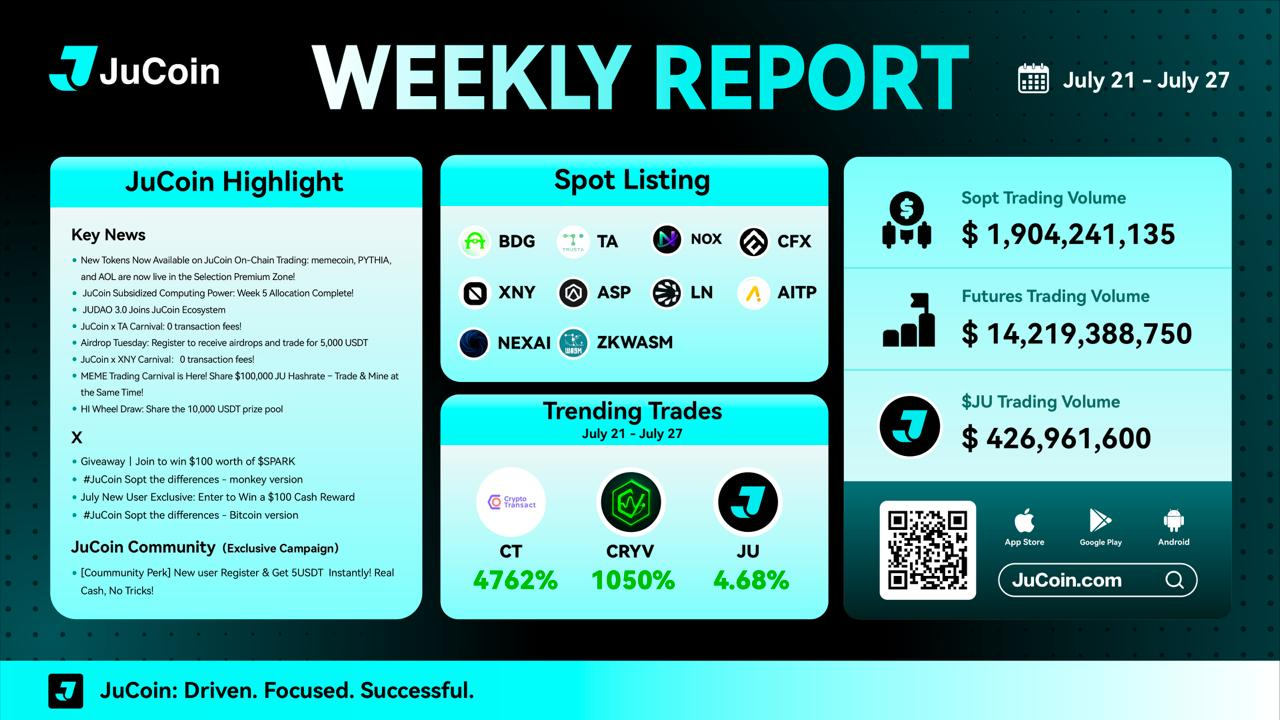

💚10 new spot listings added

💚9 campaigns launched this week

💚Platform token $JU surged over 4.68%

Stay connected with JuCoin and never miss an update!

👉 Register Now:https://www.jucoin.online/en/accounts/register?ref=MR6KTR

JuCoin Community

2025-07-31 06:26

JuCoin Weekly Report | July 21 – July 27 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

We're thrilled to announce that JUDAO 3.0, a decentralized autonomous protocol built on Polygon & AI tech, is now officially part of the JuCoin ecosystem! This collaboration initiated by NordCore Labs will focus on DAO node operations and on-chain incentive mechanisms.

🔗 JUDAO 3.0 has completed JU computing power procurement

⚙️ Will participate in JuChain ecosystem node operations

🤝 Gradually integrating into on-chain governance

JuCoin will continue providing technical support to co-build an open Web3 ecosystem! Stay tuned for on-chain updates.

JuCoin Community

2025-07-31 06:25

🚀 JUDAO 3.0 Joins JuCoin Ecosystem!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔹 Distribution Rules Recap:

▪️ Weekly contract net loss ≥ 500 USDT➡️ receive 1:1 JU computing power allocation

▪️ Computing power is permanent and generates daily JU rewards

▪️ On-chain verifiable earnings, transparent & trustworthy

⏳ Week 6 reference period: 21 July 2025 00:00 - 27 July 2025 23:59

🔸 797 users covered this round.

