Solana Wallet Integration and Hardware Security: Tools and Technologies

Understanding how to securely manage assets on the Solana blockchain is essential for both individual users and developers. As Solana continues to grow in popularity due to its high throughput and low transaction fees, the importance of reliable wallet integration and hardware security solutions becomes even more critical. This article provides a comprehensive overview of the key tools supporting wallet management and hardware security within the Solana ecosystem, highlighting recent developments, best practices, and potential challenges.

What Are Wallets in the Solana Ecosystem?

Wallets serve as digital gateways that allow users to store, send, receive, and interact with tokens like SOL—the native currency of Solana. They also enable access to decentralized applications (dApps) built on the platform. In essence, wallets hold private keys—cryptographic credentials that prove ownership of assets—and facilitate secure transactions.

In the context of Solana, wallets can be categorized into software-based options such as web or mobile wallets (e.g., Phantom or Solflare) or hardware-based solutions like Ledger or Trezor devices. The choice between these depends on user needs for convenience versus security.

Popular Software Wallets Supporting Solana

Phantom Wallet

Phantom has become one of the most widely used web3 wallets tailored specifically for the Solana network. Its intuitive interface makes it accessible even for newcomers while offering advanced features appreciated by experienced users. Phantom supports seamless interaction with dApps directly from browsers like Chrome or Firefox.

Security-wise, Phantom employs multiple layers including encryption protocols; it also supports multi-signature transactions—requiring multiple approvals before executing sensitive operations—and integrates with hardware wallets for added protection against online threats.

Solflare Wallet

Designed exclusively for solanacentric activities, Solflare offers a straightforward experience managing SOL tokens along with other SPL tokens (Solana Program Library). It provides both web-based access and browser extensions compatible with popular browsers.

A significant advantage is its native support for connecting with hardware wallets such as Ledger Nano S/X and Trezor Model T/One. This integration ensures private keys remain offline during transaction signing processes—a vital feature in preventing cyberattacks like phishing or malware infiltration.

Hardware Wallet Solutions: Ledger & Trezor

Hardware wallets are physical devices that store private keys offline—making them immune from online hacking attempts. They are considered among the most secure methods for safeguarding large holdings on blockchains like Solana.

Ledger Hardware Wallets

Ledger's line-up includes models such as Nano S Plus/X which support multiple cryptocurrencies including SOL via dedicated apps integrated through third-party interfaces like Phantom orSolflare . Users connect their Ledger device via USB or Bluetooth (depending on model), then authorize transactions through secure PIN entry on-device rather than exposing sensitive data online.

The robust security architecture involves cold storage principles—private keys never leave the device—and multi-signature capabilities when combined with compatible software wallets enhance overall asset protection significantly.

Trezor Hardware Wallets

Trezor offers similar functionalities but emphasizes features such as passphrase generation alongside PIN protection—adding an extra layer against unauthorized access—even if physical device is compromised. Like Ledger devices, Trezor can be linked to popular wallet interfaces supporting solanacryptocurrency management securely offline during transaction signing processes.

Both brands have established themselves as industry leaders by adhering to strict security standards validated through independent audits—a crucial factor aligning with best practices recommended by cybersecurity experts managing digital assets at scale.

Specialized Web3 Wallets Focused on Security: The Case of Sollet

While primarily designed as a lightweight browser extension wallet tailored specifically for developers and power users within DeFi spaces involvingSolanasmart contracts ,Sollet stands out because it supports direct integration with hardware devices such as Ledger/Trezor . Its open-source nature fosters transparency allowing community verification which enhances trustworthiness—a core principle underpinning E-A-T (Expertise-Authoritativeness-Trustworthiness).

By enabling private key storage either locally within browser environments or via connected hardware modules ,Sollet balances ease-of-use while maintaining high-security standards suitable even for institutional-grade asset management.

Recent Developments Enhancing Security & User Experience

Over recent months, several notable advancements have been made across these tools:

Expansion of Multi-Network Support: Many wallets—including Phantom—have extended their compatibility beyond just solving scalability issues associated solely with SOL token transfers; now supporting other blockchain networks broadens utility.

Partnership Announcements: Collaborations between wallet providers like Solflareand leading hardware manufacturers such asLedgerandTrezordeliver tighter integrations ensuring smoother user experiences without compromising security.

Enhanced Encryption & Protocol Upgrades: Both software-wallet providers have implemented stronger encryption algorithms alongside multi-signature functionalities aimed at reducing vulnerabilities associated with single-key control systems.

These improvements reflect ongoing efforts toward creating more resilient infrastructure capable of handling increasing adoption rates while safeguarding user funds effectively.

Challenges & Risks in Using Blockchain Security Tools

Despite technological advancements, certain risks persist:

Cyber Threats: Phishing remains a prevalent threat where malicious actors trick users into revealing seed phrases or private keys outside trusted environments.

Hardware Vulnerabilities: Although rare due diligence confirms that reputable brands undergo rigorous testing; supply chain attacks could potentially compromise devices before purchase.

Regulatory Uncertainty: As authorities scrutinize cryptocurrency activities worldwide—including those involving wallet services—the regulatory landscape may evolve unpredictably affecting how these tools operate legally.

To mitigate these risks:

- Always verify sources before downloading wallet applications

- Use official channels when purchasing hardware

- Enable all available security features

- Stay informed about latest cybersecurity advisories

How To Choose Securely Managed Solutions For Your Assets

Selecting appropriate tools depends heavily on individual risk appetite:

- For casual users engaging occasionally in small transactions — software wallets like Phantom provide sufficient convenience coupled with basic protections.

- For active traders holding significant amounts — integrating a reputable hardware wallet such as Ledger X/Trezor becomes advisable due to superior offline storage capabilities.

- Developers working extensively within DeFi protocols should consider using open-source options combined with multi-factor authentication measures supported by their chosen platforms.

Staying Informed About Advances in Blockchain Security

As blockchain technology evolves rapidly—with new vulnerabilities discovered regularly—it’s vital that users stay updated through trusted sources including official project blogs, cybersecurity advisories from industry leaders,and community forums dedicated to crypto safety best practices.

Final Thoughts

The landscape surrounding wallet integration and hardware security solutions within the solanacryptocurrency ecosystem continues evolving swiftly amid increasing adoption rates globally.. By leveraging trusted tools like Phantom,Waller,Safeguard,Hardened Hardware Devices,and staying vigilant against emerging threats,you can significantly enhance your asset safety while enjoying seamless interaction across decentralized platforms.. Ensuring you follow current best practices will help protect your investments today—and well into future innovations shaping this dynamic space

JCUSER-IC8sJL1q

2025-05-14 21:26

What tooling supports wallet integration and hardware security for Solana (SOL)?

Solana Wallet Integration and Hardware Security: Tools and Technologies

Understanding how to securely manage assets on the Solana blockchain is essential for both individual users and developers. As Solana continues to grow in popularity due to its high throughput and low transaction fees, the importance of reliable wallet integration and hardware security solutions becomes even more critical. This article provides a comprehensive overview of the key tools supporting wallet management and hardware security within the Solana ecosystem, highlighting recent developments, best practices, and potential challenges.

