How to Distinguish Between a True Breakout and a False Breakout at Resistance

Understanding the difference between a genuine breakout and a false one is essential for traders, especially in volatile markets like cryptocurrencies. Making informed decisions can prevent costly mistakes and improve your overall trading strategy. This guide explores key indicators, chart patterns, market sentiment factors, and recent developments that help traders identify whether a breakout at resistance is real or just a fleeting move.

What Is a Resistance Level in Technical Analysis?

In technical analysis, resistance refers to a price point where an asset's upward movement tends to pause or reverse due to increased selling pressure. Traders often view resistance levels as barriers that the price struggles to break through. When the price approaches this level, it signals potential trading opportunities—either for continuation if it breaks through or for reversal if it bounces back.

A breakout occurs when the price moves above this resistance level with significant momentum. Such movements are often seen as signals of strong buying interest and potential trend shifts upward. Conversely, false breakouts happen when prices temporarily breach resistance but then quickly fall back below it, trapping traders who entered positions expecting continued upward movement.

Key Technical Indicators for Identifying Breakouts

Technical indicators are vital tools that help traders assess whether a breakout is likely genuine or false. Here are some of the most effective:

Moving Averages

Moving averages smooth out price data over specific periods (e.g., 20-day or 50-day) and help identify trend direction. During true breakouts, prices tend to stay above key moving averages after crossing them convincingly. If the price briefly crosses above resistance but then reverts below these averages shortly after, it's often indicative of a false breakout.

Relative Strength Index (RSI)

The RSI measures momentum on a scale from 0 to 100; readings above 70 suggest overbought conditions while below 30 indicate oversold states. When assessing breakouts:

- A true breakout typically sees RSI rising above 50 with sustained momentum.

- A false breakout might show RSI crossing above 50 momentarily but failing to maintain strength before reverting.

Bollinger Bands

These bands adjust based on market volatility—widening during high volatility and narrowing during consolidation phases.

- In genuine breakouts, prices usually move outside the upper band with increased volume.

- False breakouts may see prices touching or slightly exceeding the upper band temporarily but quickly returning within bands without significant volume support.

Recognizing Chart Patterns That Signal Breakout Validity

Chart patterns provide visual cues about potential trend continuations or reversals:

Head and Shoulders Pattern

This pattern indicates possible reversals from bullish to bearish trends (or vice versa). After completing this pattern:

- A confirmed true breakout occurs when prices surpass the neckline with strong volume.

- An incomplete pattern or one accompanied by low volume may lead to false signals.

Triangular Patterns (Symmetrical Triangles)

These represent consolidation phases where buyers and sellers reach equilibrium before breaking out:

- A valid triangle breakout involves clear movement outside of triangle boundaries accompanied by higher-than-average volume.

- If prices only briefly pierce these boundaries without follow-through activity—or do so on low volume—it suggests an unreliable signal prone to reversal.

Market Sentiment Factors Influencing Breakout Reliability

Market sentiment plays an influential role in whether breakouts turn out authentic:

Impact of News & Events

Major news releases—such as regulatory announcements, technological upgrades in blockchain projects, or macroeconomic developments—can trigger rapid moves that appear as breakouts:

- Genuine reactions tend to be supported by sustained momentum.

- Fake reactions often occur due to rumors or speculative hype that dissipate once clarified.

Market Volatility & Manipulation Risks

High volatility environments increase chances of false signals because rapid swings can trigger temporary breaches of resistance levels:

- Traders should watch for sudden spikes driven by large trades designed intentionally (market manipulation), which can create artificial breakouts meant solely for deceiving other participants—a common tactic in crypto markets like pump-and-dump schemes.

Practical Strategies To Confirm True Breakouts

To avoid falling victim to false signals:

- Use Confirmation Signals: Wait for additional confirmation such as increased trading volume alongside price movement beyond resistance levels.

- Set Stop-Loss Orders: Protect yourself from sudden reversals by placing stop-loss orders just below recent support levels.

- Observe Price Action: Look for steady upward movement rather than sharp spikes followed by quick retracements.

- Monitor Multiple Indicators: Rely on several technical tools simultaneously rather than single indicators alone; convergence increases confidence in validity.

- Be Patient: Avoid rushing into trades immediately after initial breach attempts; patience allows clearer differentiation between true trends and fake-outs.

Recent Trends Enhancing Detection Capabilities

Advancements in technology have improved how traders analyze potential breakouts:

AI-Powered Trading Platforms: These systems analyze vast datasets—including historical patterns—and provide probabilistic assessments about whether upcoming movements are likely genuine based on complex algorithms trained on market behavior data.

Enhanced Charting Tools: Modern platforms offer more detailed visualizations such as heatmaps indicating trader activity levels around key levels—helping identify manipulation attempts versus organic moves.

Increased Awareness About Market Manipulation: Regulatory scrutiny has risen globally against practices like pump-and-dump schemes prevalent among smaller altcoins; awareness helps traders approach suspected fake-outs more cautiously.

Risks Associated With False Breakouts

Misinterpreting false breakthroughs can have serious consequences:

- Financial Losses: Entering trades prematurely based on unreliable signals leads directly into losses once prices revert back within previous ranges.2.. Eroded Confidence: Repeated failures diminish trader confidence—not only affecting individual strategies but also impacting overall market stability if many participants react similarly.3.. Regulatory Scrutiny: Persistent manipulative practices attracting regulatory attention could result in penalties against involved parties—and potentially impact legitimate investors' trustworthiness perceptions.

By understanding technical indicators like moving averages and RSI alongside chart patterns such as triangles—and considering external factors like news sentiment—you can significantly improve your ability to distinguish between true and false breakouts at resistance levels within cryptocurrency markets—or any financial asset class you trade actively.

Final Tips

Always combine multiple analytical methods before acting upon any perceived breakthrough signal; patience combined with disciplined risk management remains your best defense against deceptive market moves rooted in fake-out scenarios.

JCUSER-IC8sJL1q

2025-05-09 04:01

How can you distinguish between a true breakout and a false breakout at resistance?

How to Distinguish Between a True Breakout and a False Breakout at Resistance

Understanding the difference between a genuine breakout and a false one is essential for traders, especially in volatile markets like cryptocurrencies. Making informed decisions can prevent costly mistakes and improve your overall trading strategy. This guide explores key indicators, chart patterns, market sentiment factors, and recent developments that help traders identify whether a breakout at resistance is real or just a fleeting move.

