirm signals using RSI levels indicating overbought/oversold conditions or moving averages showing trend directionality.

By applying these best practices consistently within your trading plan—whether you’re managing stocks or digital currencies—you improve your ability to anticipate changes before they fully materialize.

How To Incorporate Into Your Trading Strategy

Integrating an NH–NL chart into your investment approach involves understanding its role as part of a broader analytical toolkit:

- Identify prevailing trends by observing whether more assets hit records high versus low points regularly.

- Use divergence signals as early warnings for potential reversals—especially when combined with volume spikes indicating increased trader activity.

- Adjust position sizes accordingly during periods where imbalance between high/low counts suggests heightened volatility risks.

- Monitor ongoing shifts over different timeframes to confirm emerging patterns before executing trades based on these insights.

Final Thoughts

The New Highs–New Lows chart remains one of the most accessible yet powerful tools available for assessing overall market health at a glance . Its ability to distill complex collective asset movements into simple visual cues makes it invaluable across various asset classes—from traditional stocks to volatile cryptocurrencies . As part of diligent technical analysis practice—and complemented by other tools—it helps traders make informed decisions rooted in real-time sentiment rather than speculation alone.

Note: Always remember that no single indicator guarantees success; combining multiple analyses along with sound risk management principles is essential for sustainable trading performance.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

