How Do Hashed Time-Locked Contracts (HTLCs) Function?

Hashed Time-Locked Contracts (HTLCs) are a fundamental component of modern blockchain technology, especially in enabling secure cross-chain transactions. They combine cryptographic principles with smart contract logic to create trustless agreements that automatically execute when predefined conditions are met. Understanding how HTLCs work is essential for grasping their role in facilitating decentralized finance (DeFi), payment channels like the Lightning Network, and multi-chain interoperability.

The Core Mechanism of HTLCs

At their core, HTLCs operate through two main components: hash locks and time locks. These features ensure that funds are only transferred under specific cryptographic conditions within a designated timeframe, thereby reducing counterparty risk without relying on intermediaries.

Step-by-Step Process

Initiation of the Contract

The process begins when a sender creates an HTLC transaction on the blockchain. This transaction includes a cryptographic hash derived from the recipient's secret or address and specifies a deadline—known as the time lock—by which the transaction must be completed.Hash Lock Implementation

The hash lock acts as a cryptographic puzzle: funds are locked with a hash value that can only be unlocked by revealing its pre-image—the original secret or key used to generate the hash. This ensures that only someone who knows this secret can claim the funds.Setting Up the Time Lock

Alongside the hash lock, a time lock is embedded into the contract, typically expressed in blocks or timestamps. It defines how long recipients have to fulfill certain conditions before they can no longer claim their funds and instead trigger refunds back to the sender.Recipient Unlocking Funds

To unlock and claim these funds, the recipient must provide proof—specifically, revealing their secret pre-image—that matches the original hash used during initialization within this timeframe.Automatic Execution & Confirmation

Once verified on-chain, if all conditions are met (correct pre-image provided before timeout), smart contracts automatically release funds to the recipient’s address; otherwise, after expiration of time locks, they revert back to sender’s control.

Ensuring Security Without Trust

The primary advantage of HTLCs lies in their ability to facilitate trustless transactions across different blockchains or payment channels without requiring intermediaries such as escrow services or third-party custodians. By leveraging cryptography rather than trustworthiness alone, parties can transact securely even if they do not know each other directly.

This mechanism also mitigates risks associated with fraud or default since either party must fulfill specific cryptographic criteria within set deadlines for successful transfer — otherwise reverting assets safely back to originators.

Practical Applications of HTLCs

HTLCs underpin several critical innovations in blockchain technology:

- Lightning Network: A second-layer scaling solution for Bitcoin that uses HTLCs extensively for fast off-chain payments between participants.

- Cross-Chain Swaps: Enabling direct exchanges between different cryptocurrencies without centralized exchanges.

- Interoperability Protocols: Facilitating communication between various blockchains like Ethereum and Polkadot through similar mechanisms.

- Decentralized Escrow Services: Allowing secure escrow arrangements where fund release depends solely on fulfilling predefined cryptographic conditions within specified periods.

Limitations & Challenges

While HTLCs offer significant benefits regarding security and decentralization, they also introduce complexities:

- Technical Complexity: Users need familiarity with concepts like hashes and secrets; mismanagement may lead to lost funds.

- Scalability Concerns: As usage grows exponentially across multiple networks and channels, network congestion could impact transaction speeds.

- Regulatory Considerations: Increasing adoption prompts regulatory scrutiny concerning compliance with AML/KYC laws across jurisdictions—a factor influencing broader acceptance.

Recent Trends & Future Outlook

Recent years have seen rapid growth in technologies leveraging HTLC principles:

- The expansion of Lightning Network nodes has surpassed 10,000 active participants by 2022—a testament to increasing adoption driven by improved scalability solutions.

- Ethereum-based Layer 2 solutions now incorporate similar mechanisms aimed at enhancing cross-chain security while maintaining efficiency.

- Regulatory discussions around these mechanisms aim at balancing innovation with compliance standards globally—an essential step toward mainstream integration.

As blockchain ecosystems evolve towards greater interoperability and scalability needs intensify, understanding how mechanisms like HTLC function will remain crucial for developers—and users alike—to navigate this rapidly changing landscape effectively.

Key Takeaways About How Hash Locks & Time Locks Work Together

In essence:

- Hash locks ensure that only those who possess specific secrets can access transferred assets

- Time locks guarantee assets revert if contractual obligations aren’t fulfilled promptly

- Their combined use creates robust frameworks enabling secure cross-platform transactions without intermediaries

Final Thoughts

Understanding how hashed time-lock contracts operate provides insight into one of blockchain's most innovative solutions for achieving trustless interactions across diverse networks. As adoption continues expanding—from payment channels like Lightning Network to complex DeFi protocols—the importance of mastering these concepts becomes increasingly vital for anyone involved in cryptocurrency trading or development.

This comprehensive overview aims at equipping readers with clear knowledge about how HTLC functions within broader blockchain applications while addressing common questions about security features and practical implementations—all aligned toward improving user confidence amid ongoing technological advancements

Lo

2025-05-09 17:29

How do hashed time-locked contracts (HTLCs) function?

How Do Hashed Time-Locked Contracts (HTLCs) Function?

Hashed Time-Locked Contracts (HTLCs) are a fundamental component of modern blockchain technology, especially in enabling secure cross-chain transactions. They combine cryptographic principles with smart contract logic to create trustless agreements that automatically execute when predefined conditions are met. Understanding how HTLCs work is essential for grasping their role in facilitating decentralized finance (DeFi), payment channels like the Lightning Network, and multi-chain interoperability.

The Core Mechanism of HTLCs

At their core, HTLCs operate through two main components: hash locks and time locks. These features ensure that funds are only transferred under specific cryptographic conditions within a designated timeframe, thereby reducing counterparty risk without relying on intermediaries.

Step-by-Step Process

Initiation of the Contract

The process begins when a sender creates an HTLC transaction on the blockchain. This transaction includes a cryptographic hash derived from the recipient's secret or address and specifies a deadline—known as the time lock—by which the transaction must be completed.Hash Lock Implementation

The hash lock acts as a cryptographic puzzle: funds are locked with a hash value that can only be unlocked by revealing its pre-image—the original secret or key used to generate the hash. This ensures that only someone who knows this secret can claim the funds.Setting Up the Time Lock

Alongside the hash lock, a time lock is embedded into the contract, typically expressed in blocks or timestamps. It defines how long recipients have to fulfill certain conditions before they can no longer claim their funds and instead trigger refunds back to the sender.Recipient Unlocking Funds

To unlock and claim these funds, the recipient must provide proof—specifically, revealing their secret pre-image—that matches the original hash used during initialization within this timeframe.Automatic Execution & Confirmation

Once verified on-chain, if all conditions are met (correct pre-image provided before timeout), smart contracts automatically release funds to the recipient’s address; otherwise, after expiration of time locks, they revert back to sender’s control.

Ensuring Security Without Trust

The primary advantage of HTLCs lies in their ability to facilitate trustless transactions across different blockchains or payment channels without requiring intermediaries such as escrow services or third-party custodians. By leveraging cryptography rather than trustworthiness alone, parties can transact securely even if they do not know each other directly.

This mechanism also mitigates risks associated with fraud or default since either party must fulfill specific cryptographic criteria within set deadlines for successful transfer — otherwise reverting assets safely back to originators.

Practical Applications of HTLCs

HTLCs underpin several critical innovations in blockchain technology:

- Lightning Network: A second-layer scaling solution for Bitcoin that uses HTLCs extensively for fast off-chain payments between participants.

- Cross-Chain Swaps: Enabling direct exchanges between different cryptocurrencies without centralized exchanges.

- Interoperability Protocols: Facilitating communication between various blockchains like Ethereum and Polkadot through similar mechanisms.

- Decentralized Escrow Services: Allowing secure escrow arrangements where fund release depends solely on fulfilling predefined cryptographic conditions within specified periods.