What Is a Resistance Level in Technical Analysis?

In technical analysis, resistance refers to a price point where an asset's upward movement tends to pause or reverse due to increased selling pressure. Traders often view resistance levels as barriers that the price struggles to break through. When the price approaches this level, it signals potential trading opportunities—either for continuation if it breaks through or for reversal if it bounces back.

A breakout occurs when the price moves above this resistance level with significant momentum. Such movements are often seen as signals of strong buying interest and potential trend shifts upward. Conversely, false breakouts happen when prices temporarily breach resistance but then quickly fall back below it, trapping traders who entered positions expecting continued upward movement.

Key Technical Indicators for Identifying Breakouts

Technical indicators are vital tools that help traders assess whether a breakout is likely genuine or false. Here are some of the most effective:

Moving Averages

Moving averages smooth out price data over specific periods (e.g., 20-day or 50-day) and help identify trend direction. During true breakouts, prices tend to stay above key moving averages after crossing them convincingly. If the price briefly crosses above resistance but then reverts below these averages shortly after, it's often indicative of a false breakout.

Relative Strength Index (RSI)

The RSI measures momentum on a scale from 0 to 100; readings above 70 suggest overbought conditions while below 30 indicate oversold states. When assessing breakouts:

- A true breakout typically sees RSI rising above 50 with sustained momentum.

- A false breakout might show RSI crossing above 50 momentarily but failing to maintain strength before reverting.

Bollinger Bands

These bands adjust based on market volatility—widening during high volatility and narrowing during consolidation phases.

- In genuine breakouts, prices usually move outside the upper band with increased volume.

- False breakouts may see prices touching or slightly exceeding the upper band temporarily but quickly returning within bands without significant volume support.

Recognizing Chart Patterns That Signal Breakout Validity

Chart patterns provide visual cues about potential trend continuations or reversals:

Head and Shoulders Pattern

This pattern indicates possible reversals from bullish to bearish trends (or vice versa). After completing this pattern:

- A confirmed true breakout occurs when prices surpass the neckline with strong volume.

- An incomplete pattern or one accompanied by low volume may lead to false signals.

Triangular Patterns (Symmetrical Triangles)

These represent consolidation phases where buyers and sellers reach equilibrium before breaking out:

- A valid triangle breakout involves clear movement outside of triangle boundaries accompanied by higher-than-average volume.

- If prices only briefly pierce these boundaries without follow-through activity—or do so on low volume—it suggests an unreliable signal prone to reversal.

Market Sentiment Factors Influencing Breakout Reliability

Market sentiment plays an influential role in whether breakouts turn out authentic:

Impact of News & Events

Major news releases—such as regulatory announcements, technological upgrades in blockchain projects, or macroeconomic developments—can trigger rapid moves that appear as breakouts:

- Genuine reactions tend to be supported by sustained momentum.

- Fake reactions often occur due to rumors or speculative hype that dissipate once clarified.

Market Volatility & Manipulation Risks

High volatility environments increase chances of false signals because rapid swings can trigger temporary breaches of resistance levels:

- Traders should watch for sudden spikes driven by large trades designed intentionally (market manipulation), which can create artificial breakouts meant solely for deceiving other participants—a common tactic in crypto markets like pump-and-dump schemes.

Practical Strategies To Confirm True Breakouts

To avoid falling victim to false signals:

- Use Confirmation Signals: Wait for additional confirmation such as increased trading volume alongside price movement beyond resistance levels.

- Set Stop-Loss Orders: Protect yourself from sudden reversals by placing stop-loss orders just below recent support levels.

- Observe Price Action: Look for steady upward movement rather than sharp spikes followed by quick retracements.

- Monitor Multiple Indicators: Rely on several technical tools simultaneously rather than single indicators alone; convergence increases confidence in validity.

- Be Patient: Avoid rushing into trades immediately after initial breach attempts; patience allows clearer differentiation between true trends and fake-outs.

Recent Trends Enhancing Detection Capabilities

Advancements in technology have improved how traders analyze potential breakouts:

AI-Powered Trading Platforms: These systems analyze vast datasets—including historical patterns—and provide probabilistic assessments about whether upcoming movements are likely genuine based on complex algorithms trained on market behavior data.

Enhanced Charting Tools: Modern platforms offer more detailed visualizations such as heatmaps indicating trader activity levels around key levels—helping identify manipulation attempts versus organic moves.

Increased Awareness About Market Manipulation: Regulatory scrutiny has risen globally against practices like pump-and-dump schemes prevalent among smaller altcoins; awareness helps traders approach suspected fake-outs more cautiously.

Risks Associated With False Breakouts

Misinterpreting false breakthroughs can have serious consequences:

- Financial Losses: Entering trades prematurely based on unreliable signals leads directly into losses once prices revert back within previous ranges.2.. Eroded Confidence: Repeated failures diminish trader confidence—not only affecting individual strategies but also impacting overall market stability if many participants react similarly.3.. Regulatory Scrutiny: Persistent manipulative practices attracting regulatory attention could result in penalties against involved parties—and potentially impact legitimate investors' trustworthiness perceptions.

By understanding technical indicators like moving averages and RSI alongside chart patterns such as triangles—and considering external factors like news sentiment—you can significantly improve your ability to distinguish between true and false breakouts at resistance levels within cryptocurrency markets—or any financial asset class you trade actively.