What Are Wallets in the Solana Ecosystem?

Wallets serve as digital gateways that allow users to store, send, receive, and interact with tokens like SOL—the native currency of Solana. They also enable access to decentralized applications (dApps) built on the platform. In essence, wallets hold private keys—cryptographic credentials that prove ownership of assets—and facilitate secure transactions.

In the context of Solana, wallets can be categorized into software-based options such as web or mobile wallets (e.g., Phantom or Solflare) or hardware-based solutions like Ledger or Trezor devices. The choice between these depends on user needs for convenience versus security.

Popular Software Wallets Supporting Solana

Phantom Wallet

Phantom has become one of the most widely used web3 wallets tailored specifically for the Solana network. Its intuitive interface makes it accessible even for newcomers while offering advanced features appreciated by experienced users. Phantom supports seamless interaction with dApps directly from browsers like Chrome or Firefox.

Security-wise, Phantom employs multiple layers including encryption protocols; it also supports multi-signature transactions—requiring multiple approvals before executing sensitive operations—and integrates with hardware wallets for added protection against online threats.

Solflare Wallet

Designed exclusively for solanacentric activities, Solflare offers a straightforward experience managing SOL tokens along with other SPL tokens (Solana Program Library). It provides both web-based access and browser extensions compatible with popular browsers.

A significant advantage is its native support for connecting with hardware wallets such as Ledger Nano S/X and Trezor Model T/One. This integration ensures private keys remain offline during transaction signing processes—a vital feature in preventing cyberattacks like phishing or malware infiltration.

Hardware Wallet Solutions: Ledger & Trezor

Hardware wallets are physical devices that store private keys offline—making them immune from online hacking attempts. They are considered among the most secure methods for safeguarding large holdings on blockchains like Solana.

Ledger Hardware Wallets

Ledger's line-up includes models such as Nano S Plus/X which support multiple cryptocurrencies including SOL via dedicated apps integrated through third-party interfaces like Phantom orSolflare . Users connect their Ledger device via USB or Bluetooth (depending on model), then authorize transactions through secure PIN entry on-device rather than exposing sensitive data online.

The robust security architecture involves cold storage principles—private keys never leave the device—and multi-signature capabilities when combined with compatible software wallets enhance overall asset protection significantly.

Trezor Hardware Wallets

Trezor offers similar functionalities but emphasizes features such as passphrase generation alongside PIN protection—adding an extra layer against unauthorized access—even if physical device is compromised. Like Ledger devices, Trezor can be linked to popular wallet interfaces supporting solanacryptocurrency management securely offline during transaction signing processes.

Both brands have established themselves as industry leaders by adhering to strict security standards validated through independent audits—a crucial factor aligning with best practices recommended by cybersecurity experts managing digital assets at scale.

Specialized Web3 Wallets Focused on Security: The Case of Sollet

While primarily designed as a lightweight browser extension wallet tailored specifically for developers and power users within DeFi spaces involvingSolanasmart contracts ,Sollet stands out because it supports direct integration with hardware devices such as Ledger/Trezor . Its open-source nature fosters transparency allowing community verification which enhances trustworthiness—a core principle underpinning E-A-T (Expertise-Authoritativeness-Trustworthiness).

By enabling private key storage either locally within browser environments or via connected hardware modules ,Sollet balances ease-of-use while maintaining high-security standards suitable even for institutional-grade asset management.

Recent Developments Enhancing Security & User Experience

Over recent months, several notable advancements have been made across these tools:

Expansion of Multi-Network Support: Many wallets—including Phantom—have extended their compatibility beyond just solving scalability issues associated solely with SOL token transfers; now supporting other blockchain networks broadens utility.

Partnership Announcements: Collaborations between wallet providers like Solflareand leading hardware manufacturers such asLedgerandTrezordeliver tighter integrations ensuring smoother user experiences without compromising security.

Enhanced Encryption & Protocol Upgrades: Both software-wallet providers have implemented stronger encryption algorithms alongside multi-signature functionalities aimed at reducing vulnerabilities associated with single-key control systems.

These improvements reflect ongoing efforts toward creating more resilient infrastructure capable of handling increasing adoption rates while safeguarding user funds effectively.

Challenges & Risks in Using Blockchain Security Tools

Despite technological advancements, certain risks persist:

Cyber Threats: Phishing remains a prevalent threat where malicious actors trick users into revealing seed phrases or private keys outside trusted environments.

Hardware Vulnerabilities: Although rare due diligence confirms that reputable brands undergo rigorous testing; supply chain attacks could potentially compromise devices before purchase.

Regulatory Uncertainty: As authorities scrutinize cryptocurrency activities worldwide—including those involving wallet services—the regulatory landscape may evolve unpredictably affecting how these tools operate legally.

To mitigate these risks:

- Always verify sources before downloading wallet applications

- Use official channels when purchasing hardware

- Enable all available security features

- Stay informed about latest cybersecurity advisories

How To Choose Securely Managed Solutions For Your Assets

Selecting appropriate tools depends heavily on individual risk appetite:

- For casual users engaging occasionally in small transactions — software wallets like Phantom provide sufficient convenience coupled with basic protections.

- For active traders holding significant amounts — integrating a reputable hardware wallet such as Ledger X/Trezor becomes advisable due to superior offline storage capabilities.

- Developers working extensively within DeFi protocols should consider using open-source options combined with multi-factor authentication measures supported by their chosen platforms.

Staying Informed About Advances in Blockchain Security

As blockchain technology evolves rapidly—with new vulnerabilities discovered regularly—it’s vital that users stay updated through trusted sources including official project blogs, cybersecurity advisories from industry leaders,and community forums dedicated to crypto safety best practices.

Final Thoughts

The landscape surrounding wallet integration and hardware security solutions within the solanacryptocurrency ecosystem continues evolving swiftly amid increasing adoption rates globally.. By leveraging trusted tools like Phantom,Waller,Safeguard,Hardened Hardware Devices,and staying vigilant against emerging threats,you can significantly enhance your asset safety while enjoying seamless interaction across decentralized platforms.. Ensuring you follow current best practices will help protect your investments today—and well into future innovations shaping this dynamic space

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is the Market Facilitation Index (BW MFI) and How Does It Signal Price Moves?

Understanding market dynamics is crucial for traders and investors, especially in the highly volatile cryptocurrency space. The Market Facilitation Index (BW MFI) is a technical analysis tool designed to provide insights into buying and selling pressures, helping market participants anticipate potential price movements. This article explores what BW MFI is, how it works, and its role in signaling trend reversals or continuations.

What Is the Market Facilitation Index (BW MFI)?

The BW MFI was developed by Bitwise Asset Management to measure the strength of market activity by combining price movements with trading volume and market capitalization data. Unlike traditional indicators such as RSI or MACD that focus solely on price action, BW MFI offers a more comprehensive view of market sentiment by integrating multiple data points.