Limitations & Challenges

While HTLCs offer significant benefits regarding security and decentralization, they also introduce complexities:

- Technical Complexity: Users need familiarity with concepts like hashes and secrets; mismanagement may lead to lost funds.

- Scalability Concerns: As usage grows exponentially across multiple networks and channels, network congestion could impact transaction speeds.

- Regulatory Considerations: Increasing adoption prompts regulatory scrutiny concerning compliance with AML/KYC laws across jurisdictions—a factor influencing broader acceptance.

Recent Trends & Future Outlook

Recent years have seen rapid growth in technologies leveraging HTLC principles:

- The expansion of Lightning Network nodes has surpassed 10,000 active participants by 2022—a testament to increasing adoption driven by improved scalability solutions.

- Ethereum-based Layer 2 solutions now incorporate similar mechanisms aimed at enhancing cross-chain security while maintaining efficiency.

- Regulatory discussions around these mechanisms aim at balancing innovation with compliance standards globally—an essential step toward mainstream integration.

As blockchain ecosystems evolve towards greater interoperability and scalability needs intensify, understanding how mechanisms like HTLC function will remain crucial for developers—and users alike—to navigate this rapidly changing landscape effectively.

Key Takeaways About How Hash Locks & Time Locks Work Together

In essence:

- Hash locks ensure that only those who possess specific secrets can access transferred assets

- Time locks guarantee assets revert if contractual obligations aren’t fulfilled promptly

- Their combined use creates robust frameworks enabling secure cross-platform transactions without intermediaries

Final Thoughts

Understanding how hashed time-lock contracts operate provides insight into one of blockchain's most innovative solutions for achieving trustless interactions across diverse networks. As adoption continues expanding—from payment channels like Lightning Network to complex DeFi protocols—the importance of mastering these concepts becomes increasingly vital for anyone involved in cryptocurrency trading or development.

This comprehensive overview aims at equipping readers with clear knowledge about how HTLC functions within broader blockchain applications while addressing common questions about security features and practical implementations—all aligned toward improving user confidence amid ongoing technological advancements

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding Full Nodes and Pruned Nodes in Blockchain

Blockchain technology relies heavily on nodes—computers that participate in maintaining and securing the network. These nodes are essential for validating transactions, propagating data, and ensuring the integrity of the blockchain. Among these, full nodes and pruned nodes are two fundamental types, each serving different roles based on their storage capacity and validation capabilities. Grasping the differences between them is crucial for anyone interested in blockchain security, scalability, or running a node.

What Is a Full Node?

A full node is a comprehensive participant in a blockchain network that maintains an exact copy of every block and transaction since the inception of the chain. This means it stores all historical data associated with the blockchain—often gigabytes or even terabytes of information depending on how long the network has been active. Full nodes perform critical functions such as validating new transactions against existing rules, verifying blocks before adding them to their local copy of the chain, and relaying validated data to other peers.

Because they hold complete historical records, full nodes play an integral role in maintaining decentralization and security within networks like Bitcoin or Ethereum. They act as trust anchors; by independently verifying all data without relying on external sources or third parties, they help prevent malicious activities such as double-spending or fraudulent blocks.

What Is a Pruned Node?

Unlike full nodes that store every piece of historical data, pruned nodes operate with significantly less storage space by discarding older parts of the blockchain after certain points have been validated. Typically used by individuals or organizations with limited hardware resources—such as personal computers or lightweight servers—pruned nodes keep only recent blocks necessary for current validation processes.

Despite this reduced dataset size, pruned nodes can still validate new transactions within their stored subset effectively. However, they lack access to complete historical information needed for certain advanced functions like deep forensic analysis or participating fully in some consensus mechanisms that require knowledge of entire history.

Key Differences Between Full Nodes and Pruned Nodes

Understanding how these two node types differ helps clarify their roles:

Storage Requirements:

- Full Node: Requires substantial disk space because it maintains an entire copy of all past blocks.

- Pruned Node: Uses much less storage by deleting old block data once it's no longer needed for validation purposes.

Validation Capabilities:

- Full Node: Can validate any transaction at any point because it has access to complete history.

- Pruned Node: Limited to validating recent transactions within its stored subset; cannot verify older ones without additional tools.

Network Participation:

- Full Node: Fully participates in network activities including broadcasting valid transactions/blocks and enforcing consensus rules.

- Pruned Node: Can still relay valid transactions but might not provide all services due to limited stored data.

Security Level:

- Full Node: Offers higher security assurance since it verifies everything from scratch using complete history.

- Pruned Node: Slightly lower security margin because its limited dataset could potentially miss some malicious activity if not properly maintained.

Why Are Pruned Nodes Gaining Popularity?

As blockchains grow larger over time—for example Bitcoin’s blockchain surpasses hundreds of gigabytes—the challenge becomes managing storage costs while maintaining participation levels across diverse users. This has led to increased interest in pruned nodes due to several advantages:

- Efficiency & Cost Savings: They require less disk space which makes running a node feasible even on modest hardware setups.

- Faster Synchronization: Because they process fewer historic blocks during setup compared to full synchronization from genesis block.

- Enhanced Accessibility: Lower hardware requirements encourage more participants which supports decentralization efforts.

In addition to individual users benefiting from lighter clients like mobile wallets connecting via pruned modes (which do not need entire histories), enterprise solutions also leverage pruning techniques when full archival capabilities aren’t necessary.

Recent Developments Improving Blockchain Scalability

The ongoing evolution toward scalable networks involves innovations aimed at reducing load while preserving security standards:

Sharding & Layer Two Solutions: These techniques distribute transaction processing across multiple smaller chains (shards) or off-chain layers (like Lightning Network), alleviating pressure on individual full nodes while enabling efficient validation through lightweight clients such as pruned nodes.

Optimized Validation Algorithms: Developers are creating more efficient algorithms that allow quick verification without sacrificing accuracy—a boon especially relevant for resource-constrained devices operating as pruned validators.

Hybrid Approaches: Many networks now support hybrid models where users can choose between running a full archive node (full history) versus pruning options suited for everyday use cases requiring less storage but still robust participation rights.

Security Measures & Risks Management: As reliance increases on lighter clients like prunned modes especially among casual users—and given potential attack vectors related to incomplete datasets—blockchain projects implement safeguards such as checkpoints (known good states) ensuring integrity despite partial histories.

Potential Challenges With Pruning

While pruning offers many benefits regarding efficiency and accessibility—it does come with trade-offs:

- Security vulnerabilities may arise if malicious actors exploit gaps created by missing historical data

- Network fragmentation risks increase if different participants run incompatible versions

- Certain analytical functions become impossible without access to comprehensive records

Most modern implementations mitigate these issues through rigorous protocol standards ensuring minimal risk exposure when deploying pruning features.

Who Should Use Which Type?

For most individual users interested primarily in transacting securely without needing deep historical insights—or those constrained by hardware limitations—a prunned node provides an excellent balance between performance and participation capability.

Conversely, entities involved in development work requiring detailed audit trails—or those committed fully toward decentralization's highest standards—prefer operating full archive nodes despite higher resource demands.

By understanding these distinctions—and staying informed about ongoing technological improvements—you can better appreciate how blockchain networks maintain resilience amid growing size challenges while balancing accessibility with security needs.

Keywords:

Blockchain Nodes | Full vs Pruned Nodes | Blockchain Validation | Decentralized Network Security | Blockchain Scalability | Lightweight Clients

JCUSER-WVMdslBw

2025-05-09 16:39

What is the difference between a full node and a pruned node?

Understanding Full Nodes and Pruned Nodes in Blockchain

Blockchain technology relies heavily on nodes—computers that participate in maintaining and securing the network. These nodes are essential for validating transactions, propagating data, and ensuring the integrity of the blockchain. Among these, full nodes and pruned nodes are two fundamental types, each serving different roles based on their storage capacity and validation capabilities. Grasping the differences between them is crucial for anyone interested in blockchain security, scalability, or running a node.