Final Tips

Always combine multiple analytical methods before acting upon any perceived breakthrough signal; patience combined with disciplined risk management remains your best defense against deceptive market moves rooted in fake-out scenarios.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

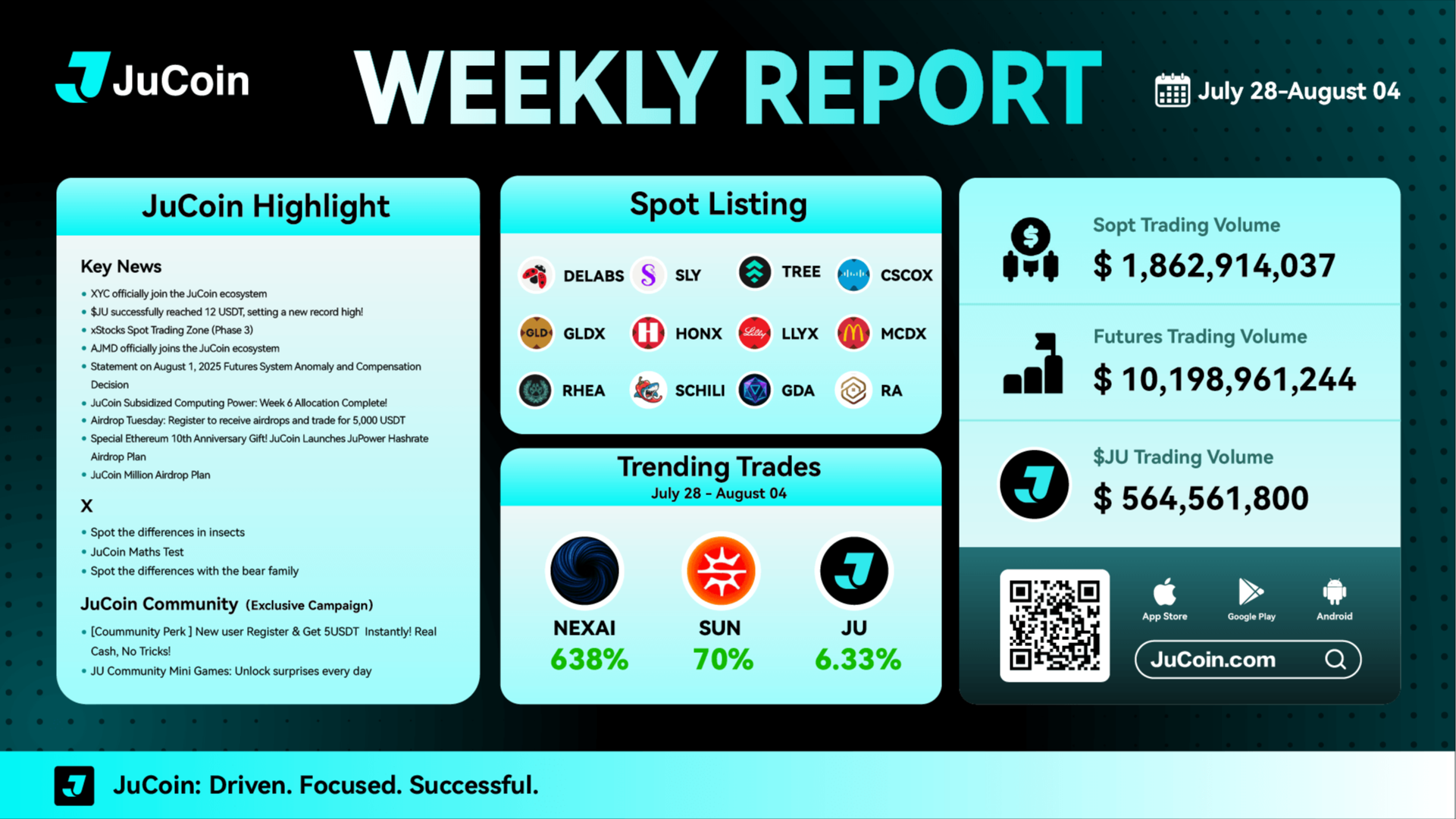

💚12 new spot listings added

💚8 campaigns launched this week

💚Platform token $JU surged over 6.33%

Stay connected with JuCoin and never miss an update!

👉 Register Now:https://www.jucoin.online/en/accounts/register?ref=MR6KTR

JuCoin Community

2025-08-04 09:41

👌JuCoin Weekly Report | July 28 – August 3 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Exclusive community benefits are here! Invite 5+ friends to join JuCoin, climb the leaderboard, and earn USDT rewards!

⏰ Event Period:August 4, 08:00 – August 11, 08:00 (UTC)

🏆 Rewards for Top 5:

🥇 1st Place: $50 USDT

🥈 2nd Place: $40 USDT

🥉 3rd Place: $30 USDT

🏅 4th Place: $20 USDT

🏅 5th Place: $10 USDT

✅ How to Participate:

1️⃣ Log in to JuCoin and get your unique referral link.

2️⃣ Share your link – friends must register + complete KYC.

3️⃣ Reach 5+ valid invites to qualify for the leaderboard.

4️⃣ Submit your JuCoin UID to confirm entry:👉 https://forms.gle/vGi6c9LAksggH68D6

❗ Important Notice:

• Fraudulent activity (e.g., fake/bulk accounts) will result in immediate disqualification.

• Rewards will be distributed to winners’ JuCoin accounts after verification.

🚀 Start inviting now – dominate the leaderboard and claim your USDT!

JuCoin Community

2025-08-04 08:40

🔥 JuCoin Community Contest: Invite Friends & Win USDT! 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👌JuCoin will list the CMEW/USDT trading pair on August 7, 2025

🔹 Deposit: August 6, 2025 at 04:00 (UTC)

🔹 Trading: August 7, 2025 at 09:00 (UTC)

🔹 Withdrawal: August 8, 2025 at 09:00 (UTC)

🪧More:https://bit.ly/458FkfG

JuCoin Community

2025-08-04 07:45

📢 New Listing|CMEW (CelestialMew) 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

TA used to be charts, indicators, and KD lines 🎯 Now it’s just tweets, vibes, and memes 🫥 Accurate enough, right?

Check out our YouTube Channel 👉

#TechnicalAnalysis #MemeTrading #CryptoTA

JuCoin Media

2025-08-01 11:33

Technical Analysis Cryptocurrency 📊 | The Only Chart That Matters

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Factors Behind the Recent Bitcoin (BTC) Price Surge

The cryptocurrency market has experienced a remarkable rally in Bitcoin (BTC), reaching an all-time high of $111,878 on May 22, 2025. This unprecedented surge has captured the attention of investors, analysts, and regulators alike. Understanding the key factors that contributed to this rally provides valuable insights into the current state and future potential of Bitcoin as an asset class.

Institutional Investment and Demand for Bitcoin

One of the most significant drivers behind Bitcoin’s recent price increase is growing institutional interest. Large financial institutions and investment firms are increasingly viewing BTC as a legitimate asset for diversification and hedging purposes. The introduction and expansion of Bitcoin exchange-traded funds (ETFs) have played a crucial role in this shift.