👉 More Details:https://support.jucoin.blog/hc/zh-cn/articles/49209048884505?utm_campaign=ann_power_0725&utm_source=telegram&utm_medium=post

JuCoin Community

2025-07-31 06:24

JuCoin Subsidized Computing Power: Week 5 Allocation Complete! 🎉

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

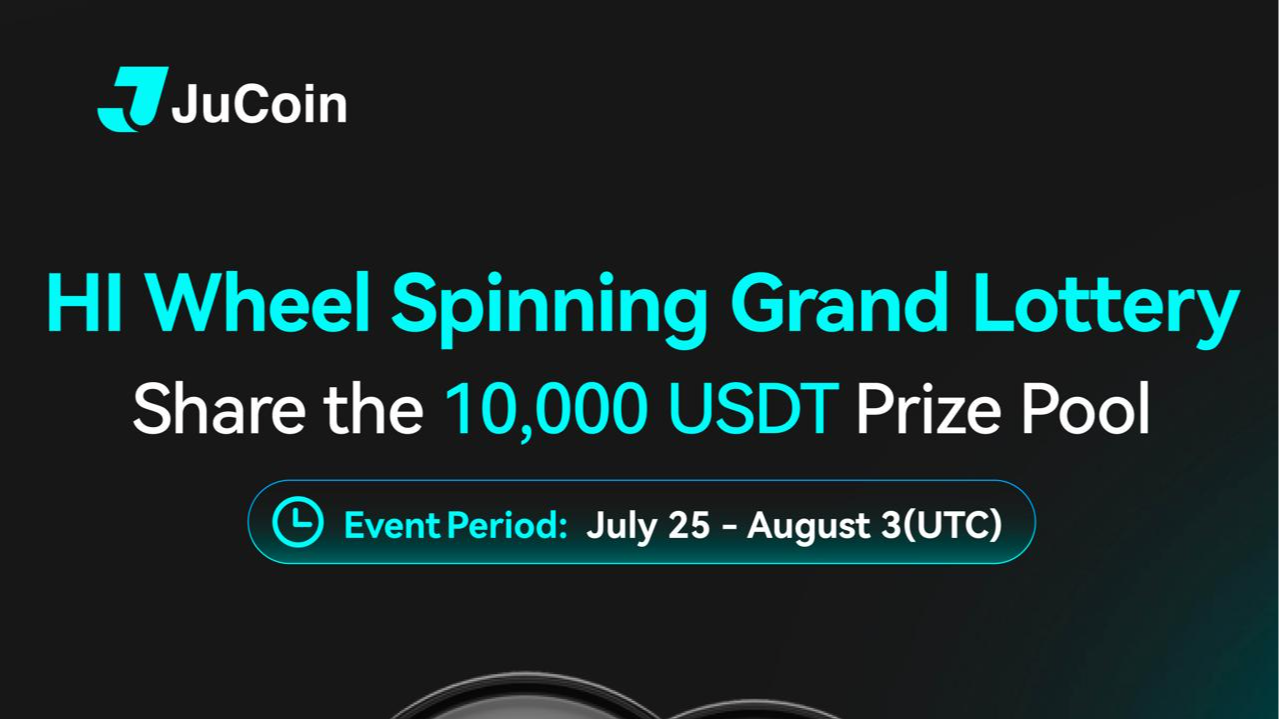

Time: 2025/7/25 13:00 - 2025/8/3 15:59 (UTC)

🔷Completing regular tasks, daily tasks, and step-by-step tasks can earn you a chance to win a USDT airdrop and share a prize pool of 10,000 USDT.

JuCoin Community

2025-07-31 06:22

HI Wheel Draw: Share the 10,000 USDT prize pool!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🕙Event Duration: July 24, 16:00 – August 24, 15:59 (UTC)

🏆 Weekly Prize Pool: $25,000 in JU Hashrate

Eligible Trading Pairs: All MEME tokens in the Spot MEME Zone + On-Chain Preferred Zone

❕Hashrate Mining Highlights:

Mine While You Trade: Earn JU hashrate based on tasks, settled weekly

High-Yield Bonus: Earn JU continuously from your awarded hashrate

On-Chain Transparency: All JU earnings are verifiable on-chain

JuCoin Community

2025-07-31 06:21

🎁 MEME Trading Carnival is Here! Share $100,000 JU Hashrate – Trade & Mine at the Same Time!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JCUSER-F1IIaxXA

2025-05-22 09:56

How do hardware wallets safeguard private keys against hacks?