What Is a Full Node?

A full node is a comprehensive participant in a blockchain network that maintains an exact copy of every block and transaction since the inception of the chain. This means it stores all historical data associated with the blockchain—often gigabytes or even terabytes of information depending on how long the network has been active. Full nodes perform critical functions such as validating new transactions against existing rules, verifying blocks before adding them to their local copy of the chain, and relaying validated data to other peers.

Because they hold complete historical records, full nodes play an integral role in maintaining decentralization and security within networks like Bitcoin or Ethereum. They act as trust anchors; by independently verifying all data without relying on external sources or third parties, they help prevent malicious activities such as double-spending or fraudulent blocks.

What Is a Pruned Node?

Unlike full nodes that store every piece of historical data, pruned nodes operate with significantly less storage space by discarding older parts of the blockchain after certain points have been validated. Typically used by individuals or organizations with limited hardware resources—such as personal computers or lightweight servers—pruned nodes keep only recent blocks necessary for current validation processes.

Despite this reduced dataset size, pruned nodes can still validate new transactions within their stored subset effectively. However, they lack access to complete historical information needed for certain advanced functions like deep forensic analysis or participating fully in some consensus mechanisms that require knowledge of entire history.

Key Differences Between Full Nodes and Pruned Nodes

Understanding how these two node types differ helps clarify their roles:

Storage Requirements:

- Full Node: Requires substantial disk space because it maintains an entire copy of all past blocks.

- Pruned Node: Uses much less storage by deleting old block data once it's no longer needed for validation purposes.

Validation Capabilities:

- Full Node: Can validate any transaction at any point because it has access to complete history.

- Pruned Node: Limited to validating recent transactions within its stored subset; cannot verify older ones without additional tools.

Network Participation:

- Full Node: Fully participates in network activities including broadcasting valid transactions/blocks and enforcing consensus rules.

- Pruned Node: Can still relay valid transactions but might not provide all services due to limited stored data.

Security Level:

- Full Node: Offers higher security assurance since it verifies everything from scratch using complete history.

- Pruned Node: Slightly lower security margin because its limited dataset could potentially miss some malicious activity if not properly maintained.

Why Are Pruned Nodes Gaining Popularity?

As blockchains grow larger over time—for example Bitcoin’s blockchain surpasses hundreds of gigabytes—the challenge becomes managing storage costs while maintaining participation levels across diverse users. This has led to increased interest in pruned nodes due to several advantages:

- Efficiency & Cost Savings: They require less disk space which makes running a node feasible even on modest hardware setups.

- Faster Synchronization: Because they process fewer historic blocks during setup compared to full synchronization from genesis block.

- Enhanced Accessibility: Lower hardware requirements encourage more participants which supports decentralization efforts.

In addition to individual users benefiting from lighter clients like mobile wallets connecting via pruned modes (which do not need entire histories), enterprise solutions also leverage pruning techniques when full archival capabilities aren’t necessary.

Recent Developments Improving Blockchain Scalability

The ongoing evolution toward scalable networks involves innovations aimed at reducing load while preserving security standards:

Sharding & Layer Two Solutions: These techniques distribute transaction processing across multiple smaller chains (shards) or off-chain layers (like Lightning Network), alleviating pressure on individual full nodes while enabling efficient validation through lightweight clients such as pruned nodes.

Optimized Validation Algorithms: Developers are creating more efficient algorithms that allow quick verification without sacrificing accuracy—a boon especially relevant for resource-constrained devices operating as pruned validators.

Hybrid Approaches: Many networks now support hybrid models where users can choose between running a full archive node (full history) versus pruning options suited for everyday use cases requiring less storage but still robust participation rights.

Security Measures & Risks Management: As reliance increases on lighter clients like prunned modes especially among casual users—and given potential attack vectors related to incomplete datasets—blockchain projects implement safeguards such as checkpoints (known good states) ensuring integrity despite partial histories.

Potential Challenges With Pruning

While pruning offers many benefits regarding efficiency and accessibility—it does come with trade-offs:

- Security vulnerabilities may arise if malicious actors exploit gaps created by missing historical data

- Network fragmentation risks increase if different participants run incompatible versions

- Certain analytical functions become impossible without access to comprehensive records

Most modern implementations mitigate these issues through rigorous protocol standards ensuring minimal risk exposure when deploying pruning features.

Who Should Use Which Type?

For most individual users interested primarily in transacting securely without needing deep historical insights—or those constrained by hardware limitations—a prunned node provides an excellent balance between performance and participation capability.

Conversely, entities involved in development work requiring detailed audit trails—or those committed fully toward decentralization's highest standards—prefer operating full archive nodes despite higher resource demands.

By understanding these distinctions—and staying informed about ongoing technological improvements—you can better appreciate how blockchain networks maintain resilience amid growing size challenges while balancing accessibility with security needs.

Keywords:

Blockchain Nodes | Full vs Pruned Nodes | Blockchain Validation | Decentralized Network Security | Blockchain Scalability | Lightweight Clients

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Ethereum's Berlin Hard Fork: A Key Milestone in Blockchain Development

What Is a Hard Fork in Blockchain Technology?

A hard fork is a fundamental change to the protocol of a blockchain network that results in the creation of two separate chains. Unlike soft forks, which are backward-compatible and do not split the network, hard forks are incompatible with previous versions of the protocol. This incompatibility means that nodes running different versions cannot validate each other's transactions, leading to a permanent divergence.

In cryptocurrency communities, hard forks often serve as mechanisms for implementing significant upgrades or corrections. They can be contentious or smooth, depending on community consensus and the nature of changes introduced. When successful, they enhance network security, scalability, and functionality; when mishandled or controversial, they can lead to splits like Bitcoin Cash (BCH) from Bitcoin (BTC).

The Significance of Ethereum’s Berlin Hard Fork

Ethereum stands out as one of the most actively developed blockchain platforms globally. Since its launch in 2015 by Vitalik Buterin and others, it has undergone multiple upgrades through hard forks aimed at improving performance and security.

The Berlin Hard Fork took place on April 15, 2021. It was part of Ethereum’s broader roadmap toward scalability improvements and transitioning from proof-of-work (PoW) to proof-of-stake (PoS). This upgrade was crucial because it laid groundwork for future features like sharding—an essential component for increasing transaction throughput.

This event exemplifies how strategic protocol updates via hard forks help maintain Ethereum's position as an innovative leader in decentralized applications (dApps), DeFi projects, and smart contract development.

Key Features Introduced During the Berlin Hard Fork

The Berlin upgrade focused on several core improvements through specific Ethereum Improvement Proposals (EIPs). These enhancements aimed at optimizing transaction efficiency while addressing security concerns:

EIP-2565: This proposal reduces miners’ block rewards by approximately 20% every 6.9 million blocks (~every six months). The reduction aims to control inflationary pressures over time.

EIP-3074: It introduces new precompile contracts that enable more efficient execution paths for certain smart contracts involving account abstraction—making complex operations less costly.

EIP-3085: Adds a new opcode called

STATICCALL, which allows smart contracts to execute read-only calls more efficiently without risking state changes.EIP-3534: Improves handling edge cases related to

CREATE2, an opcode used for deploying deterministic addresses—a feature important for advanced contract deployment strategies.

These updates collectively aim at making transactions cheaper and smarter while preparing Ethereum’s infrastructure for future scaling solutions such as sharding.

How Did the Community Respond?

Post-hard fork analysis indicates that Ethereum experienced a smooth transition with minimal disruptions following the Berlin upgrade. Developers quickly adopted new opcodes into their smart contracts; this rapid integration demonstrated strong community engagement and confidence in testing environments beforehand.

The upgrades have also spurred increased activity within developer circles exploring innovative use cases enabled by these enhancements—such as more efficient DeFi protocols or NFT platforms leveraging optimized contract execution paths.

Furthermore, feedback from users highlighted improved transaction speeds and reduced gas fees—key metrics influencing user experience on decentralized networks today.