The approval or launch of ETFs allows institutional investors to gain exposure to Bitcoin without directly holding it, reducing perceived risks related to custody or security concerns. For example, on June 3, 2025, 21Shares US announced a 3-for-1 split for its ARK Bitcoin ETF. This move aimed to make investing more accessible by lowering share prices and increasing liquidity—factors that attract broader investor participation.

This influx from institutional players not only boosts demand but also signals increased market legitimacy. As more reputable entities enter the space with substantial capital commitments, confidence among retail investors tends to grow correspondingly.

Global Economic Uncertainty Fuels Safe-Haven Demand

Another critical factor influencing BTC’s rally is global economic uncertainty fueled by geopolitical tensions. Events such as renewed tariff threats between major economies like China and the European Union have heightened fears about economic stability worldwide.

In times of geopolitical unrest or macroeconomic instability—such as inflationary pressures or currency devaluations—investors often seek safe-haven assets that can preserve value during turbulent periods. Historically gold has been considered a primary safe haven; however, cryptocurrencies like Bitcoin are increasingly viewed as digital alternatives due to their decentralized nature.

During this period, gold prices surged concurrently with BTC’s rise—reaching a three-week high—which underscores investor appetite for secure assets amid uncertain times. This trend indicates that many see cryptocurrencies not just as speculative investments but also as potential hedges against traditional financial system vulnerabilities.

Market Sentiment Driven by Optimism & Speculation

Market sentiment plays an essential role in fueling rapid price movements within cryptocurrency markets. Positive news flow—including regulatory developments favoring crypto adoption—and widespread optimism about future growth prospects tend to attract new buyers.

Speculative trading further amplifies these effects; traders often buy into rising markets expecting continued gains—a phenomenon known as momentum trading. As more participants become optimistic about long-term prospects based on technological advancements or macroeconomic trends, buying pressure intensifies leading up to record highs like those seen recently with BTC.

This collective optimism creates self-reinforcing cycles where rising prices generate media coverage and social media buzz—drawing even more retail traders into the market—and pushing prices higher still.

Technological Progress Enhances Cryptocurrency Adoption

Advancements in blockchain technology underpin much of Bitcoin's recent success by improving scalability, security features, usability enhancements—and ultimately making it easier for mainstream users to participate confidently in crypto markets.

Innovations such as layer-2 solutions (e.g., Lightning Network), improved wallet interfaces, faster transaction speeds—all contribute toward making cryptocurrencies more practical for everyday transactions while reducing barriers related to cost or complexity.

Furthermore: ongoing development efforts aim at addressing regulatory concerns around privacy standards or compliance frameworks—allaying fears among cautious investors who might otherwise stay away from digital assets altogether[1].

Regulatory Environment Becomes More Favorable

While regulation remains one of the most complex aspects influencing cryptocurrency markets globally—including concerns over bans or restrictions—the recent environment appears somewhat supportive rather than restrictive overall[1].

For instance: announcements like ETF approvals—or moves toward clearer legal frameworks—can boost investor confidence significantly because they reduce uncertainty surrounding legal risks associated with holding cryptocurrencies[2]. The decision by regulators regarding products such as ETFs signals recognition that digital assets are becoming integral components within mainstream finance systems rather than fringe investments alone[1].

However: regulatory scrutiny could tighten again if governments perceive risks related either directly—or indirectly—to financial stability or consumer protection measures[2]. Investors should remain vigilant regarding evolving policies across jurisdictions which could impact future market dynamics adversely if unfavorable regulations emerge unexpectedly[2].

Recent Developments Supporting Market Growth

Recent events have further reinforced positive sentiment around BTC:

ARK Bitcoin ETF Split: The strategic move by 21Shares US aimed at increasing accessibility helped attract new retail investors while maintaining liquidity.

Gold Price Movements: Gold's upward trend during similar geopolitical tensions highlights how traditional safe-havens continue competing alongside cryptocurrencies for investor attention during uncertain times.

These developments reflect broader macroeconomic themes influencing investment decisions today—from risk aversion strategies during geopolitical crises through technological innovations easing access points into crypto markets.[1][2]

Risks That Could Impact Future Prices

Despite strong momentum currently supporting higher valuations:

Market Volatility: Rapid price increases often lead to heightened volatility levels which can cause sharp corrections.

Regulatory Risks: Stricter regulations—or outright bans—in key markets could dampen enthusiasm suddenly.

Economic Downturns: If global economic conditions worsen significantly—as seen historically—the appeal of alternative assets like gold may overshadow cryptocurrencies once again.[2]

Investors should consider these factors carefully when assessing long-term prospects amid ongoing market fluctuations.[1][2]

Summary

The recent massive rally in Bitcoin reflects multiple intertwined factors—from expanding institutional demand driven by ETFs; global economic uncertainties prompting safe-haven flows; positive market sentiment fueled by technological progress; all supported by evolving regulatory landscapes favoring adoption.[1][2] While these elements suggest continued growth potential under favorable conditions—with awareness towards possible volatility spikes—they also highlight inherent risks requiring careful monitoring moving forward.[1][2] Understanding these dynamics helps both seasoned traders and newcomers navigate this rapidly changing landscape effectively.

References

[1] Research Report – Massive BTC Rally Factors & Context

[2] Industry Analysis – Cryptocurrency Market Trends

Lo

2025-06-09 20:11

What factors contributed to the massive BTC rally?

Factors Behind the Recent Bitcoin (BTC) Price Surge

The cryptocurrency market has experienced a remarkable rally in Bitcoin (BTC), reaching an all-time high of $111,878 on May 22, 2025. This unprecedented surge has captured the attention of investors, analysts, and regulators alike. Understanding the key factors that contributed to this rally provides valuable insights into the current state and future potential of Bitcoin as an asset class.

Institutional Investment and Demand for Bitcoin

One of the most significant drivers behind Bitcoin’s recent price increase is growing institutional interest. Large financial institutions and investment firms are increasingly viewing BTC as a legitimate asset for diversification and hedging purposes. The introduction and expansion of Bitcoin exchange-traded funds (ETFs) have played a crucial role in this shift.