The index ranges from 0 to 100; higher values suggest strong buying pressure, indicating bullish sentiment, while lower values point toward selling pressure or bearish conditions. Traders use these readings to assess whether an asset is overbought or oversold—key signals for potential trend reversals.

How Is BW MFI Calculated?

The calculation of BW MFI involves analyzing recent price changes alongside trading volume and overall market capitalization. While specific formulas are proprietary to Bitwise Asset Management, the core concept revolves around:

- Price Movements: Tracking recent highs and lows.

- Trading Volume: Measuring how much of an asset has been traded.

- Market Capitalization: Considering the total value of all circulating coins/tokens.

By combining these factors into a single index score between 0 and 100, traders can quickly gauge whether buying or selling pressures dominate at any given time.

Interpreting BW MFI Signals

One of the primary uses of BW MFI is identifying overbought or oversold conditions that may precede significant price moves. When the index reaches extreme levels—typically above 80—it suggests that buyers are heavily dominating, which could signal an overbought condition ripe for a reversal downward. Conversely, readings below 20 indicate strong selling pressure that might lead to an upward correction once sellers exhaust their momentum.

However, it's important not to rely solely on these extremes; instead, traders often look for divergence patterns where price trends diverge from indicator signals as confirmation before acting.

Recent Developments in BW MFI

Since its inception by Bitwise Asset Management in early 2023, there have been ongoing efforts to refine the accuracy of BW MFI through algorithm updates incorporating new data sources and machine learning techniques. These improvements aim at reducing false signals—a common challenge with technical indicators—especially given cryptocurrency markets' notorious volatility.

In addition:

- The tool has gained popularity among professional traders seeking actionable insights.

- Its integration with other technical tools like moving averages enhances decision-making processes.

- Community discussions highlight both successes in predicting trends and limitations during unpredictable market swings.

Advantages & Limitations

Advantages:

- Provides a nuanced view combining volume with price action.

- Helps identify potential trend reversals early.

- Useful when combined with other indicators for confirmation signals.

Limitations:

- Can generate false positives during high volatility periods.

- Requires experience to interpret correctly within broader analysis frameworks.

- Not foolproof—should always be used alongside fundamental analysis or other technical tools like Bollinger Bands or RSI for better accuracy.

Practical Tips for Using BW MFI Effectively

To maximize its utility:

- Use it alongside complementary indicators such as moving averages or Bollinger Bands.

- Watch for divergence patterns where prices move contrary to indicator signals before making trades.

- Be cautious during highly volatile periods common in crypto markets—they can produce misleading signals.

- Regularly update your understanding based on community feedback and latest algorithm refinements from providers like Bitwise Asset Management.

Why Traders Are Increasingly Adopting This Tool

Over recent years—including up until May 2025—the adoption rate among cryptocurrency traders has surged due to its ability to offer real-time insights into underlying market forces without relying solely on raw price data alone. As more users share their experiences online—from social media forums like Reddit’s r/CryptoCurrency communities—to professional trading groups—the collective knowledge about effective usage continues evolving.

Final Thoughts

The Market Facilitation Index (BW MFI) stands out as a valuable addition within modern crypto trading strategies because it captures complex interactions between volume-driven activity and pricing trends succinctly. While not infallible—as all technical tools have limitations—it remains an essential component when combined thoughtfully with other analytical methods aimed at understanding cryptocurrency markets’ unique behaviors.

Keywords: Market Facilitation Index , BW MFI , cryptocurrency trading signals , technical analysis tools , buy/sell pressure indicator , trend reversal signal , crypto volatility strategies

JCUSER-WVMdslBw

2025-05-14 14:43

What is the Market Facilitation Index (BW MFI) and how does it signal price moves?

What Is the Market Facilitation Index (BW MFI) and How Does It Signal Price Moves?

Understanding market dynamics is crucial for traders and investors, especially in the highly volatile cryptocurrency space. The Market Facilitation Index (BW MFI) is a technical analysis tool designed to provide insights into buying and selling pressures, helping market participants anticipate potential price movements. This article explores what BW MFI is, how it works, and its role in signaling trend reversals or continuations.

What Is the Market Facilitation Index (BW MFI)?

The BW MFI was developed by Bitwise Asset Management to measure the strength of market activity by combining price movements with trading volume and market capitalization data. Unlike traditional indicators such as RSI or MACD that focus solely on price action, BW MFI offers a more comprehensive view of market sentiment by integrating multiple data points.

The index ranges from 0 to 100; higher values suggest strong buying pressure, indicating bullish sentiment, while lower values point toward selling pressure or bearish conditions. Traders use these readings to assess whether an asset is overbought or oversold—key signals for potential trend reversals.

How Is BW MFI Calculated?

The calculation of BW MFI involves analyzing recent price changes alongside trading volume and overall market capitalization. While specific formulas are proprietary to Bitwise Asset Management, the core concept revolves around:

- Price Movements: Tracking recent highs and lows.

- Trading Volume: Measuring how much of an asset has been traded.

- Market Capitalization: Considering the total value of all circulating coins/tokens.

By combining these factors into a single index score between 0 and 100, traders can quickly gauge whether buying or selling pressures dominate at any given time.

Interpreting BW MFI Signals

One of the primary uses of BW MFI is identifying overbought or oversold conditions that may precede significant price moves. When the index reaches extreme levels—typically above 80—it suggests that buyers are heavily dominating, which could signal an overbought condition ripe for a reversal downward. Conversely, readings below 20 indicate strong selling pressure that might lead to an upward correction once sellers exhaust their momentum.

However, it's important not to rely solely on these extremes; instead, traders often look for divergence patterns where price trends diverge from indicator signals as confirmation before acting.

Recent Developments in BW MFI

Since its inception by Bitwise Asset Management in early 2023, there have been ongoing efforts to refine the accuracy of BW MFI through algorithm updates incorporating new data sources and machine learning techniques. These improvements aim at reducing false signals—a common challenge with technical indicators—especially given cryptocurrency markets' notorious volatility.

In addition:

- The tool has gained popularity among professional traders seeking actionable insights.

- Its integration with other technical tools like moving averages enhances decision-making processes.

- Community discussions highlight both successes in predicting trends and limitations during unpredictable market swings.

Advantages & Limitations

Advantages:

- Provides a nuanced view combining volume with price action.

- Helps identify potential trend reversals early.

- Useful when combined with other indicators for confirmation signals.

Limitations:

- Can generate false positives during high volatility periods.

- Requires experience to interpret correctly within broader analysis frameworks.

- Not foolproof—should always be used alongside fundamental analysis or other technical tools like Bollinger Bands or RSI for better accuracy.

Practical Tips for Using BW MFI Effectively

To maximize its utility:

- Use it alongside complementary indicators such as moving averages or Bollinger Bands.

- Watch for divergence patterns where prices move contrary to indicator signals before making trades.