Security Concerns & Challenges Post-Hard Fork

Despite overall success, no upgrade is entirely free from risks. Some minor security issues emerged related to newly introduced opcodes like STATICCALL. These concerns prompted swift patches by developers before any exploitation could occur—a testament to proactive risk management within Ethereum’s development community.

Additionally, while scalability improvements are promising long-term solutions—especially ahead of full implementation of sharding—they require ongoing testing across diverse scenarios before widespread deployment during subsequent phases like ETH 2.0 transitions.

This process underscores why continuous auditing remains critical during major protocol upgrades: ensuring robustness against potential vulnerabilities enhances trustworthiness among users and investors alike.

Impact on Scalability & Future Developments

One primary motivation behind many hard forks—including Berlin—is enhancing network scalability without compromising decentralization or security standards. The introduced EIPs contribute directly toward reducing gas costs per transaction—a vital factor given rising demand driven by DeFi growths and NFT markets.

Looking forward:

The upcoming transition towards Proof-of-Stake will leverage these foundational upgrades.

Sharding implementation will further multiply transaction capacity.

Together with ongoing research into layer-two solutions such as rollups—which bundle multiple transactions off-chain—the ecosystem aims at achieving high throughput suitable for mainstream adoption.

Broader Context: Notable Cryptocurrency Hard Forks

Ethereum's Berlin event is just one example among many significant hard forks across cryptocurrencies:

Bitcoin Cash (BCH) Hard Fork — In August 2017 resulted in Bitcoin SV (BSV), creating two distinct communities with differing visions about block size limits.

Ethereum’s Constantinople — Initially scheduled for January 2019 but postponed due to security vulnerabilities; eventually executed successfully in February 2020 aiming at cost reductions via EIPs similar to those seen later during Berlin.

These events highlight how community consensus plays a pivotal role—and how contentious debates around protocol changes can shape cryptocurrency histories significantly.

Why Do Hard Forks Matter?

Hard forks influence not only technical aspects but also market dynamics:

They may cause temporary volatility due to uncertainty about chain splits or token distributions.

Successful implementations reinforce confidence among investors regarding project maturity.

They pave pathways toward innovation—enabling developers worldwide access new functionalities essential for building scalable dApps.

Final Thoughts: The Role of Protocol Upgrades in Blockchain Evolution

Ethereum's Berlin Hard Fork exemplifies how strategic protocol updates drive technological progress within blockchain ecosystems—from reducing costs through optimized opcodes to laying groundwork necessary for future scaling solutions like sharding under ETH 2.x plans.

As blockchain technology matures amid increasing adoption across industries—from finance sectors adopting DeFi protocols—to gaming platforms utilizing NFTs—the importance of well-executed hard forks becomes even clearer: they ensure networks remain secure yet adaptable enough meet evolving demands effectively.

By understanding key events such as Ethereum's Berlin Hard Fork—and their implications—you gain insight into how continuous development shapes resilient blockchain infrastructures capable of supporting tomorrow’s decentralized innovations.

kai

2025-05-09 13:04

Can you name a famous hard fork event?

Ethereum's Berlin Hard Fork: A Key Milestone in Blockchain Development

What Is a Hard Fork in Blockchain Technology?

A hard fork is a fundamental change to the protocol of a blockchain network that results in the creation of two separate chains. Unlike soft forks, which are backward-compatible and do not split the network, hard forks are incompatible with previous versions of the protocol. This incompatibility means that nodes running different versions cannot validate each other's transactions, leading to a permanent divergence.

In cryptocurrency communities, hard forks often serve as mechanisms for implementing significant upgrades or corrections. They can be contentious or smooth, depending on community consensus and the nature of changes introduced. When successful, they enhance network security, scalability, and functionality; when mishandled or controversial, they can lead to splits like Bitcoin Cash (BCH) from Bitcoin (BTC).

The Significance of Ethereum’s Berlin Hard Fork

Ethereum stands out as one of the most actively developed blockchain platforms globally. Since its launch in 2015 by Vitalik Buterin and others, it has undergone multiple upgrades through hard forks aimed at improving performance and security.

The Berlin Hard Fork took place on April 15, 2021. It was part of Ethereum’s broader roadmap toward scalability improvements and transitioning from proof-of-work (PoW) to proof-of-stake (PoS). This upgrade was crucial because it laid groundwork for future features like sharding—an essential component for increasing transaction throughput.

This event exemplifies how strategic protocol updates via hard forks help maintain Ethereum's position as an innovative leader in decentralized applications (dApps), DeFi projects, and smart contract development.

Key Features Introduced During the Berlin Hard Fork

The Berlin upgrade focused on several core improvements through specific Ethereum Improvement Proposals (EIPs). These enhancements aimed at optimizing transaction efficiency while addressing security concerns:

EIP-2565: This proposal reduces miners’ block rewards by approximately 20% every 6.9 million blocks (~every six months). The reduction aims to control inflationary pressures over time.

EIP-3074: It introduces new precompile contracts that enable more efficient execution paths for certain smart contracts involving account abstraction—making complex operations less costly.

EIP-3085: Adds a new opcode called

STATICCALL, which allows smart contracts to execute read-only calls more efficiently without risking state changes.EIP-3534: Improves handling edge cases related to

CREATE2, an opcode used for deploying deterministic addresses—a feature important for advanced contract deployment strategies.

These updates collectively aim at making transactions cheaper and smarter while preparing Ethereum’s infrastructure for future scaling solutions such as sharding.

How Did the Community Respond?

Post-hard fork analysis indicates that Ethereum experienced a smooth transition with minimal disruptions following the Berlin upgrade. Developers quickly adopted new opcodes into their smart contracts; this rapid integration demonstrated strong community engagement and confidence in testing environments beforehand.

The upgrades have also spurred increased activity within developer circles exploring innovative use cases enabled by these enhancements—such as more efficient DeFi protocols or NFT platforms leveraging optimized contract execution paths.

Furthermore, feedback from users highlighted improved transaction speeds and reduced gas fees—key metrics influencing user experience on decentralized networks today.

Security Concerns & Challenges Post-Hard Fork

Despite overall success, no upgrade is entirely free from risks. Some minor security issues emerged related to newly introduced opcodes like STATICCALL. These concerns prompted swift patches by developers before any exploitation could occur—a testament to proactive risk management within Ethereum’s development community.

Additionally, while scalability improvements are promising long-term solutions—especially ahead of full implementation of sharding—they require ongoing testing across diverse scenarios before widespread deployment during subsequent phases like ETH 2.0 transitions.

This process underscores why continuous auditing remains critical during major protocol upgrades: ensuring robustness against potential vulnerabilities enhances trustworthiness among users and investors alike.

Impact on Scalability & Future Developments

One primary motivation behind many hard forks—including Berlin—is enhancing network scalability without compromising decentralization or security standards. The introduced EIPs contribute directly toward reducing gas costs per transaction—a vital factor given rising demand driven by DeFi growths and NFT markets.

Looking forward:

The upcoming transition towards Proof-of-Stake will leverage these foundational upgrades.

Sharding implementation will further multiply transaction capacity.

Together with ongoing research into layer-two solutions such as rollups—which bundle multiple transactions off-chain—the ecosystem aims at achieving high throughput suitable for mainstream adoption.

Broader Context: Notable Cryptocurrency Hard Forks

Ethereum's Berlin event is just one example among many significant hard forks across cryptocurrencies:

Bitcoin Cash (BCH) Hard Fork — In August 2017 resulted in Bitcoin SV (BSV), creating two distinct communities with differing visions about block size limits.

Ethereum’s Constantinople — Initially scheduled for January 2019 but postponed due to security vulnerabilities; eventually executed successfully in February 2020 aiming at cost reductions via EIPs similar to those seen later during Berlin.

These events highlight how community consensus plays a pivotal role—and how contentious debates around protocol changes can shape cryptocurrency histories significantly.