The approval or launch of ETFs allows institutional investors to gain exposure to Bitcoin without directly holding it, reducing perceived risks related to custody or security concerns. For example, on June 3, 2025, 21Shares US announced a 3-for-1 split for its ARK Bitcoin ETF. This move aimed to make investing more accessible by lowering share prices and increasing liquidity—factors that attract broader investor participation.

This influx from institutional players not only boosts demand but also signals increased market legitimacy. As more reputable entities enter the space with substantial capital commitments, confidence among retail investors tends to grow correspondingly.

Global Economic Uncertainty Fuels Safe-Haven Demand

Another critical factor influencing BTC’s rally is global economic uncertainty fueled by geopolitical tensions. Events such as renewed tariff threats between major economies like China and the European Union have heightened fears about economic stability worldwide.

In times of geopolitical unrest or macroeconomic instability—such as inflationary pressures or currency devaluations—investors often seek safe-haven assets that can preserve value during turbulent periods. Historically gold has been considered a primary safe haven; however, cryptocurrencies like Bitcoin are increasingly viewed as digital alternatives due to their decentralized nature.

During this period, gold prices surged concurrently with BTC’s rise—reaching a three-week high—which underscores investor appetite for secure assets amid uncertain times. This trend indicates that many see cryptocurrencies not just as speculative investments but also as potential hedges against traditional financial system vulnerabilities.

Market Sentiment Driven by Optimism & Speculation

Market sentiment plays an essential role in fueling rapid price movements within cryptocurrency markets. Positive news flow—including regulatory developments favoring crypto adoption—and widespread optimism about future growth prospects tend to attract new buyers.

Speculative trading further amplifies these effects; traders often buy into rising markets expecting continued gains—a phenomenon known as momentum trading. As more participants become optimistic about long-term prospects based on technological advancements or macroeconomic trends, buying pressure intensifies leading up to record highs like those seen recently with BTC.

This collective optimism creates self-reinforcing cycles where rising prices generate media coverage and social media buzz—drawing even more retail traders into the market—and pushing prices higher still.

Technological Progress Enhances Cryptocurrency Adoption

Advancements in blockchain technology underpin much of Bitcoin's recent success by improving scalability, security features, usability enhancements—and ultimately making it easier for mainstream users to participate confidently in crypto markets.

Innovations such as layer-2 solutions (e.g., Lightning Network), improved wallet interfaces, faster transaction speeds—all contribute toward making cryptocurrencies more practical for everyday transactions while reducing barriers related to cost or complexity.

Furthermore: ongoing development efforts aim at addressing regulatory concerns around privacy standards or compliance frameworks—allaying fears among cautious investors who might otherwise stay away from digital assets altogether[1].

Regulatory Environment Becomes More Favorable

While regulation remains one of the most complex aspects influencing cryptocurrency markets globally—including concerns over bans or restrictions—the recent environment appears somewhat supportive rather than restrictive overall[1].

For instance: announcements like ETF approvals—or moves toward clearer legal frameworks—can boost investor confidence significantly because they reduce uncertainty surrounding legal risks associated with holding cryptocurrencies[2]. The decision by regulators regarding products such as ETFs signals recognition that digital assets are becoming integral components within mainstream finance systems rather than fringe investments alone[1].

However: regulatory scrutiny could tighten again if governments perceive risks related either directly—or indirectly—to financial stability or consumer protection measures[2]. Investors should remain vigilant regarding evolving policies across jurisdictions which could impact future market dynamics adversely if unfavorable regulations emerge unexpectedly[2].

Recent Developments Supporting Market Growth

Recent events have further reinforced positive sentiment around BTC:

ARK Bitcoin ETF Split: The strategic move by 21Shares US aimed at increasing accessibility helped attract new retail investors while maintaining liquidity.

Gold Price Movements: Gold's upward trend during similar geopolitical tensions highlights how traditional safe-havens continue competing alongside cryptocurrencies for investor attention during uncertain times.

These developments reflect broader macroeconomic themes influencing investment decisions today—from risk aversion strategies during geopolitical crises through technological innovations easing access points into crypto markets.[1][2]

Risks That Could Impact Future Prices

Despite strong momentum currently supporting higher valuations:

Market Volatility: Rapid price increases often lead to heightened volatility levels which can cause sharp corrections.

Regulatory Risks: Stricter regulations—or outright bans—in key markets could dampen enthusiasm suddenly.

Economic Downturns: If global economic conditions worsen significantly—as seen historically—the appeal of alternative assets like gold may overshadow cryptocurrencies once again.[2]

Investors should consider these factors carefully when assessing long-term prospects amid ongoing market fluctuations.[1][2]

Summary

The recent massive rally in Bitcoin reflects multiple intertwined factors—from expanding institutional demand driven by ETFs; global economic uncertainties prompting safe-haven flows; positive market sentiment fueled by technological progress; all supported by evolving regulatory landscapes favoring adoption.[1][2] While these elements suggest continued growth potential under favorable conditions—with awareness towards possible volatility spikes—they also highlight inherent risks requiring careful monitoring moving forward.[1][2] Understanding these dynamics helps both seasoned traders and newcomers navigate this rapidly changing landscape effectively.

References

[1] Research Report – Massive BTC Rally Factors & Context

[2] Industry Analysis – Cryptocurrency Market Trends

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Did Doodles Transition Into a Global Media Brand?

Understanding the Rise of Doodles in Digital Art and NFTs

Doodles began as a small digital art collective founded in 2021 by Scott Barry and Evan Keast. Their initial focus was on creating humorous, relatable digital illustrations that quickly resonated with online audiences. Leveraging social media platforms like Twitter and Instagram, Doodles gained rapid popularity among younger generations who appreciated its playful style and irreverent approach to digital art. This early success laid the groundwork for what would become a significant transformation from an art collective into a full-fledged media brand.

The Role of Community Engagement in Building Trust

A key factor behind Doodles’ growth has been its strong community engagement. From the outset, the founders prioritized interacting with followers through social media, live events, and exclusive releases. This direct connection fostered loyalty among fans who felt personally invested in the brand’s evolution. Such community-driven strategies are crucial for establishing trust—especially within rapidly evolving sectors like digital art and NFTs—where authenticity often determines long-term success.