Error executing ChatgptTask

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

kai

2025-05-22 09:54

What’s the difference between custodial and non-custodial wallets?

Error executing ChatgptTask

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding the Role of Oracles in Blockchain Technology

In the rapidly evolving world of blockchain, oracles serve as a vital link between decentralized networks and real-world data. While blockchains excel at maintaining secure, transparent ledgers, they inherently lack direct access to external information. This gap is where oracles come into play, enabling smart contracts—self-executing agreements with coded rules—to interact with data outside their native environment. Whether it's fetching current asset prices for decentralized finance (DeFi) applications or verifying real-world events for insurance claims, oracles are fundamental to expanding blockchain utility beyond digital assets.

What Are Oracles and How Do They Work?

Oracles are third-party services that provide external data to blockchain networks in a trustworthy manner. They act as bridges that transmit information from outside sources—such as APIs, IoT devices, human inputs, or databases—to smart contracts on the blockchain. For example, a weather oracle might supply rainfall data needed for crop insurance contracts; a price oracle could deliver live cryptocurrency valuations used in trading platforms.

The process typically involves an oracle querying an external source via mechanisms like API calls or webhooks. Once the data is retrieved and verified—either through multiple independent nodes in decentralized systems or trusted sources—it is then fed into the smart contract to trigger specific actions based on predefined conditions.

Why Are Oracles Essential for Blockchain Applications?

Blockchains operate within isolated environments called "trustless" systems—they do not inherently trust any external entity unless explicitly programmed to do so through mechanisms like oracles. Without them, smart contracts would be limited solely to internal logic and self-contained transactions.

This limitation restricts many practical use cases such as:

- Decentralized Finance (DeFi): Accurate asset prices are crucial for lending protocols and derivatives.

- NFT Marketplaces: Verifying ownership transfers based on real-world events.

- Insurance: Validating claims using external event data like weather patterns.

- Supply Chain Management: Tracking goods through IoT sensors providing location updates.

By integrating reliable external data sources via oracles, these applications can operate dynamically and respond accurately to real-world conditions.

Types of Oracles: Reliable vs Unreliable

Not all oracles offer equal levels of trustworthiness; understanding their types helps assess risks involved:

Reliable Oracles: These prioritize accuracy by sourcing data from reputable providers and often employ multiple nodes to cross-verify information before delivery.

Unreliable Oracles: These may rely on single sources without validation processes; thus they pose higher risks of delivering false or outdated information which can compromise contract execution.

Hybrid Oracles: Combining elements from both categories, hybrid models aim to balance reliability with flexibility by integrating multiple verification methods.

Choosing the right type depends heavily on application requirements—especially when dealing with high-stakes financial transactions where security breaches could lead to significant losses.

Mechanisms Used by Oracles

Oracular technology employs various methods for delivering accurate data:

- API Calls: Directly querying trusted APIs from service providers such as financial markets feeds.

- Webhooks: Listening for notifications from external services when new relevant events occur.

- Human Inputs: Incorporating expert judgment when automated sources are unavailable—or necessary—for validation purposes.

- Data Aggregation & Consensus Protocols: Especially in decentralized oracle networks (DONs), multiple nodes gather independent reports which are then aggregated using consensus algorithms like majority voting — reducing reliance on any single source's integrity.

These mechanisms help ensure that only validated information influences smart contract outcomes while minimizing potential attack vectors such as false reporting.

Security Challenges Facing Oracle Systems

Despite their importance,oracle systems face notable security concerns that must be addressed proactively:

Data Manipulation Attacks: Malicious actors may attempt to feed false information into an oracle system if it lacks proper safeguards.

Single Point of Failure: Centralized oracle solutions risk becoming targets because reliance on one node increases vulnerability—a problem mitigated by decentralization efforts like Chainlink’s multi-node architecture.

Denial-of-Service (DoS) Attacks: Attackers could disrupt service availability by overwhelming servers hosting critical data feeds leading to delays or failures in executing smart contracts correctly.

To mitigate these risks effectively requires implementing robust cryptographic techniques, decentralizing node infrastructure across diverse geographic locations—and continuously auditing system integrity against emerging threats.