Why Do Hard Forks Matter?

Hard forks influence not only technical aspects but also market dynamics:

They may cause temporary volatility due to uncertainty about chain splits or token distributions.

Successful implementations reinforce confidence among investors regarding project maturity.

They pave pathways toward innovation—enabling developers worldwide access new functionalities essential for building scalable dApps.

Final Thoughts: The Role of Protocol Upgrades in Blockchain Evolution

Ethereum's Berlin Hard Fork exemplifies how strategic protocol updates drive technological progress within blockchain ecosystems—from reducing costs through optimized opcodes to laying groundwork necessary for future scaling solutions like sharding under ETH 2.x plans.

As blockchain technology matures amid increasing adoption across industries—from finance sectors adopting DeFi protocols—to gaming platforms utilizing NFTs—the importance of well-executed hard forks becomes even clearer: they ensure networks remain secure yet adaptable enough meet evolving demands effectively.

By understanding key events such as Ethereum's Berlin Hard Fork—and their implications—you gain insight into how continuous development shapes resilient blockchain infrastructures capable of supporting tomorrow’s decentralized innovations.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Public vs. Private Blockchain: What’s the Difference?

Understanding the distinctions between public and private blockchains is essential for anyone interested in blockchain technology, whether you're an investor, developer, or business leader. Both types of blockchains leverage distributed ledger technology (DLT), but they serve different purposes and operate under different principles. This article provides a clear overview of what sets them apart, their key features, use cases, and recent trends shaping their development.

What Is a Public Blockchain?

A public blockchain is an open-source network where anyone can participate without restrictions. These networks are fully decentralized—meaning no single entity controls the entire system—and rely on consensus mechanisms like proof-of-work (PoW) or proof-of-stake (PoS) to validate transactions. Because they are accessible to everyone globally, public blockchains promote transparency and security through widespread participation.

For example, Bitcoin was the first successful public blockchain that introduced peer-to-peer digital currency without intermediaries such as banks. Ethereum expanded on this concept by enabling smart contracts—self-executing agreements written into code—that facilitate complex decentralized applications (dApps). These platforms have fueled innovations like decentralized finance (DeFi), which allows users to lend, borrow, or trade assets directly on blockchain networks.

Public blockchains are particularly suited for applications requiring transparency and censorship resistance. Their open nature makes them ideal for financial transactions involving cryptocurrencies but also extends to supply chain tracking and voting systems where trustlessness is vital.

Characteristics of Public Blockchains

- Decentralization: Anyone can join as a node; no central authority controls the network.

- Open Access: No permission needed; anyone can read data or participate in validation.

- Transparency: All transaction data is publicly visible.

- Immutability: Once recorded, data cannot be altered retroactively.

- Security Through Consensus: Network security relies on collective agreement mechanisms like PoW or PoS.

These features foster trust among participants because they eliminate single points of failure while ensuring data integrity across all nodes.

What Is a Private Blockchain?

In contrast to public blockchains, private blockchains restrict access to authorized participants only. They are often used within organizations or consortia that require controlled environments for sharing sensitive information securely. Managed by a central authority—or sometimes by multiple trusted entities—private networks prioritize privacy and efficiency over complete decentralization.

Private blockchains enable organizations such as banks or supply chain companies to automate internal processes while maintaining strict control over who can view or modify data. For instance, Hyperledger Fabric—a popular private blockchain framework—is widely adopted in enterprise settings due to its modular architecture allowing customization according to specific compliance needs.

Because access is limited and permissions are managed centrally—or through consortium governance—private chains tend not to be fully transparent externally but offer higher throughput speeds suitable for enterprise-scale operations requiring confidentiality.

Key Features of Private Blockchains

- Controlled Access: Only selected users with permissions can join the network.

- Closed Source/Permissioned: The codebase may not be publicly available; modifications are controlled.

- Data Privacy: Transaction details are visible only among authorized parties.

- Higher Performance & Scalability: Reduced consensus overhead leads to faster transaction processing.

- Governance & Compliance Focused: Designed with regulatory requirements in mind—for example GDPR compliance in Europe.

This structure makes private blockchains attractive for industries needing secure yet confidential recordkeeping without exposing sensitive information externally.

Comparing Public vs Private Blockchains

| Feature | Public Blockchain | Private Blockchain |

|---|---|---|

| Accessibility | Open worldwide | Restricted membership |

| Decentralization | Fully decentralized | Partially centralized |

| Transparency | Complete visibility | Limited visibility |

| Speed & Scalability | Lower due to consensus complexity | Higher performance |

| Use Cases | Cryptocurrencies; DeFi; voting systems | Internal processes; supply chains; compliance |

While both types aim at enhancing security through cryptography and distributed ledgers, their design choices reflect differing priorities: openness versus control depending on application needs.

Recent Trends & Developments

The landscape of blockchain continues evolving rapidly:

Enterprise Adoption: Many corporations prefer private chains like Hyperledger Fabric because they align with regulatory standards while offering scalability benefits necessary for large-scale operations such as banking transactions or healthcare records management.

Hybrid Models: Some projects combine elements from both worlds—public permissioned chains—to balance transparency with privacy concerns effectively—a trend gaining traction especially within regulated sectors like finance and government services.

Regulatory Environment: As governments scrutinize cryptocurrencies more closely—with notable figures such as SEC Chair Paul Atkins emphasizing oversight—the distinction between public tokens versus permissioned networks becomes increasingly significant from legal perspectives.

Security Considerations: While both models provide high levels of cryptographic security when properly implemented, private networks face risks related mainly to insider threats if governance isn’t robust enough.

Technological Innovations: Advances include interoperability solutions allowing seamless communication between different types of ledgers—a step toward integrated multi-chain ecosystems supporting diverse organizational needs.

Understanding these developments helps stakeholders make informed decisions about deploying appropriate blockchain solutions aligned with strategic goals and compliance requirements.

Which Type Fits Your Needs?

Choosing between a public versus private blockchain depends heavily on your specific objectives:

If your priority is transparency —such as tracking product provenance across global supply chains—or creating open financial ecosystems—public chains might be best suited—you should consider factors like scalability limitations due to consensus protocols though these remain areas under active research improving performance metrics over time.

Conversely if your organization handles sensitive customer data requiring strict confidentiality—and you need faster transaction speeds—a private chain offers better control over access rights while still leveraging core DLT benefits.

Ultimately understanding these differences enables better alignment with industry standards—including E-A-T principles—to ensure trustworthy implementation that meets user expectations regarding security expertise and authoritative practices.

Final Thoughts

The debate between public versus private blockchains centers around balancing openness against control based on application demands—from democratized cryptocurrency markets favoring decentralization towards highly regulated industries prioritizing privacy/security measures respectively.. As technological innovations continue pushing boundaries—including interoperability protocols—the lines may blur further creating hybrid models tailored precisely per organizational needs.

Staying informed about recent trends ensures stakeholders harness blockchain's full potential responsibly while adhering best practices rooted in transparency—and building trust among users across various sectors seeking reliable digital transformation tools today

JCUSER-WVMdslBw

2025-05-09 12:19

What is the difference between a public and a private blockchain?

Public vs. Private Blockchain: What’s the Difference?

Understanding the distinctions between public and private blockchains is essential for anyone interested in blockchain technology, whether you're an investor, developer, or business leader. Both types of blockchains leverage distributed ledger technology (DLT), but they serve different purposes and operate under different principles. This article provides a clear overview of what sets them apart, their key features, use cases, and recent trends shaping their development.

What Is a Public Blockchain?

A public blockchain is an open-source network where anyone can participate without restrictions. These networks are fully decentralized—meaning no single entity controls the entire system—and rely on consensus mechanisms like proof-of-work (PoW) or proof-of-stake (PoS) to validate transactions. Because they are accessible to everyone globally, public blockchains promote transparency and security through widespread participation.