Expansion into Merchandise and Collectibles

One of the pivotal steps in Doodles’ transition was expanding beyond traditional digital artwork into merchandise such as T-shirts, stickers, and other collectibles. These physical products allowed fans to showcase their support offline while also monetizing the brand effectively. The introduction of Non-Fungible Tokens (NFTs) further accelerated this process; Doodles launched several NFT collections that sold out swiftly, generating substantial revenue and attracting mainstream attention.

NFTs: A Game-Changer for Digital Art Brands

The move into NFTs marked a significant turning point for Doodles. By releasing exclusive collections on blockchain platforms, they tapped into an emerging market that combines ownership rights with unique digital assets. These NFT drops not only boosted visibility but also positioned Doodles as leaders within the crypto-enabled art space—a sector characterized by rapid innovation but also regulatory uncertainty.

Partnerships Boosting Global Reach

Strategic collaborations have played an essential role in elevating Doodles’ profile worldwide. The collective partnered with prominent brands such as Roblox to create exclusive in-game items—an initiative that introduced their artwork to millions of gamers globally. Collaborations with other renowned digital artists or mainstream outlets have helped diversify their audience base while reinforcing credibility within both traditional media circles and emerging markets.

Global Expansion Through Exhibitions & Media Presence

Doodles has actively expanded its footprint internationally through exhibitions held across major cities including New York City and Tokyo. These events serve multiple purposes: showcasing new artworks, engaging directly with fans worldwide, fostering networking opportunities among creators—and ultimately strengthening its position as a global media entity rather than just an online art project.

Mainstream Media Recognition Enhances Credibility

Media appearances have significantly contributed to raising awareness about Doodles' innovative approach to digital content creation. Features from reputable outlets such as Forbes, Bloomberg, or The New York Times validate their influence beyond niche crypto communities—helping attract investors, partners—and solidify their reputation as pioneers shaping future trends at intersection of technology & creativity.

Addressing Challenges During Rapid Growth

Despite impressive progress over just a few years—including launching international exhibitions—the expansion presents potential risks:

- Market Saturation: As more artists enter space driven by NFT hype,

- Regulatory Uncertainty: Changes in laws governing cryptocurrencies could impact business models,

- Environmental Concerns: The ecological footprint associated with blockchain transactions remains contentious; sustainable practices are increasingly vital for maintaining public trust.

Maintaining Authenticity While Scaling Up

For long-term success amid these challenges, maintaining core values is essential—particularly transparency about environmental impacts or regulatory compliance—and continuing authentic community engagement will be critical factors differentiating genuine brands from fleeting trends.

What Lies Ahead for Digital Art Collectives Like Doodles?

Looking forward, companies like Doodles are likely to explore further innovations—including augmented reality experiences or integration into virtual worlds—to deepen user interaction while expanding revenue streams beyond merchandise or NFTs alone.Their ability to adapt quickly while preserving authenticity will determine whether they sustain growth or face setbacks due to market volatility or external pressures.As they continue building on early successes—with global exhibitions becoming more frequent—they set examples for how creative collectives can evolve into influential multimedia brands capable of shaping cultural conversations around technology-driven artistry.

JCUSER-WVMdslBw

2025-06-09 16:53

How did Doodles transition into a global media brand?

How Did Doodles Transition Into a Global Media Brand?

Understanding the Rise of Doodles in Digital Art and NFTs

Doodles began as a small digital art collective founded in 2021 by Scott Barry and Evan Keast. Their initial focus was on creating humorous, relatable digital illustrations that quickly resonated with online audiences. Leveraging social media platforms like Twitter and Instagram, Doodles gained rapid popularity among younger generations who appreciated its playful style and irreverent approach to digital art. This early success laid the groundwork for what would become a significant transformation from an art collective into a full-fledged media brand.

The Role of Community Engagement in Building Trust

A key factor behind Doodles’ growth has been its strong community engagement. From the outset, the founders prioritized interacting with followers through social media, live events, and exclusive releases. This direct connection fostered loyalty among fans who felt personally invested in the brand’s evolution. Such community-driven strategies are crucial for establishing trust—especially within rapidly evolving sectors like digital art and NFTs—where authenticity often determines long-term success.

Expansion into Merchandise and Collectibles

One of the pivotal steps in Doodles’ transition was expanding beyond traditional digital artwork into merchandise such as T-shirts, stickers, and other collectibles. These physical products allowed fans to showcase their support offline while also monetizing the brand effectively. The introduction of Non-Fungible Tokens (NFTs) further accelerated this process; Doodles launched several NFT collections that sold out swiftly, generating substantial revenue and attracting mainstream attention.

NFTs: A Game-Changer for Digital Art Brands

The move into NFTs marked a significant turning point for Doodles. By releasing exclusive collections on blockchain platforms, they tapped into an emerging market that combines ownership rights with unique digital assets. These NFT drops not only boosted visibility but also positioned Doodles as leaders within the crypto-enabled art space—a sector characterized by rapid innovation but also regulatory uncertainty.

Partnerships Boosting Global Reach

Strategic collaborations have played an essential role in elevating Doodles’ profile worldwide. The collective partnered with prominent brands such as Roblox to create exclusive in-game items—an initiative that introduced their artwork to millions of gamers globally. Collaborations with other renowned digital artists or mainstream outlets have helped diversify their audience base while reinforcing credibility within both traditional media circles and emerging markets.

Global Expansion Through Exhibitions & Media Presence

Doodles has actively expanded its footprint internationally through exhibitions held across major cities including New York City and Tokyo. These events serve multiple purposes: showcasing new artworks, engaging directly with fans worldwide, fostering networking opportunities among creators—and ultimately strengthening its position as a global media entity rather than just an online art project.

Mainstream Media Recognition Enhances Credibility

Media appearances have significantly contributed to raising awareness about Doodles' innovative approach to digital content creation. Features from reputable outlets such as Forbes, Bloomberg, or The New York Times validate their influence beyond niche crypto communities—helping attract investors, partners—and solidify their reputation as pioneers shaping future trends at intersection of technology & creativity.

Addressing Challenges During Rapid Growth

Despite impressive progress over just a few years—including launching international exhibitions—the expansion presents potential risks:

- Market Saturation: As more artists enter space driven by NFT hype,

- Regulatory Uncertainty: Changes in laws governing cryptocurrencies could impact business models,

- Environmental Concerns: The ecological footprint associated with blockchain transactions remains contentious; sustainable practices are increasingly vital for maintaining public trust.