- Be cautious during highly volatile periods common in crypto markets—they can produce misleading signals.

- Regularly update your understanding based on community feedback and latest algorithm refinements from providers like Bitwise Asset Management.

Why Traders Are Increasingly Adopting This Tool

Over recent years—including up until May 2025—the adoption rate among cryptocurrency traders has surged due to its ability to offer real-time insights into underlying market forces without relying solely on raw price data alone. As more users share their experiences online—from social media forums like Reddit’s r/CryptoCurrency communities—to professional trading groups—the collective knowledge about effective usage continues evolving.

Final Thoughts

The Market Facilitation Index (BW MFI) stands out as a valuable addition within modern crypto trading strategies because it captures complex interactions between volume-driven activity and pricing trends succinctly. While not infallible—as all technical tools have limitations—it remains an essential component when combined thoughtfully with other analytical methods aimed at understanding cryptocurrency markets’ unique behaviors.

Keywords: Market Facilitation Index , BW MFI , cryptocurrency trading signals , technical analysis tools , buy/sell pressure indicator , trend reversal signal , crypto volatility strategies

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is a Blockchain Oracle Network and How Is Decentralization Ensured?

Understanding Blockchain Oracle Networks

A blockchain oracle network is an essential component in the ecosystem of smart contracts and decentralized applications (dApps). It functions as a bridge that connects on-chain smart contracts with off-chain data sources, enabling these contracts to interact with real-world information. Unlike traditional systems that rely solely on internal blockchain data, oracle networks fetch external data such as market prices, weather conditions, or event outcomes. This external data is critical for executing complex logic within smart contracts—automated agreements that self-execute when predefined conditions are met.

Smart contracts are inherently limited because they cannot access information outside their blockchain environment. For example, a decentralized insurance contract might need to verify weather reports or flight delays before releasing funds. Without reliable external data feeds, such applications would be severely constrained. That’s where blockchain oracle networks come into play—they provide the necessary real-world inputs securely and efficiently.

The Role of External Data in Smart Contracts

Smart contracts operate based on code stored on blockchains like Ethereum or Binance Smart Chain. They execute automatically once certain criteria are fulfilled but depend heavily on accurate and timely data inputs to function correctly. Since blockchains do not have native access to off-chain information due to their closed nature, they require an intermediary—an oracle—to supply this data.

Oracle networks gather information from multiple sources such as APIs (Application Programming Interfaces), databases, sensors (for IoT devices), or even human input in some cases. Once collected, this data undergoes verification processes before being transmitted onto the blockchain for use by smart contracts. This process ensures that decisions made by these digital agreements reflect real-world conditions accurately.

Decentralization: Why It Matters for Oracles

Decentralization is fundamental when it comes to maintaining trustworthiness and security within oracle networks. A centralized oracle relies on a single source of truth; if this source becomes compromised or provides false information—either intentionally or accidentally—the entire system's integrity could be at risk.

To mitigate such vulnerabilities, decentralized oracle networks employ multiple independent nodes that verify and validate external data collectively before feeding it into the blockchain see more about decentralization here. This approach reduces reliance on any single point of failure and enhances resilience against manipulation attempts.

By distributing trust across numerous nodes operating under consensus mechanisms—such as voting schemes or cryptographic proofs—the network ensures higher security standards while preserving transparency learn about security measures here.

Types of Blockchain Oracles

There are several types of oracle architectures designed to suit different needs:

Centralized Oracles: These depend on one trusted entity providing all external data points; they tend to be faster but less secure due to single points of failure.

Decentralized Oracles: Utilize multiple independent nodes verifying the same piece of information; they offer enhanced security through redundancy.

Hybrid Oracles: Combine elements from both models—for instance, using centralized sources for speed but adding decentralization layers for validation—to balance efficiency with trustworthiness.

Each type has its advantages and trade-offs concerning speed, cost, complexity, and security considerations see detailed comparison here.

Recent Advances in Blockchain Oracle Technology

The rise of Decentralized Finance (DeFi) has significantly increased demand for robust oracle solutions capable of delivering high-quality off-chain data securely explore DeFi's impact here. Prominent projects like Chainlink have pioneered decentralized oracle platforms offering extensive libraries of verified datasets—including asset prices—which DeFi protocols rely upon heavily.

Innovations also include cross-chain interoperability solutions where multiple blockchains share verified external datasets via interconnected oracles—a step toward more interconnected decentralized ecosystems more about Chainlink’s role here.

However, reliance on these systems introduces risks like potential manipulation if not properly secured—a concern addressed through cryptographic techniques such as multi-signature schemes and reputation-based node selection processes see how security is maintained.

Risks Associated with Oracle Networks

Despite their importance in expanding what smart contracts can achieve beyond simple transactions within a single chain context—and increasing automation capabilities—they pose unique challenges:

- Data Manipulation & Spoofing: Malicious actors may attempt to feed false info into the system.

- Single Point Failures: Centralized models risk collapse if their sole source becomes compromised.

- Oracle Failure & Latency: Delays in fetching accurate info can lead to incorrect contract execution.

- Economic Attacks: Exploiting economic incentives around certain datasets may influence node behavior unfairly.

Addressing these issues involves implementing rigorous verification methods—including cryptography-based proofs—and designing incentive structures aligned with honest participation more details available here.

Future Outlook for Blockchain Oracle Networks

As blockchain technology matures alongside growing adoption across industries—from finance and supply chain management to gaming—the importance of reliable decentralization will only increase[see industry trends]. Ongoing research aims at enhancing scalability without compromising security through innovations like threshold signatures or zero-knowledge proofs which enable secure validation without revealing sensitive info publicly[read more about emerging tech].

Furthermore, integrating artificial intelligence (AI) could improve anomaly detection within feeds—making them even more trustworthy—and facilitate dynamic updates based on changing circumstances globally[future prospects].

Ensuring robust decentralization remains central—not just from technical perspectives but also through governance frameworks—that empower community oversight over node operations helps sustain long-term trustworthiness across diverse applications.

By understanding how blockchain oracle networks work—and why decentralizing them matters—you gain insight into one key pillar supporting modern decentralized ecosystems’ growth while safeguarding against vulnerabilities inherent in relying solely on centralized sources.Learn more about securing your systems here. As innovation continues apace—with new protocols emerging—it’s clear that resiliently designed—oracular infrastructure will remain vital for realizing fully autonomous digital economies built upon trustworthy foundations.

Lo

2025-05-14 11:29

What is a blockchain oracle network and how is decentralization ensured?

What Is a Blockchain Oracle Network and How Is Decentralization Ensured?

Understanding Blockchain Oracle Networks

A blockchain oracle network is an essential component in the ecosystem of smart contracts and decentralized applications (dApps). It functions as a bridge that connects on-chain smart contracts with off-chain data sources, enabling these contracts to interact with real-world information. Unlike traditional systems that rely solely on internal blockchain data, oracle networks fetch external data such as market prices, weather conditions, or event outcomes. This external data is critical for executing complex logic within smart contracts—automated agreements that self-execute when predefined conditions are met.