For example, Bitcoin was the first successful public blockchain that introduced peer-to-peer digital currency without intermediaries such as banks. Ethereum expanded on this concept by enabling smart contracts—self-executing agreements written into code—that facilitate complex decentralized applications (dApps). These platforms have fueled innovations like decentralized finance (DeFi), which allows users to lend, borrow, or trade assets directly on blockchain networks.

Public blockchains are particularly suited for applications requiring transparency and censorship resistance. Their open nature makes them ideal for financial transactions involving cryptocurrencies but also extends to supply chain tracking and voting systems where trustlessness is vital.

Characteristics of Public Blockchains

- Decentralization: Anyone can join as a node; no central authority controls the network.

- Open Access: No permission needed; anyone can read data or participate in validation.

- Transparency: All transaction data is publicly visible.

- Immutability: Once recorded, data cannot be altered retroactively.

- Security Through Consensus: Network security relies on collective agreement mechanisms like PoW or PoS.

These features foster trust among participants because they eliminate single points of failure while ensuring data integrity across all nodes.

What Is a Private Blockchain?

In contrast to public blockchains, private blockchains restrict access to authorized participants only. They are often used within organizations or consortia that require controlled environments for sharing sensitive information securely. Managed by a central authority—or sometimes by multiple trusted entities—private networks prioritize privacy and efficiency over complete decentralization.

Private blockchains enable organizations such as banks or supply chain companies to automate internal processes while maintaining strict control over who can view or modify data. For instance, Hyperledger Fabric—a popular private blockchain framework—is widely adopted in enterprise settings due to its modular architecture allowing customization according to specific compliance needs.

Because access is limited and permissions are managed centrally—or through consortium governance—private chains tend not to be fully transparent externally but offer higher throughput speeds suitable for enterprise-scale operations requiring confidentiality.

Key Features of Private Blockchains

- Controlled Access: Only selected users with permissions can join the network.

- Closed Source/Permissioned: The codebase may not be publicly available; modifications are controlled.

- Data Privacy: Transaction details are visible only among authorized parties.

- Higher Performance & Scalability: Reduced consensus overhead leads to faster transaction processing.

- Governance & Compliance Focused: Designed with regulatory requirements in mind—for example GDPR compliance in Europe.

This structure makes private blockchains attractive for industries needing secure yet confidential recordkeeping without exposing sensitive information externally.

Comparing Public vs Private Blockchains

| Feature | Public Blockchain | Private Blockchain |

|---|---|---|

| Accessibility | Open worldwide | Restricted membership |

| Decentralization | Fully decentralized | Partially centralized |

| Transparency | Complete visibility | Limited visibility |

| Speed & Scalability | Lower due to consensus complexity | Higher performance |

| Use Cases | Cryptocurrencies; DeFi; voting systems | Internal processes; supply chains; compliance |

While both types aim at enhancing security through cryptography and distributed ledgers, their design choices reflect differing priorities: openness versus control depending on application needs.

Recent Trends & Developments

The landscape of blockchain continues evolving rapidly:

Enterprise Adoption: Many corporations prefer private chains like Hyperledger Fabric because they align with regulatory standards while offering scalability benefits necessary for large-scale operations such as banking transactions or healthcare records management.

Hybrid Models: Some projects combine elements from both worlds—public permissioned chains—to balance transparency with privacy concerns effectively—a trend gaining traction especially within regulated sectors like finance and government services.

Regulatory Environment: As governments scrutinize cryptocurrencies more closely—with notable figures such as SEC Chair Paul Atkins emphasizing oversight—the distinction between public tokens versus permissioned networks becomes increasingly significant from legal perspectives.

Security Considerations: While both models provide high levels of cryptographic security when properly implemented, private networks face risks related mainly to insider threats if governance isn’t robust enough.

Technological Innovations: Advances include interoperability solutions allowing seamless communication between different types of ledgers—a step toward integrated multi-chain ecosystems supporting diverse organizational needs.

Understanding these developments helps stakeholders make informed decisions about deploying appropriate blockchain solutions aligned with strategic goals and compliance requirements.

Which Type Fits Your Needs?

Choosing between a public versus private blockchain depends heavily on your specific objectives:

If your priority is transparency —such as tracking product provenance across global supply chains—or creating open financial ecosystems—public chains might be best suited—you should consider factors like scalability limitations due to consensus protocols though these remain areas under active research improving performance metrics over time.

Conversely if your organization handles sensitive customer data requiring strict confidentiality—and you need faster transaction speeds—a private chain offers better control over access rights while still leveraging core DLT benefits.

Ultimately understanding these differences enables better alignment with industry standards—including E-A-T principles—to ensure trustworthy implementation that meets user expectations regarding security expertise and authoritative practices.

Final Thoughts

The debate between public versus private blockchains centers around balancing openness against control based on application demands—from democratized cryptocurrency markets favoring decentralization towards highly regulated industries prioritizing privacy/security measures respectively.. As technological innovations continue pushing boundaries—including interoperability protocols—the lines may blur further creating hybrid models tailored precisely per organizational needs.

Staying informed about recent trends ensures stakeholders harness blockchain's full potential responsibly while adhering best practices rooted in transparency—and building trust among users across various sectors seeking reliable digital transformation tools today

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is a Rising Wedge in Technical Analysis?

A rising wedge is a well-known chart pattern used by traders and investors to analyze potential market reversals. It appears when the price of an asset moves within converging trend lines, characterized by higher highs and lower lows. Essentially, the pattern forms as the price makes increasingly smaller upward movements while also experiencing decreasing downward swings, creating a wedge shape that slopes upward on the chart.

This pattern signals that although prices are still rising, momentum is weakening. The narrowing of highs and lows suggests that buyers are losing strength, which often precedes a reversal into a downtrend. Recognizing this pattern can help traders anticipate potential sell signals before significant declines occur.

How Does a Rising Wedge Form?

The formation of a rising wedge involves specific price behaviors:

- The asset's price makes higher highs, indicating ongoing upward movement.

- Simultaneously, it records lower lows.

- The distance between successive highs and lows gradually decreases over time.

This creates two trend lines: an upper resistance line connecting the higher highs and a lower support line connecting the lower lows. As these lines converge, they form an ascending wedge shape on the chart.

Importantly, this pattern can develop over various timeframes—from intraday charts to long-term weekly charts—making it relevant across different trading styles and markets.

Why Is the Rising Wedge Considered Bearish?

Despite its appearance during an uptrend, the rising wedge is generally regarded as bearish because it indicates waning buying pressure. Traders interpret this pattern as early warning signs that bullish momentum may be exhausted and that sellers could soon take control.

The key reason for its bearish nature lies in its typical outcome: once prices break below the lower trend line of the wedge with increased volume, it often triggers sharp declines. This breakdown confirms that buyers have lost their grip on prices — leading to rapid selling activity as market participants recognize weakness in what was previously an uptrend.

Furthermore, rising wedges frequently appear after strong rallies or during periods of high volatility when market sentiment shifts from optimism to caution or fear. This transition increases probabilities for reversal rather than continuation.

How Do Traders Confirm a Rising Wedge Breakdown?

Confirmation is crucial for validating trading decisions based on this pattern:

- Break Below Support Line: A decisive move below the lower trend line signals potential reversal.

- Increased Volume: A spike in trading volume accompanying this break adds credibility to bearish sentiment.

- Retest of Support: Sometimes after breaking downwards, prices retest previous support levels before continuing downward.

Traders often wait for these confirmations before executing trades to avoid false signals caused by temporary fluctuations or market noise.

Trading Strategies Using Rising Wedges

Recognizing a rising wedge offers multiple strategic opportunities:

- Short Selling: Traders may initiate short positions once confirmed breakdown occurs beneath support levels.

- Stop-Loss Placement: To manage risk effectively, placing stop-loss orders above recent swing highs ensures limited losses if breakout fails.