Recent Innovations in Oracle Technology

The landscape has seen significant advancements aimed at enhancing security and interoperability:

Decentralized Oracle Networks (DONs)

Projects like Chainlink have pioneered decentralized architectures where multiple independent nodes source and verify data before feeding it into blockchains—a move toward reducing reliance on centralized points of failure while increasing trustworthiness through consensus mechanisms.

Cross-chain Compatibility

Emerging solutions focus not only on securing individual chains but also facilitating interoperability among different blockchain platforms—for example , projects developing cross-chain bridges enable seamless transfer of verified off-chain info across diverse ecosystems without compromising security standards.

Blockchain-Agnostic Solutions

Some newer oracle frameworks aim at platform neutrality—they work across various blockchains regardless of underlying architecture—thus broadening applicability especially within multi-chain environments prevalent today.

Risks Associated With Using Oracles

While offering immense benefits ,oracular solutions introduce certain vulnerabilities:

- If compromised ,a single malicious node can corrupt entire datasets leading potentially catastrophic outcomes — especially relevant during high-value DeFi operations where incorrect price feeds might cause liquidations unfairly .2 . Regulatory uncertainties around how externally sourced sensitive personal/financial info should be handled raise compliance questions .3 . Dependence upon third-party providers introduces operational dependencies that require rigorous due diligence .

Understanding these risks underscores why selecting reputable oracle providers with proven track records remains critical.

The Future Trajectory of Oracle Technology

Looking ahead,the evolution will likely focus heavily on enhancing decentralization further,making systems more resilient against attacks while improving transparency.Innovation areas include advanced cryptographic proofs such as zero knowledge proofs—which allow verification without revealing underlying sensitive info—and increased automation via AI-driven validation processes.These developments promise more secure,reliable,and scalable integrations between blockchains and real-world datasets .

As regulatory frameworks mature globally,the industry will also need standardized compliance protocols ensuring privacy standards meet legal requirements without hindering innovation—all contributing toward broader adoption across sectors ranging from finance,to supply chain management,and beyond.

By bridging the gap between digital ledgers and physical reality,data-oracle integration remains central not just for current applications but also future innovations within blockchain ecosystems.As technology advances,taking steps toward more secure,decentralized,and trustworthy solutions will be key drivers shaping this dynamic field moving forward

JCUSER-WVMdslBw

2025-05-22 09:45

What role do oracles play in linking blockchains to real-world data?

Understanding the Role of Oracles in Blockchain Technology

In the rapidly evolving world of blockchain, oracles serve as a vital link between decentralized networks and real-world data. While blockchains excel at maintaining secure, transparent ledgers, they inherently lack direct access to external information. This gap is where oracles come into play, enabling smart contracts—self-executing agreements with coded rules—to interact with data outside their native environment. Whether it's fetching current asset prices for decentralized finance (DeFi) applications or verifying real-world events for insurance claims, oracles are fundamental to expanding blockchain utility beyond digital assets.

What Are Oracles and How Do They Work?

Oracles are third-party services that provide external data to blockchain networks in a trustworthy manner. They act as bridges that transmit information from outside sources—such as APIs, IoT devices, human inputs, or databases—to smart contracts on the blockchain. For example, a weather oracle might supply rainfall data needed for crop insurance contracts; a price oracle could deliver live cryptocurrency valuations used in trading platforms.

The process typically involves an oracle querying an external source via mechanisms like API calls or webhooks. Once the data is retrieved and verified—either through multiple independent nodes in decentralized systems or trusted sources—it is then fed into the smart contract to trigger specific actions based on predefined conditions.

Why Are Oracles Essential for Blockchain Applications?

Blockchains operate within isolated environments called "trustless" systems—they do not inherently trust any external entity unless explicitly programmed to do so through mechanisms like oracles. Without them, smart contracts would be limited solely to internal logic and self-contained transactions.

This limitation restricts many practical use cases such as:

- Decentralized Finance (DeFi): Accurate asset prices are crucial for lending protocols and derivatives.

- NFT Marketplaces: Verifying ownership transfers based on real-world events.

- Insurance: Validating claims using external event data like weather patterns.

- Supply Chain Management: Tracking goods through IoT sensors providing location updates.

By integrating reliable external data sources via oracles, these applications can operate dynamically and respond accurately to real-world conditions.

Types of Oracles: Reliable vs Unreliable

Not all oracles offer equal levels of trustworthiness; understanding their types helps assess risks involved:

Reliable Oracles: These prioritize accuracy by sourcing data from reputable providers and often employ multiple nodes to cross-verify information before delivery.