Smart contracts are inherently limited because they cannot access information outside their blockchain environment. For example, a decentralized insurance contract might need to verify weather reports or flight delays before releasing funds. Without reliable external data feeds, such applications would be severely constrained. That’s where blockchain oracle networks come into play—they provide the necessary real-world inputs securely and efficiently.

The Role of External Data in Smart Contracts

Smart contracts operate based on code stored on blockchains like Ethereum or Binance Smart Chain. They execute automatically once certain criteria are fulfilled but depend heavily on accurate and timely data inputs to function correctly. Since blockchains do not have native access to off-chain information due to their closed nature, they require an intermediary—an oracle—to supply this data.

Oracle networks gather information from multiple sources such as APIs (Application Programming Interfaces), databases, sensors (for IoT devices), or even human input in some cases. Once collected, this data undergoes verification processes before being transmitted onto the blockchain for use by smart contracts. This process ensures that decisions made by these digital agreements reflect real-world conditions accurately.

Decentralization: Why It Matters for Oracles

Decentralization is fundamental when it comes to maintaining trustworthiness and security within oracle networks. A centralized oracle relies on a single source of truth; if this source becomes compromised or provides false information—either intentionally or accidentally—the entire system's integrity could be at risk.

To mitigate such vulnerabilities, decentralized oracle networks employ multiple independent nodes that verify and validate external data collectively before feeding it into the blockchain see more about decentralization here. This approach reduces reliance on any single point of failure and enhances resilience against manipulation attempts.

By distributing trust across numerous nodes operating under consensus mechanisms—such as voting schemes or cryptographic proofs—the network ensures higher security standards while preserving transparency learn about security measures here.

Types of Blockchain Oracles

There are several types of oracle architectures designed to suit different needs:

Centralized Oracles: These depend on one trusted entity providing all external data points; they tend to be faster but less secure due to single points of failure.

Decentralized Oracles: Utilize multiple independent nodes verifying the same piece of information; they offer enhanced security through redundancy.

Hybrid Oracles: Combine elements from both models—for instance, using centralized sources for speed but adding decentralization layers for validation—to balance efficiency with trustworthiness.

Each type has its advantages and trade-offs concerning speed, cost, complexity, and security considerations see detailed comparison here.

Recent Advances in Blockchain Oracle Technology

The rise of Decentralized Finance (DeFi) has significantly increased demand for robust oracle solutions capable of delivering high-quality off-chain data securely explore DeFi's impact here. Prominent projects like Chainlink have pioneered decentralized oracle platforms offering extensive libraries of verified datasets—including asset prices—which DeFi protocols rely upon heavily.

Innovations also include cross-chain interoperability solutions where multiple blockchains share verified external datasets via interconnected oracles—a step toward more interconnected decentralized ecosystems more about Chainlink’s role here.

However, reliance on these systems introduces risks like potential manipulation if not properly secured—a concern addressed through cryptographic techniques such as multi-signature schemes and reputation-based node selection processes see how security is maintained.

Risks Associated with Oracle Networks

Despite their importance in expanding what smart contracts can achieve beyond simple transactions within a single chain context—and increasing automation capabilities—they pose unique challenges:

- Data Manipulation & Spoofing: Malicious actors may attempt to feed false info into the system.

- Single Point Failures: Centralized models risk collapse if their sole source becomes compromised.

- Oracle Failure & Latency: Delays in fetching accurate info can lead to incorrect contract execution.

- Economic Attacks: Exploiting economic incentives around certain datasets may influence node behavior unfairly.

Addressing these issues involves implementing rigorous verification methods—including cryptography-based proofs—and designing incentive structures aligned with honest participation more details available here.

Future Outlook for Blockchain Oracle Networks

As blockchain technology matures alongside growing adoption across industries—from finance and supply chain management to gaming—the importance of reliable decentralization will only increase[see industry trends]. Ongoing research aims at enhancing scalability without compromising security through innovations like threshold signatures or zero-knowledge proofs which enable secure validation without revealing sensitive info publicly[read more about emerging tech].

Furthermore, integrating artificial intelligence (AI) could improve anomaly detection within feeds—making them even more trustworthy—and facilitate dynamic updates based on changing circumstances globally[future prospects].

Ensuring robust decentralization remains central—not just from technical perspectives but also through governance frameworks—that empower community oversight over node operations helps sustain long-term trustworthiness across diverse applications.

By understanding how blockchain oracle networks work—and why decentralizing them matters—you gain insight into one key pillar supporting modern decentralized ecosystems’ growth while safeguarding against vulnerabilities inherent in relying solely on centralized sources.Learn more about securing your systems here. As innovation continues apace—with new protocols emerging—it’s clear that resiliently designed—oracular infrastructure will remain vital for realizing fully autonomous digital economies built upon trustworthy foundations.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JuTrust Insurance is a Web3.0 open API interface. The Solth Trust protocol has been integrated into JuTrust Insurance. 30% of the funds entered by users into Solth Trust will automatically enter the insurance pool, which is used to underwrite risk policies for the amount entered by users into Sloth Trust. JuTrust will automatically capture user withdrawal records as a basis for statistical claims.

💎Compensation triggering mechanism

🔣The core service of the project is closed, and tokens cannot be withdrawn.

🔣And other force majeure factors determined by the platform.

👉 Read More:https://bit.ly/4foWISj

JuCoin Community

2025-08-04 10:23

Sloth Trust officially joins JuTrust insurance warehouse

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Exclusive community benefits are here! Invite 5+ friends to join JuCoin, climb the leaderboard, and earn USDT rewards!

⏰ Event Period:August 4, 08:00 – August 11, 08:00 (UTC)

🏆 Rewards for Top 5:

🥇 1st Place: $50 USDT

🥈 2nd Place: $40 USDT

🥉 3rd Place: $30 USDT

🏅 4th Place: $20 USDT

🏅 5th Place: $10 USDT

✅ How to Participate:

1️⃣ Log in to JuCoin and get your unique referral link.

2️⃣ Share your link – friends must register + complete KYC.

3️⃣ Reach 5+ valid invites to qualify for the leaderboard.

4️⃣ Submit your JuCoin UID to confirm entry:👉 https://forms.gle/vGi6c9LAksggH68D6

❗ Important Notice:

• Fraudulent activity (e.g., fake/bulk accounts) will result in immediate disqualification.

• Rewards will be distributed to winners’ JuCoin accounts after verification.

🚀 Start inviting now – dominate the leaderboard and claim your USDT!