Maintaining Authenticity While Scaling Up

For long-term success amid these challenges, maintaining core values is essential—particularly transparency about environmental impacts or regulatory compliance—and continuing authentic community engagement will be critical factors differentiating genuine brands from fleeting trends.

What Lies Ahead for Digital Art Collectives Like Doodles?

Looking forward, companies like Doodles are likely to explore further innovations—including augmented reality experiences or integration into virtual worlds—to deepen user interaction while expanding revenue streams beyond merchandise or NFTs alone.Their ability to adapt quickly while preserving authenticity will determine whether they sustain growth or face setbacks due to market volatility or external pressures.As they continue building on early successes—with global exhibitions becoming more frequent—they set examples for how creative collectives can evolve into influential multimedia brands capable of shaping cultural conversations around technology-driven artistry.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The Impact of Bitcoin's Legality on Its Price Volatility

Understanding how the legal status of Bitcoin influences its price fluctuations is essential for investors, regulators, and market observers alike. As the most prominent cryptocurrency, Bitcoin’s value is highly sensitive to regulatory developments across different jurisdictions. This article explores how legality shapes Bitcoin’s market behavior, highlighting recent trends and potential future implications.

Legal Frameworks and Their Effect on Market Stability

Bitcoin's legal environment varies widely around the world. Countries with clear and supportive regulations—such as Japan, South Korea, and Singapore—have fostered a more stable trading environment. These nations have established comprehensive guidelines that legitimize cryptocurrency activities, encouraging adoption among consumers and businesses. When regulations are transparent and consistent, investor confidence tends to increase because participants feel protected against fraud or sudden policy shifts.

Conversely, regions with strict or ambiguous rules tend to experience heightened volatility. For example, China’s crackdown on cryptocurrencies—including banning ICOs (Initial Coin Offerings) in 2017—caused significant price drops both domestically and globally. Such regulatory crackdowns create uncertainty among traders who may rush to sell holdings fearing future restrictions or outright bans.

In countries where cryptocurrencies are banned altogether—like Bolivia or Ecuador—their use diminishes sharply within those borders but can still influence global markets through reduced liquidity pools. Less liquidity often leads to sharper price swings when large trades occur or when new regulatory announcements are made.

Regulatory Uncertainty: A Catalyst for Price Fluctuations

Uncertainty surrounding cryptocurrency regulation remains one of the primary drivers of Bitcoin’s price volatility. When governments announce potential restrictions or tighten existing rules without clear timelines or details, markets react swiftly with sharp declines in value as traders seek safety elsewhere.

For instance:

- The anticipation of a ban can lead to panic selling.

- Conversely, positive signals about regulation can boost prices by attracting institutional investors seeking clarity.

This pattern underscores why stable regulatory environments tend to correlate with less volatile prices—they reduce unpredictability by providing clear guidelines that market participants can trust.

Recent Regulatory Developments Shaping Market Dynamics

Over recent years, major economies have taken steps toward establishing clearer frameworks for cryptocurrencies:

United States: In 2023, the US Securities and Exchange Commission (SEC) issued more defined guidelines regarding token classification—a move aimed at reducing ambiguity for crypto projects listed on US exchanges.

European Union: The EU has proposed comprehensive legislation designed to harmonize crypto regulations across member states by 2024. This initiative aims not only at consumer protection but also at fostering innovation while maintaining financial stability.

These developments suggest a trend toward greater regulatory clarity worldwide—a factor likely contributing over time to reduced volatility as markets adapt accordingly.

Potential Long-Term Effects of Regulatory Changes

The evolving legal landscape influences several key aspects of Bitcoin trading:

- Investor Confidence: Stable laws attract institutional players who require certainty before allocating funds into digital assets.

- Market Liquidity: Clearer regulations encourage broader participation from retail investors; conversely, bans limit liquidity pools leading to increased price swings.

- Technological Progress: Advances like decentralized finance (DeFi) solutions aim at creating more transparent transaction mechanisms that could mitigate some effects caused by regulatory uncertainties.

While regulation alone cannot eliminate all volatility inherent in emerging asset classes like cryptocurrencies—which are still relatively young—it plays a crucial role in shaping long-term stability prospects.

Historical Context Shows Regulation's Role in Price Trends

Looking back:

- In 2017**, China’s ban on ICOs triggered a steep decline across global crypto markets.

- By 2020**, clearer guidance from US authorities helped stabilize some parts of the industry amid ongoing debates about token classifications.

- Recent proposals from Europe aim at standardizing rules across multiple jurisdictions—a move expected eventually to smooth out abrupt market reactions caused by inconsistent policies elsewhere.

Such historical examples reinforce how legislative actions directly impact investor sentiment—and consequently—the pricing behavior of Bitcoin over time.

Implications for Investors and Market Participants

For those involved in cryptocurrency trading or investment:

- Monitoring legal developments should be part of risk management strategies since sudden policy shifts can cause rapid price changes.

- Favoring jurisdictions with transparent regulations might reduce exposure to unexpected volatility spikes.

Additionally,

- Understanding regional differences* helps assess where opportunities may arise versus areas prone to sudden downturns due solely to legal uncertainties.

How Future Regulations Could Shape Cryptocurrency Markets

As governments continue refining their approaches towards digital assets:

- We might see increased adoption driven by clearer rules that protect consumers while enabling innovation

- Conversely*, overly restrictive policies could suppress growth opportunities,* leading traders into less regulated offshore markets which carry their own risks

Overall*, balanced regulation appears key—not only for reducing short-term volatility but also for fostering sustainable growth within the cryptocurrency ecosystem.*

By recognizing these dynamics between legality and market behavior*, stakeholders can better navigate an increasingly complex landscape.* Whether you’re an investor seeking stability or a regulator aiming for responsible innovation*, understanding this relationship is vital.*

kai

2025-06-09 07:06

Can Bitcoin's legality affect its price volatility?

The Impact of Bitcoin's Legality on Its Price Volatility

Understanding how the legal status of Bitcoin influences its price fluctuations is essential for investors, regulators, and market observers alike. As the most prominent cryptocurrency, Bitcoin’s value is highly sensitive to regulatory developments across different jurisdictions. This article explores how legality shapes Bitcoin’s market behavior, highlighting recent trends and potential future implications.