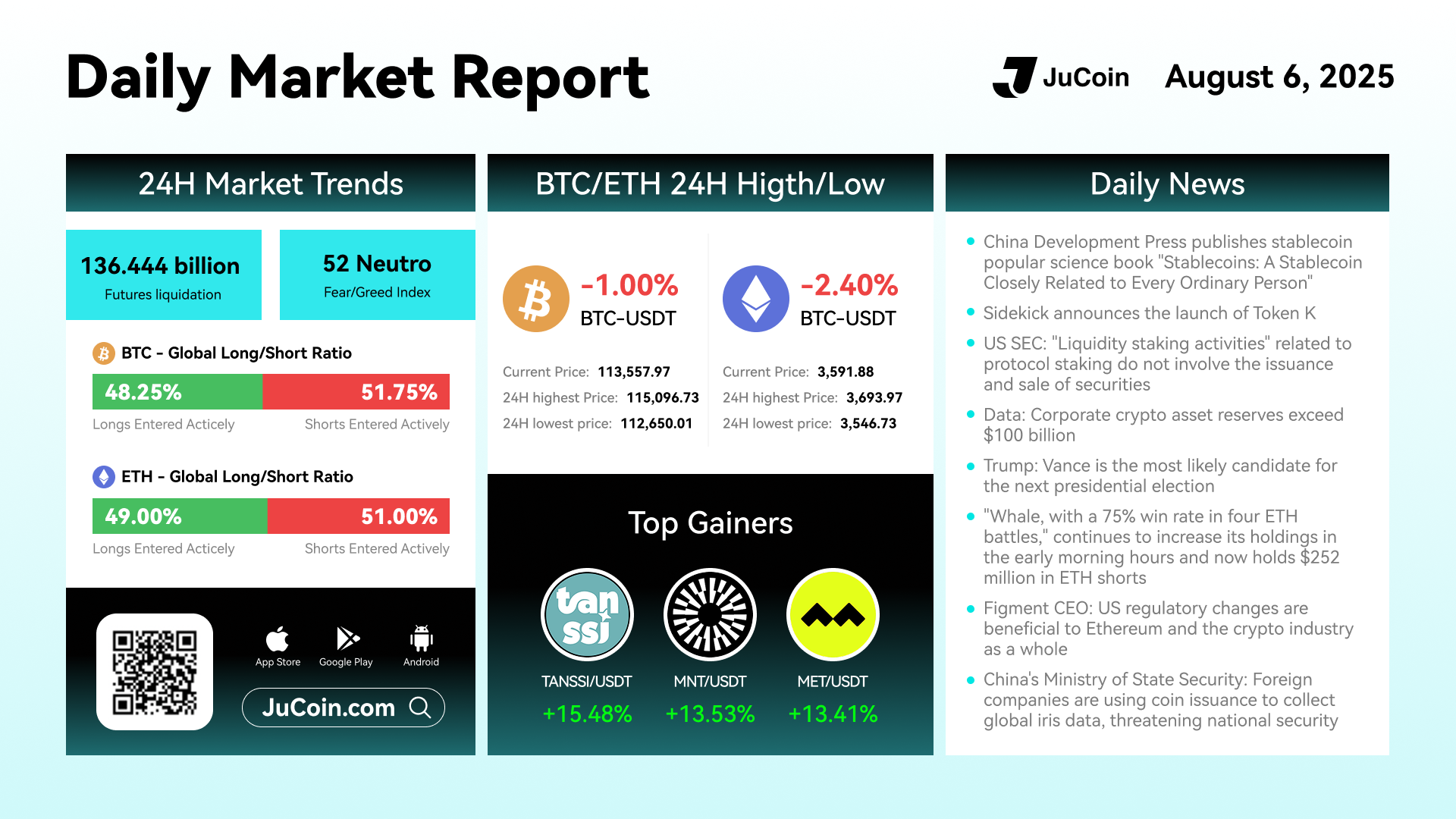

📅 August 6 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-06 04:51

#JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

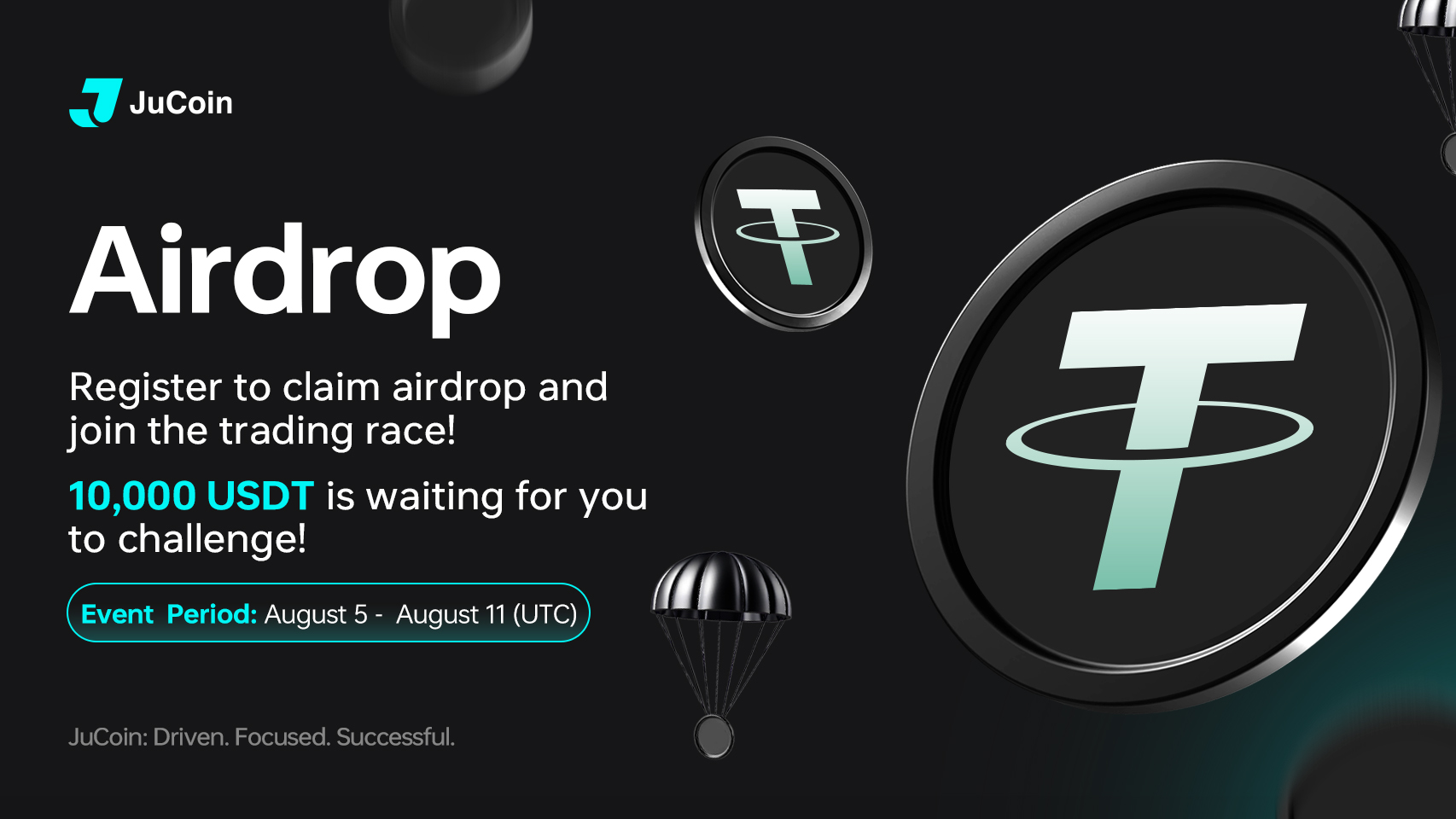

⏰ Time: 2025/8/5 21:00:00 - 2025/8/11 23:59:59(UTC)

✅ Activity 1: Register and complete the trading tasks below to receive one share of the airdrop.