- Target Setting: Price targets are typically estimated by measuring height at formation start and projecting downward from breakout point—providing clear profit objectives.

- Risk Management: Combining technical indicators such as volume analysis or momentum oscillators enhances decision-making accuracy during volatile periods.

It’s important for traders to remain disciplined with their risk controls since false breakouts can lead to losses if not properly managed.

Recent Market Examples of Rising Wedges

In recent years across various markets—cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), stocks such as Tesla (TSLA) or Amazon (AMZN)—the rising wedge has been observed during times of heightened volatility:

During Bitcoin’s 2021 bull run leading into late 2021’s correction phase,

- Several instances showed BTC forming ascending wedges before sharp drops post-breakdown.

In stock markets,

- Companies experiencing rapid gains sometimes develop rising wedges signaling exhaustion; subsequent breakdowns resulted in notable corrections or reversals in stock prices.

These examples highlight how widespread awareness of this pattern can aid investors in timing entries/exits more effectively amidst turbulent conditions.

Implications for Investors and Market Participants

Understanding what causes rises within these patterns helps investors gauge overall market health:

- A rising wedge suggests underlying weakness despite ongoing gains

- It indicates diminishing buying interest

- Its appearance often coincides with increasing investor caution

For long-term investors focusing on fundamentals rather than short-term swings,

being aware of technical patterns like falling wedges provides additional context about possible near-term reversals without relying solely on financial statements or macroeconomic data.

Risks Associated With Relying Solely on Pattern Recognition

While recognizing patterns like falling wedges offers valuable insights,

it’s essential not to depend exclusively on them due to inherent risks:

– False Breakouts: Not every breach results in sustained moves; some may reverse quickly– Market Noise: Short-term volatility can mimic patterns without meaningful implications– Confirmation Bias: Overconfidence might lead traders into premature entries

Combining technical analysis with other tools such as fundamental analysis or sentiment indicators enhances decision-making robustness.

Final Thoughts: Using Falling Wedges Effectively

The rise-and-fall dynamics captured by falling wedges make them powerful tools within technical analysis frameworks when used correctly:

- They serve as early warning signs indicating weakening bullish momentum

- Their confirmation through volume spikes strengthens trade validity

- Proper risk management strategies mitigate potential losses from false signals

By integrating knowledge about these patterns into broader trading plans—alongside sound money management practices—market participants improve their ability to navigate complex financial landscapes confidently.

Key Takeaways:

– A rising wedge forms during an uptrend but typically predicts reversals toward downside movement

– Confirmation involves breaking below support with increased volume

– Effective use requires combining technical cues with prudent risk controls

Understanding how falling wedges operate empowers both novice and experienced traders alike—and ultimately supports more informed investment decisions amid volatile markets

Lo

2025-05-09 06:07

What is a rising wedge and why is it often bearish?

What Is a Rising Wedge in Technical Analysis?

A rising wedge is a well-known chart pattern used by traders and investors to analyze potential market reversals. It appears when the price of an asset moves within converging trend lines, characterized by higher highs and lower lows. Essentially, the pattern forms as the price makes increasingly smaller upward movements while also experiencing decreasing downward swings, creating a wedge shape that slopes upward on the chart.

This pattern signals that although prices are still rising, momentum is weakening. The narrowing of highs and lows suggests that buyers are losing strength, which often precedes a reversal into a downtrend. Recognizing this pattern can help traders anticipate potential sell signals before significant declines occur.

How Does a Rising Wedge Form?

The formation of a rising wedge involves specific price behaviors:

- The asset's price makes higher highs, indicating ongoing upward movement.

- Simultaneously, it records lower lows.

- The distance between successive highs and lows gradually decreases over time.

This creates two trend lines: an upper resistance line connecting the higher highs and a lower support line connecting the lower lows. As these lines converge, they form an ascending wedge shape on the chart.

Importantly, this pattern can develop over various timeframes—from intraday charts to long-term weekly charts—making it relevant across different trading styles and markets.

Why Is the Rising Wedge Considered Bearish?

Despite its appearance during an uptrend, the rising wedge is generally regarded as bearish because it indicates waning buying pressure. Traders interpret this pattern as early warning signs that bullish momentum may be exhausted and that sellers could soon take control.

The key reason for its bearish nature lies in its typical outcome: once prices break below the lower trend line of the wedge with increased volume, it often triggers sharp declines. This breakdown confirms that buyers have lost their grip on prices — leading to rapid selling activity as market participants recognize weakness in what was previously an uptrend.

Furthermore, rising wedges frequently appear after strong rallies or during periods of high volatility when market sentiment shifts from optimism to caution or fear. This transition increases probabilities for reversal rather than continuation.

How Do Traders Confirm a Rising Wedge Breakdown?

Confirmation is crucial for validating trading decisions based on this pattern:

- Break Below Support Line: A decisive move below the lower trend line signals potential reversal.

- Increased Volume: A spike in trading volume accompanying this break adds credibility to bearish sentiment.

- Retest of Support: Sometimes after breaking downwards, prices retest previous support levels before continuing downward.

Traders often wait for these confirmations before executing trades to avoid false signals caused by temporary fluctuations or market noise.

Trading Strategies Using Rising Wedges

Recognizing a rising wedge offers multiple strategic opportunities:

- Short Selling: Traders may initiate short positions once confirmed breakdown occurs beneath support levels.

- Stop-Loss Placement: To manage risk effectively, placing stop-loss orders above recent swing highs ensures limited losses if breakout fails.

- Target Setting: Price targets are typically estimated by measuring height at formation start and projecting downward from breakout point—providing clear profit objectives.

- Risk Management: Combining technical indicators such as volume analysis or momentum oscillators enhances decision-making accuracy during volatile periods.

It’s important for traders to remain disciplined with their risk controls since false breakouts can lead to losses if not properly managed.

Recent Market Examples of Rising Wedges

In recent years across various markets—cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), stocks such as Tesla (TSLA) or Amazon (AMZN)—the rising wedge has been observed during times of heightened volatility:

During Bitcoin’s 2021 bull run leading into late 2021’s correction phase,

- Several instances showed BTC forming ascending wedges before sharp drops post-breakdown.

In stock markets,

- Companies experiencing rapid gains sometimes develop rising wedges signaling exhaustion; subsequent breakdowns resulted in notable corrections or reversals in stock prices.

These examples highlight how widespread awareness of this pattern can aid investors in timing entries/exits more effectively amidst turbulent conditions.

Implications for Investors and Market Participants

Understanding what causes rises within these patterns helps investors gauge overall market health:

- A rising wedge suggests underlying weakness despite ongoing gains

- It indicates diminishing buying interest

- Its appearance often coincides with increasing investor caution

For long-term investors focusing on fundamentals rather than short-term swings,

being aware of technical patterns like falling wedges provides additional context about possible near-term reversals without relying solely on financial statements or macroeconomic data.

Risks Associated With Relying Solely on Pattern Recognition

While recognizing patterns like falling wedges offers valuable insights,

it’s essential not to depend exclusively on them due to inherent risks:

– False Breakouts: Not every breach results in sustained moves; some may reverse quickly– Market Noise: Short-term volatility can mimic patterns without meaningful implications– Confirmation Bias: Overconfidence might lead traders into premature entries

Combining technical analysis with other tools such as fundamental analysis or sentiment indicators enhances decision-making robustness.

Final Thoughts: Using Falling Wedges Effectively

The rise-and-fall dynamics captured by falling wedges make them powerful tools within technical analysis frameworks when used correctly:

- They serve as early warning signs indicating weakening bullish momentum

- Their confirmation through volume spikes strengthens trade validity

- Proper risk management strategies mitigate potential losses from false signals

By integrating knowledge about these patterns into broader trading plans—alongside sound money management practices—market participants improve their ability to navigate complex financial landscapes confidently.