JuCoin Community

2025-08-04 08:40

🔥 JuCoin Community Contest: Invite Friends & Win USDT! 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👌JuCoin will list the CMEW/USDT trading pair on August 7, 2025

🔹 Deposit: August 6, 2025 at 04:00 (UTC)

🔹 Trading: August 7, 2025 at 09:00 (UTC)

🔹 Withdrawal: August 8, 2025 at 09:00 (UTC)

🪧More:https://bit.ly/458FkfG

JuCoin Community

2025-08-04 07:45

📢 New Listing|CMEW (CelestialMew) 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JuCoin is pleased to announce the launch of xStocks Spot Trading (Phase 4 on Aug. 4, 2025. We welcome all users to participate in trading. Below are the details:

🔹Trading Pairs: ABBVX/USDT、ACNX/USDT、AZNX/USDT、CMCSAX/USDT、CRWDX/USDT、HDX/USDT、KOX/USDT、NFLXX/USDT、PEPX/USDT、PGX/USDT、UNHX/USDT、VTIX/USDT

🔹Trading Time: Aug. 4, 2025 at 07:00 (UTC)

👉 More: https://bit.ly/3U8VIYP

JuCoin Community

2025-08-04 04:34

🚨 xStocks Spot Trading Zone (Phase 4)

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

TA used to be charts, indicators, and KD lines 🎯 Now it’s just tweets, vibes, and memes 🫥 Accurate enough, right?

Check out our YouTube Channel 👉

#TechnicalAnalysis #MemeTrading #CryptoTA

JuCoin Media

2025-08-01 11:33

Technical Analysis Cryptocurrency 📊 | The Only Chart That Matters

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Me in 2050 telling my grandkids: “Bitcoin was only 100k back then!” 😌 They’ll never believe how good we had it 🪙 The golden age of crypto

Check out our YouTube Channel 👉

#BitcoinMemories #FutureInvestorTales #CryptoLegend

JuCoin Media

2025-08-01 11:29

My Bitcoin Investment Story They Won’t Believe in 2050 🕰️

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Bitcoin Investment — every time she walks by, even the ETH crowd turns their heads 🫣 Main character energy in the crypto streets 🧿 She’s the MVP of the blockchain

Check out our YouTube Channel 👉

#BitcoinInvestment #MainCharacterVibes #CryptoAttraction

JuCoin Media

2025-08-01 11:21

How a Bitcoin Investment Steals the Show Every Time ✨

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👌JuCoin to List GDA/HI Trading Pair on August 18, 2025

🔷Deposit Time: August 17, 2025 at 09:00 (UTC)

🔷Trading Time: August 18, 2025 at 09:00 (UTC)

🔷Withdrawal Time: August 19, 2025 at 09:00 (UTC)

👉 More Detail:https://bit.ly/45jcyJv

JuCoin Community

2025-08-01 06:47

📢New Listing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Are There Any Disadvantages to Market Orders? An In-Depth Analysis

Understanding the potential drawbacks of market orders is essential for investors aiming to make informed trading decisions. While market orders are popular due to their simplicity and speed, they carry certain risks that can impact investment outcomes. This article explores the disadvantages associated with market orders, recent developments influencing their use, and how investors can navigate these challenges effectively.

What Is a Market Order and How Does It Work?

A market order is an instruction from an investor to buy or sell a security immediately at the best available current price. This type of order prioritizes execution speed over price certainty, making it ideal for traders who want quick entry or exit positions. When placed, a broker executes the order promptly in most cases, but the actual transaction price may differ from expectations due to fluctuating market conditions.

Market orders are widely used across various financial markets—including stock exchanges, cryptocurrency platforms, and forex—because of their straightforward nature. They eliminate the need for complex decision-making about specific prices but introduce certain risks that traders should be aware of.

Key Disadvantages of Using Market Orders

While convenience is a significant advantage of market orders, several disadvantages warrant careful consideration:

Price Uncertainty

One primary concern with market orders is that they do not guarantee a specific execution price. Instead, they execute at what’s available at that moment in time—often called the "best available" price—which can fluctuate rapidly during volatile periods. As a result, investors might pay more than anticipated when buying or receive less when selling assets unexpectedly.

Liquidity Risks and Slippage

In markets with low liquidity or during times of high volatility—such as economic news releases or geopolitical events—market orders may not fill instantly or may fill at unfavorable prices due to slippage. Slippage occurs when there’s a difference between expected transaction prices and actual execution prices; this risk increases significantly in illiquid assets like small-cap stocks or certain cryptocurrencies.

Execution Delays During Fast-Moving Markets

Although generally executed quickly under normal conditions, fast-moving markets can cause delays in executing large or rapid trades through market orders. These delays might lead traders to miss out on favorable pricing opportunities or incur higher costs if prices move unfavorably before completion.

Impact on Small Markets Due to Large Orders

Large volume trades placed via market orders have the potential to influence asset prices directly—a phenomenon known as "market impact." For example, executing sizable buy/sell transactions in thinly traded securities could push prices upward/downward temporarily until equilibrium restores itself.

Gapping Risks During Extreme Conditions

Gaps happen when asset prices jump sharply between trading sessions without any trades occurring within those ranges—for instance after major news announcements—or during trading halts caused by regulatory issues or technical failures.

Executing a market order amid such gaps often results in unfavorable fills because it does not account for sudden jumps beyond current quotes; this exposes traders further risk especially during unpredictable events like earnings surprises or geopolitical crises.

Recent Developments Affecting Market Order Risks

The landscape surrounding market order usage has evolved considerably over recent years owing primarily to technological advancements and regulatory changes:

Cryptocurrency Volatility: Digital assets such as Bitcoin have experienced unprecedented swings recently—with daily fluctuations sometimes exceeding 10%. Such volatility amplifies risks associated with using simple-market instructions because rapid price changes mean traders could end up paying significantly more than intended—or receiving less if selling quickly.

Regulatory Initiatives: Authorities worldwide are increasingly scrutinizing trading practices aimed at protecting retail investors from adverse outcomes linked with aggressive order types like immediate-or-candomarket executions without sufficient transparency mechanisms.

Technological Innovations: High-frequency trading (HFT) algorithms now execute thousands of transactions per second based on complex strategies—including exploiting minute arbitrage opportunities—that traditional retail-market participants cannot match manually.

These systems contribute both positively by increasing liquidity but also negatively by creating unpredictable short-term volatility which impacts all types of trade executions including standard-market orders.

Investor Education Efforts: Recognizing these complexities has led many financial institutions and regulators toward emphasizing investor education about different order types’ advantages versus their inherent risks—helping individuals understand when alternative strategies such as limit orders might better serve their objectives.

Potential Impacts on Investors and Markets

The disadvantages tied specifically to market orders extend beyond individual trader losses—they also influence broader financial stability:

Investor Losses: Without control over exact pricing points—even if executed swiftly—increased exposure exists during volatile periods where unexpected slippage leads directly into losses.

Market Stability Concerns: Large aggregate use of aggressive ordering strategies can induce short-term instability by causing abrupt shifts in supply-demand dynamics; this raises systemic concerns especially within less liquid markets where single large trades disproportionately affect pricing trends.