✅ Activity 2: Trade ahead and get 5 USDT airdrop

✅ Activity 3: Sunshine Award, register and get 10 USDT equivalent tokens

🔸 More details:https://bit.ly/453FTc5

JuCoin Community

2025-08-05 15:25

💙Airdrop Tuesday: Register to receive airdrops and trade for 10,000 USDT 🎉

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The DeFi sector is experiencing a remarkable resurgence in 2025, transforming from speculative arena to robust financial infrastructure. Here's what's driving this explosive growth:

💰 Key Growth Drivers:

-

Layer 2 solutions (Optimism, Arbitrum, zk-Rollups) slashing costs & boosting speeds by 20%

$153 billion TVL reached in July 2025 - a three-year high!

Major institutional investment with $1.69B+ Ethereum holdings from leading firms

Enhanced regulatory clarity through EU's MiCA framework

🎯 What's Powering the Momentum:

1️⃣ Cross-Chain Revolution: Seamless asset transfers across Ethereum, Solana, Avalanche ecosystems 2️⃣ Yield Farming Evolution: Advanced protocols offering up to 25% returns on stablecoin strategies 3️⃣ Solana DEX Dominance: 81% of all DEX transactions, $890B trading volume in 5 months 4️⃣ Real-World Asset Tokenization: Converting real estate, commodities into tradeable blockchain tokens

🏆 Innovation Highlights:

-

Jupiter Perps averaging $1B daily perpetual trading volume

AI-powered security with real-time risk alerts and scam detection

Decentralized stablecoins driving cross-chain liquidity

Enhanced composability creating "money legos" for complex financial products

💡 Market Impact:

-

Ethereum maintains 60% DeFi TVL dominance with Lido & Aave leading

Solana surpassing Ethereum in transaction volumes and daily active users

Liquid restaking protocols attracting massive institutional inflows

Multi-signature wallets & advanced auditing boosting security confidence

🔮 Future Outlook: The shift from speculation to utility-focused infrastructure signals DeFi's maturation. With improved security, regulatory clarity, and institutional adoption, the sector is positioned for mainstream financial integration.

Read the complete analysis with detailed insights and market projections: 👇

https://blog.jucoin.com/explore-the-catalysts-behind-defis-recent-surge/?utm_source=blog

#DeFi #Layer2 #Ethereum #Solana #YieldFarming #Crypto #Blockchain #TVL #Institutions #RWA #CrossChain #JuCoin #Web3 #TradFi #Stablecoins #DEX #AI #Security

JU Blog

2025-08-01 08:54

🚀 DeFi Hits $153B TVL - Exploring the Key Catalysts Behind 2025's Massive Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JCUSER-Rj4NMyiW

2025-07-31 03:52

My First Post

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Earn CYBER Tokens: A Complete Guide

Understanding how to earn CYBER tokens is essential for users interested in participating actively within the CyberConnect ecosystem. As a decentralized social platform leveraging blockchain technology, CyberConnect offers multiple avenues for users to earn and utilize CYBER tokens. This guide provides a clear overview of the steps involved, ensuring you can maximize your engagement and potential rewards.

What Are CYBER Tokens and Why Are They Valuable?

CYBER tokens are the native cryptocurrency of the CyberConnect platform, serving as a fundamental component of its decentralized social network. These tokens facilitate various activities such as paying transaction fees, staking for governance participation, and unlocking exclusive features. Their value is driven by their utility within the ecosystem and broader market dynamics influenced by DeFi trends.

Holding CYBER tokens not only grants access to special features but also empowers users to participate in decision-making processes through governance voting. This dual role enhances user engagement while aligning incentives across the community.

How Can You Earn CYBER Tokens Through Staking?

Staking is one of the most straightforward methods to earn additional CYBER tokens. It involves locking up a certain amount of your existing tokens in designated smart contracts on the platform for a specified period—ranging from days to months. In return, stakers receive rewards proportional to their staked amount.

To get started with staking:

- Acquire CYBER Tokens: First, purchase or transfer existing CYBER tokens into your compatible wallet.

- Choose a Staking Pool: Navigate through available staking pools on official platforms or partner sites that support CyberConnect.