Key Takeaways:

– A rising wedge forms during an uptrend but typically predicts reversals toward downside movement

– Confirmation involves breaking below support with increased volume

– Effective use requires combining technical cues with prudent risk controls

Understanding how falling wedges operate empowers both novice and experienced traders alike—and ultimately supports more informed investment decisions amid volatile markets

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

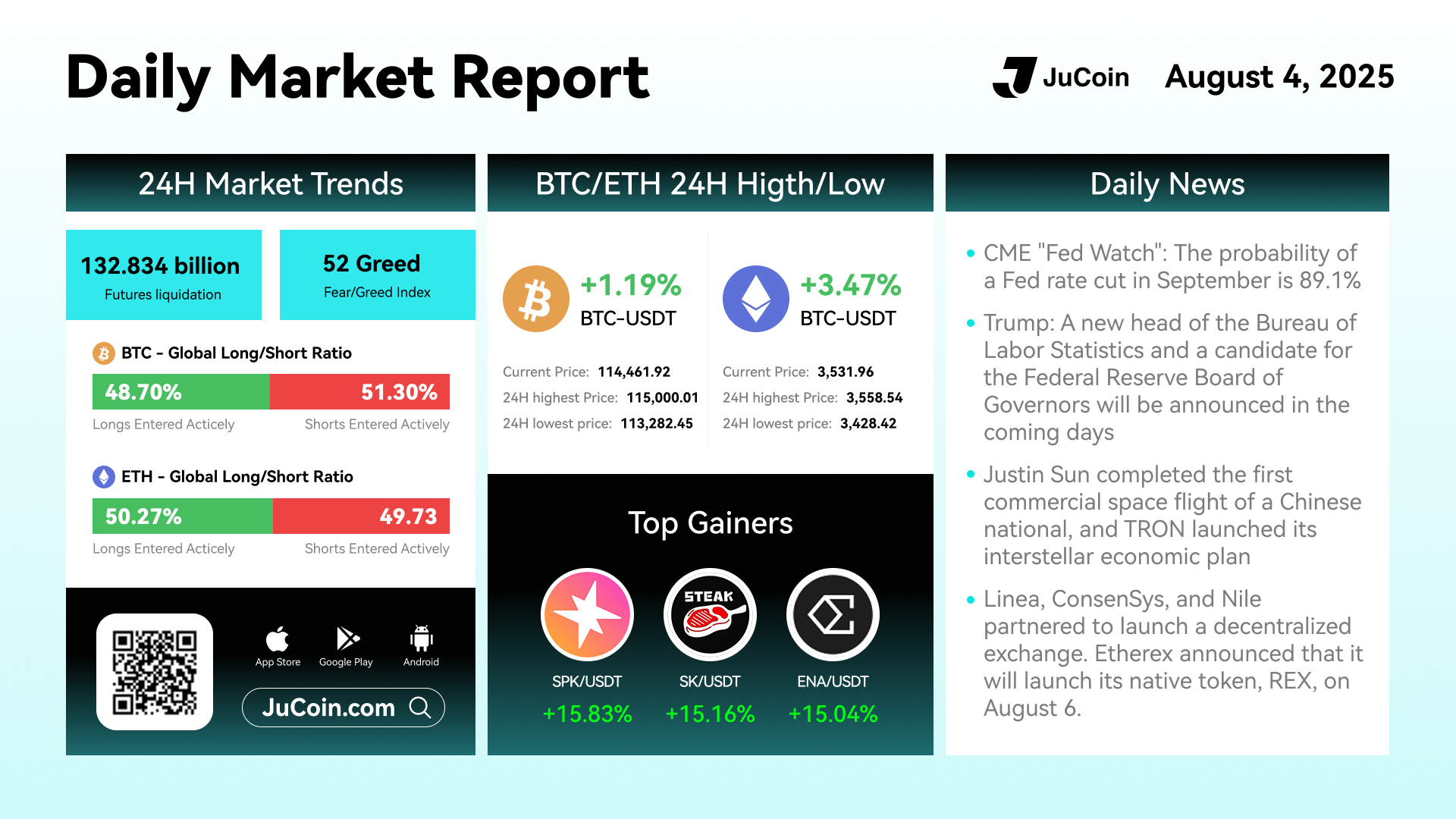

📅 August 4 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-04 04:34

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Does the Rebranding of EOS to Vaulta Affect Its Market Perception and Value?

The recent rebranding of EOS to Vaulta marks a significant shift in the cryptocurrency landscape, sparking widespread discussion among investors, developers, and industry analysts. This strategic move aims to reshape how the project is perceived in terms of security, innovation, and market relevance. Understanding its implications requires examining both the background of EOS and what Vaulta represents moving forward.

Background of EOS: From Launch to Challenges

EOS was launched in 2017 by blockchain pioneers Dan Larimer and Brendan Blumer. It quickly gained attention for its high-performance decentralized operating system designed for scalable smart contracts and dApps (decentralized applications). At its peak, EOS was considered one of the leading platforms in blockchain technology due to its innovative consensus mechanism—Delegated Proof-of-Stake (DPoS)—and developer-friendly environment.

However, despite early success, EOS faced persistent governance issues such as centralization concerns and disputes over decision-making processes. Security vulnerabilities also emerged over time, raising questions about platform stability. These challenges affected community trust and investor confidence—factors crucial for long-term sustainability.

Despite these hurdles, EOS maintained a dedicated user base that continued contributing to its ecosystem's growth. Over time, efforts were made to improve protocol security and governance structures; however, perceptions around past controversies lingered within broader market narratives.

The Rationale Behind Rebranding: From EOS to Vaulta

In late 2024, the project announced it would rebrand from EOS to Vaulta—a move signaling a fresh start aimed at overcoming previous limitations. The primary motivation appears rooted in distancing itself from past governance scandals while emphasizing new strategic priorities centered on decentralized finance (DeFi).

Vaulta’s branding underscores a renewed focus on security enhancements—an essential aspect given recent DeFi exploits across various platforms—and aims at positioning itself as a trustworthy player within this rapidly expanding sector. By aligning with DeFi trends such as lending protocols or stablecoins integration, Vaulta seeks not only technological upgrades but also improved market perception among investors seeking reliable financial services on blockchain.

This rebranding can be viewed as an effort by leadership to redefine identity amidst fierce competition among DeFi projects like Aave or Compound that are capturing investor interest through transparency and robust security measures.

Market Context: Why Rebranding Matters Now

The cryptocurrency industry has experienced exponential growth in DeFi applications over recent years. As users increasingly look toward decentralized financial solutions for borrowing/lending or asset management without intermediaries—the sector has become highly competitive yet fragmented.

In this environment:

- Projects that successfully reposition themselves with clear value propositions tend to attract more investment.

- Transparency around technical improvements enhances credibility.

- Community engagement fosters trust during transitional phases like rebranding.

Rebranding efforts like Vaulta’s are therefore critical—they serve both marketing purposes by signaling change—and practical ones by implementing technical upgrades aligned with current industry standards.

Impact on Market Perception

Market perception following such a major change depends heavily on community response and tangible progress made post-rebrand:

- Community Engagement: Active communication through updates or meetings helps build trust; positive feedback can boost confidence.

- Technical Improvements: Upgrades focusing on smart contract efficiency alongside enhanced security protocols demonstrate commitment toward reliability—a key factor influencing investor sentiment.

- Partnerships & Collaborations: Strategic alliances within DeFi ecosystems reinforce credibility; they suggest validation from established players which can positively influence perception.

However, skepticism remains prevalent among some segments who question whether rebranding alone addresses core issues like governance transparency or whether it is merely superficial branding effort aimed at attracting new investors without substantial changes underneath.

Short-Term Market Effects: Token Price Fluctuations

Following any major announcement—including rebrands—cryptocurrency tokens often experience volatility driven by speculative trading behaviors:

- Some investors interpret the move optimistically expecting future growth opportunities.

- Others may react cautiously due to uncertainties about actual implementation success or lingering doubts about past controversies affecting long-term viability.