Regulatory Responses: To mitigate these issues—and protect retail participants—regulators may impose restrictions such as minimum resting times for certain order types (e.g., limit vs.market), enhanced transparency requirements around trade execution quality—and even ban some high-risk practices altogether depending on evolving circumstances.

How Investors Can Manage Risks Associated With Market Orders

Given these disadvantages—and ongoing developments—it’s crucial for investors not only understand how marketplace dynamics work but also adopt prudent strategies:

Use limit Orders When Possible: Unlike simple-market instructions which accept prevailing quotes automatically—a limit order allows setting maximum purchase price (or minimum sale) thresholds ensuring better control over trade costs amidst volatile environments.

Stay Informed About Market Conditions: Monitoring real-time data feeds helps anticipate periods where rapid fluctuations could adversely affect your intended trade execution strategy.

Diversify Order Types: Combining different approaches based on specific goals—for example employing stop-loss limits alongside traditional entries—can help manage downside risk effectively while maintaining flexibility.

Educate Yourself Continually: Staying updated about technological innovations affecting markets—as well as regulatory changes—is vital for adapting your approach accordingly.

By understanding both the inherent limitations and recent advancements related to market orders—and applying strategic safeguards—you position yourself better against unforeseen adverse outcomes while participating actively across diverse financial landscapes.

This comprehensive overview underscores that while marketplace simplicity makes them attractive tools for quick transactions, awareness about their pitfalls remains essential — particularly amid evolving technology-driven environments shaping modern investing practices today.*

JCUSER-IC8sJL1q

2025-05-29 02:04

Are there any disadvantages to market orders?

Are There Any Disadvantages to Market Orders? An In-Depth Analysis

Understanding the potential drawbacks of market orders is essential for investors aiming to make informed trading decisions. While market orders are popular due to their simplicity and speed, they carry certain risks that can impact investment outcomes. This article explores the disadvantages associated with market orders, recent developments influencing their use, and how investors can navigate these challenges effectively.

What Is a Market Order and How Does It Work?

A market order is an instruction from an investor to buy or sell a security immediately at the best available current price. This type of order prioritizes execution speed over price certainty, making it ideal for traders who want quick entry or exit positions. When placed, a broker executes the order promptly in most cases, but the actual transaction price may differ from expectations due to fluctuating market conditions.

Market orders are widely used across various financial markets—including stock exchanges, cryptocurrency platforms, and forex—because of their straightforward nature. They eliminate the need for complex decision-making about specific prices but introduce certain risks that traders should be aware of.

Key Disadvantages of Using Market Orders

While convenience is a significant advantage of market orders, several disadvantages warrant careful consideration:

Price Uncertainty

One primary concern with market orders is that they do not guarantee a specific execution price. Instead, they execute at what’s available at that moment in time—often called the "best available" price—which can fluctuate rapidly during volatile periods. As a result, investors might pay more than anticipated when buying or receive less when selling assets unexpectedly.

Liquidity Risks and Slippage

In markets with low liquidity or during times of high volatility—such as economic news releases or geopolitical events—market orders may not fill instantly or may fill at unfavorable prices due to slippage. Slippage occurs when there’s a difference between expected transaction prices and actual execution prices; this risk increases significantly in illiquid assets like small-cap stocks or certain cryptocurrencies.

Execution Delays During Fast-Moving Markets

Although generally executed quickly under normal conditions, fast-moving markets can cause delays in executing large or rapid trades through market orders. These delays might lead traders to miss out on favorable pricing opportunities or incur higher costs if prices move unfavorably before completion.

Impact on Small Markets Due to Large Orders

Large volume trades placed via market orders have the potential to influence asset prices directly—a phenomenon known as "market impact." For example, executing sizable buy/sell transactions in thinly traded securities could push prices upward/downward temporarily until equilibrium restores itself.

Gapping Risks During Extreme Conditions

Gaps happen when asset prices jump sharply between trading sessions without any trades occurring within those ranges—for instance after major news announcements—or during trading halts caused by regulatory issues or technical failures.

Executing a market order amid such gaps often results in unfavorable fills because it does not account for sudden jumps beyond current quotes; this exposes traders further risk especially during unpredictable events like earnings surprises or geopolitical crises.

Recent Developments Affecting Market Order Risks

The landscape surrounding market order usage has evolved considerably over recent years owing primarily to technological advancements and regulatory changes:

Cryptocurrency Volatility: Digital assets such as Bitcoin have experienced unprecedented swings recently—with daily fluctuations sometimes exceeding 10%. Such volatility amplifies risks associated with using simple-market instructions because rapid price changes mean traders could end up paying significantly more than intended—or receiving less if selling quickly.

Regulatory Initiatives: Authorities worldwide are increasingly scrutinizing trading practices aimed at protecting retail investors from adverse outcomes linked with aggressive order types like immediate-or-candomarket executions without sufficient transparency mechanisms.

Technological Innovations: High-frequency trading (HFT) algorithms now execute thousands of transactions per second based on complex strategies—including exploiting minute arbitrage opportunities—that traditional retail-market participants cannot match manually.

These systems contribute both positively by increasing liquidity but also negatively by creating unpredictable short-term volatility which impacts all types of trade executions including standard-market orders.

Investor Education Efforts: Recognizing these complexities has led many financial institutions and regulators toward emphasizing investor education about different order types’ advantages versus their inherent risks—helping individuals understand when alternative strategies such as limit orders might better serve their objectives.

Potential Impacts on Investors and Markets

The disadvantages tied specifically to market orders extend beyond individual trader losses—they also influence broader financial stability:

Investor Losses: Without control over exact pricing points—even if executed swiftly—increased exposure exists during volatile periods where unexpected slippage leads directly into losses.

Market Stability Concerns: Large aggregate use of aggressive ordering strategies can induce short-term instability by causing abrupt shifts in supply-demand dynamics; this raises systemic concerns especially within less liquid markets where single large trades disproportionately affect pricing trends.

Regulatory Responses: To mitigate these issues—and protect retail participants—regulators may impose restrictions such as minimum resting times for certain order types (e.g., limit vs.market), enhanced transparency requirements around trade execution quality—and even ban some high-risk practices altogether depending on evolving circumstances.

How Investors Can Manage Risks Associated With Market Orders

Given these disadvantages—and ongoing developments—it’s crucial for investors not only understand how marketplace dynamics work but also adopt prudent strategies:

Use limit Orders When Possible: Unlike simple-market instructions which accept prevailing quotes automatically—a limit order allows setting maximum purchase price (or minimum sale) thresholds ensuring better control over trade costs amidst volatile environments.

Stay Informed About Market Conditions: Monitoring real-time data feeds helps anticipate periods where rapid fluctuations could adversely affect your intended trade execution strategy.

Diversify Order Types: Combining different approaches based on specific goals—for example employing stop-loss limits alongside traditional entries—can help manage downside risk effectively while maintaining flexibility.

Educate Yourself Continually: Staying updated about technological innovations affecting markets—as well as regulatory changes—is vital for adapting your approach accordingly.