Unreliable Oracles: These may rely on single sources without validation processes; thus they pose higher risks of delivering false or outdated information which can compromise contract execution.

Hybrid Oracles: Combining elements from both categories, hybrid models aim to balance reliability with flexibility by integrating multiple verification methods.

Choosing the right type depends heavily on application requirements—especially when dealing with high-stakes financial transactions where security breaches could lead to significant losses.

Mechanisms Used by Oracles

Oracular technology employs various methods for delivering accurate data:

- API Calls: Directly querying trusted APIs from service providers such as financial markets feeds.

- Webhooks: Listening for notifications from external services when new relevant events occur.

- Human Inputs: Incorporating expert judgment when automated sources are unavailable—or necessary—for validation purposes.

- Data Aggregation & Consensus Protocols: Especially in decentralized oracle networks (DONs), multiple nodes gather independent reports which are then aggregated using consensus algorithms like majority voting — reducing reliance on any single source's integrity.

These mechanisms help ensure that only validated information influences smart contract outcomes while minimizing potential attack vectors such as false reporting.

Security Challenges Facing Oracle Systems

Despite their importance,oracle systems face notable security concerns that must be addressed proactively:

Data Manipulation Attacks: Malicious actors may attempt to feed false information into an oracle system if it lacks proper safeguards.

Single Point of Failure: Centralized oracle solutions risk becoming targets because reliance on one node increases vulnerability—a problem mitigated by decentralization efforts like Chainlink’s multi-node architecture.

Denial-of-Service (DoS) Attacks: Attackers could disrupt service availability by overwhelming servers hosting critical data feeds leading to delays or failures in executing smart contracts correctly.

To mitigate these risks effectively requires implementing robust cryptographic techniques, decentralizing node infrastructure across diverse geographic locations—and continuously auditing system integrity against emerging threats.

Recent Innovations in Oracle Technology

The landscape has seen significant advancements aimed at enhancing security and interoperability:

Decentralized Oracle Networks (DONs)

Projects like Chainlink have pioneered decentralized architectures where multiple independent nodes source and verify data before feeding it into blockchains—a move toward reducing reliance on centralized points of failure while increasing trustworthiness through consensus mechanisms.

Cross-chain Compatibility

Emerging solutions focus not only on securing individual chains but also facilitating interoperability among different blockchain platforms—for example , projects developing cross-chain bridges enable seamless transfer of verified off-chain info across diverse ecosystems without compromising security standards.

Blockchain-Agnostic Solutions

Some newer oracle frameworks aim at platform neutrality—they work across various blockchains regardless of underlying architecture—thus broadening applicability especially within multi-chain environments prevalent today.

Risks Associated With Using Oracles

While offering immense benefits ,oracular solutions introduce certain vulnerabilities:

- If compromised ,a single malicious node can corrupt entire datasets leading potentially catastrophic outcomes — especially relevant during high-value DeFi operations where incorrect price feeds might cause liquidations unfairly .2 . Regulatory uncertainties around how externally sourced sensitive personal/financial info should be handled raise compliance questions .3 . Dependence upon third-party providers introduces operational dependencies that require rigorous due diligence .

Understanding these risks underscores why selecting reputable oracle providers with proven track records remains critical.

The Future Trajectory of Oracle Technology

Looking ahead,the evolution will likely focus heavily on enhancing decentralization further,making systems more resilient against attacks while improving transparency.Innovation areas include advanced cryptographic proofs such as zero knowledge proofs—which allow verification without revealing underlying sensitive info—and increased automation via AI-driven validation processes.These developments promise more secure,reliable,and scalable integrations between blockchains and real-world datasets .

As regulatory frameworks mature globally,the industry will also need standardized compliance protocols ensuring privacy standards meet legal requirements without hindering innovation—all contributing toward broader adoption across sectors ranging from finance,to supply chain management,and beyond.

By bridging the gap between digital ledgers and physical reality,data-oracle integration remains central not just for current applications but also future innovations within blockchain ecosystems.As technology advances,taking steps toward more secure,decentralized,and trustworthy solutions will be key drivers shaping this dynamic field moving forward

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JCUSER-IC8sJL1q

2025-05-22 09:41

How do sidechains compare to layer-2 networks in terms of security?

Error executing ChatgptTask

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.