By understanding both the inherent limitations and recent advancements related to market orders—and applying strategic safeguards—you position yourself better against unforeseen adverse outcomes while participating actively across diverse financial landscapes.

This comprehensive overview underscores that while marketplace simplicity makes them attractive tools for quick transactions, awareness about their pitfalls remains essential — particularly amid evolving technology-driven environments shaping modern investing practices today.*

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

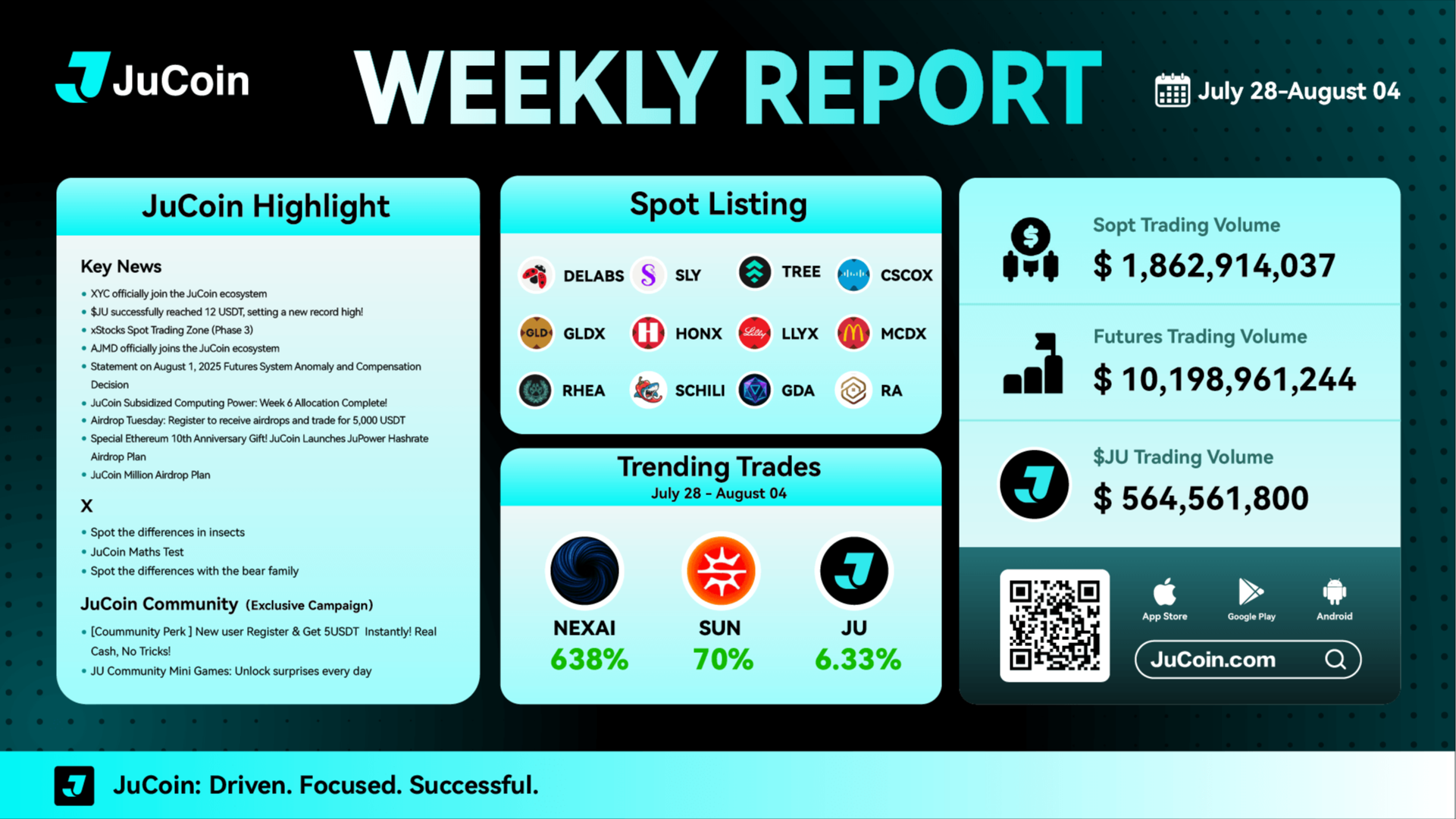

💚12 new spot listings added

💚8 campaigns launched this week

💚Platform token $JU surged over 6.33%

Stay connected with JuCoin and never miss an update!

👉 Register Now:https://www.jucoin.online/en/accounts/register?ref=MR6KTR

JuCoin Community

2025-08-04 09:41

👌JuCoin Weekly Report | July 28 – August 3 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JCUSER-Rj4NMyiW

2025-07-31 03:52

My First Post

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Backed by Amber Group's Web3 accelerator, MIA launched August 1st as the pioneering AgentFi platform token, enabling autonomous AI agent services with economic capabilities.

💰 What's New:

-

First-ever AgentFi platform with autonomous economic AI agents

5,000+ early users already onboarded and actively using services

10+ commercial agent templates (marketing assistants, community managers, data analysts)

10,000+ community members across Telegram and Discord

🔧 Core Technology:

-

Smart-Agent Engine with Llama 3 integration and RAG support

AgentFi Protocol Layer on Ethereum-compatible Base network

Cross-chain bridge technology for rapid deployment

No-code agent creation via natural language prompts

💎 Tokenomics (1B Total Supply):

-

50% Agent Incentives (performance-based rewards)

20% Community Governance (DAO voting rights)

15% Ecosystem Fund (incubation & marketing)

10% Team & Advisors (4-year linear unlock)

5% Liquidity & Airdrops

🎯 Key Features: 1️⃣ Create AI agents without coding using natural language 2️⃣ Deploy agents that earn MIA tokens autonomously 3️⃣ Participate in governance with 1,000+ MIA stake 4️⃣ Access enterprise-grade AgentFi APIs (coming soon)

🛡️ Security Measures:

-

Multiple security audits completed

3-of-5 multisig with 6-month timelocks

KYC verification required (200 MIA minimum)

Real-time cross-chain monitoring

🚀 Roadmap Highlights:

-

Q4 2025: Uniswap V3 (Base) and PancakeSwap (BSC) listings

2026: Major CEX listings and multi-chain expansion

Agent NFT Marketplace launch

Enterprise API rollout and DAO v2 implementation

With AgentFi representing the next evolution of AI-powered autonomous economies, MIA positions itself at the forefront of this emerging sector.

Read the complete analysis with technical deep-dive and market insights: 👇 https://blog.jucoin.com/mia-ai-ac-agentfi-token-analysis/

#MIA #AgentFi #AIAgent #Crypto #Blockchain #DeFi #AI #Web3 #Base #AmberGroup #JuCoin #DAO #SmartContracts #CrossChain #TokenAnalysis

JU Blog

2025-08-04 06:12

🤖 MIA: World's First AI Agent Token from ai.ac is LIVE!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.