Legal Frameworks and Their Effect on Market Stability

Bitcoin's legal environment varies widely around the world. Countries with clear and supportive regulations—such as Japan, South Korea, and Singapore—have fostered a more stable trading environment. These nations have established comprehensive guidelines that legitimize cryptocurrency activities, encouraging adoption among consumers and businesses. When regulations are transparent and consistent, investor confidence tends to increase because participants feel protected against fraud or sudden policy shifts.

Conversely, regions with strict or ambiguous rules tend to experience heightened volatility. For example, China’s crackdown on cryptocurrencies—including banning ICOs (Initial Coin Offerings) in 2017—caused significant price drops both domestically and globally. Such regulatory crackdowns create uncertainty among traders who may rush to sell holdings fearing future restrictions or outright bans.

In countries where cryptocurrencies are banned altogether—like Bolivia or Ecuador—their use diminishes sharply within those borders but can still influence global markets through reduced liquidity pools. Less liquidity often leads to sharper price swings when large trades occur or when new regulatory announcements are made.

Regulatory Uncertainty: A Catalyst for Price Fluctuations

Uncertainty surrounding cryptocurrency regulation remains one of the primary drivers of Bitcoin’s price volatility. When governments announce potential restrictions or tighten existing rules without clear timelines or details, markets react swiftly with sharp declines in value as traders seek safety elsewhere.

For instance:

- The anticipation of a ban can lead to panic selling.

- Conversely, positive signals about regulation can boost prices by attracting institutional investors seeking clarity.

This pattern underscores why stable regulatory environments tend to correlate with less volatile prices—they reduce unpredictability by providing clear guidelines that market participants can trust.

Recent Regulatory Developments Shaping Market Dynamics

Over recent years, major economies have taken steps toward establishing clearer frameworks for cryptocurrencies:

United States: In 2023, the US Securities and Exchange Commission (SEC) issued more defined guidelines regarding token classification—a move aimed at reducing ambiguity for crypto projects listed on US exchanges.

European Union: The EU has proposed comprehensive legislation designed to harmonize crypto regulations across member states by 2024. This initiative aims not only at consumer protection but also at fostering innovation while maintaining financial stability.

These developments suggest a trend toward greater regulatory clarity worldwide—a factor likely contributing over time to reduced volatility as markets adapt accordingly.

Potential Long-Term Effects of Regulatory Changes

The evolving legal landscape influences several key aspects of Bitcoin trading:

- Investor Confidence: Stable laws attract institutional players who require certainty before allocating funds into digital assets.

- Market Liquidity: Clearer regulations encourage broader participation from retail investors; conversely, bans limit liquidity pools leading to increased price swings.

- Technological Progress: Advances like decentralized finance (DeFi) solutions aim at creating more transparent transaction mechanisms that could mitigate some effects caused by regulatory uncertainties.

While regulation alone cannot eliminate all volatility inherent in emerging asset classes like cryptocurrencies—which are still relatively young—it plays a crucial role in shaping long-term stability prospects.

Historical Context Shows Regulation's Role in Price Trends

Looking back:

- In 2017**, China’s ban on ICOs triggered a steep decline across global crypto markets.

- By 2020**, clearer guidance from US authorities helped stabilize some parts of the industry amid ongoing debates about token classifications.

- Recent proposals from Europe aim at standardizing rules across multiple jurisdictions—a move expected eventually to smooth out abrupt market reactions caused by inconsistent policies elsewhere.

Such historical examples reinforce how legislative actions directly impact investor sentiment—and consequently—the pricing behavior of Bitcoin over time.

Implications for Investors and Market Participants

For those involved in cryptocurrency trading or investment:

- Monitoring legal developments should be part of risk management strategies since sudden policy shifts can cause rapid price changes.

- Favoring jurisdictions with transparent regulations might reduce exposure to unexpected volatility spikes.

Additionally,

- Understanding regional differences* helps assess where opportunities may arise versus areas prone to sudden downturns due solely to legal uncertainties.

How Future Regulations Could Shape Cryptocurrency Markets

As governments continue refining their approaches towards digital assets:

- We might see increased adoption driven by clearer rules that protect consumers while enabling innovation

- Conversely*, overly restrictive policies could suppress growth opportunities,* leading traders into less regulated offshore markets which carry their own risks

Overall*, balanced regulation appears key—not only for reducing short-term volatility but also for fostering sustainable growth within the cryptocurrency ecosystem.*

By recognizing these dynamics between legality and market behavior*, stakeholders can better navigate an increasingly complex landscape.* Whether you’re an investor seeking stability or a regulator aiming for responsible innovation*, understanding this relationship is vital.*

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Assets Can I Trade During the XT Carnival?

The XT Carnival is one of the most anticipated events in the cryptocurrency calendar, especially for traders and investors interested in decentralized finance (DeFi) and digital assets. Organized annually by XT.com, this event offers a unique platform to engage with a wide range of tradable assets, from established cryptocurrencies to innovative tokens and NFTs. Understanding what assets are available during the carnival can help participants maximize their trading strategies and capitalize on promotional activities.

Overview of Assets Available for Trading at XT Carnival

During the XT Carnival, traders have access to an extensive selection of digital assets. This diversity reflects both the broad scope of cryptocurrency markets and XT.com’s commitment to supporting various segments within crypto trading. The main categories include major cryptocurrencies, DeFi tokens, NFTs, and exclusive event-specific tokens.

Major Cryptocurrencies

At its core, the event provides opportunities to trade well-known cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). These assets serve as foundational holdings for many traders due to their liquidity and market stability. Besides BTC and ETH, other popular altcoins like Ripple (XRP), Litecoin (LTC), Cardano (ADA), Solana (SOL), Binance Coin (BNB), among others are also available for trading during this period.

DeFi Tokens

Decentralized Finance has become a dominant theme within crypto markets over recent years. The XT Carnival emphasizes this trend by offering access to DeFi tokens from leading protocols such as Uniswap’s UNI token, SushiSwap’s SUSHI token, Aave’s LEND token, Compound’s COMP token, among others. These tokens often experience increased trading volume during events like these due to promotional campaigns or liquidity incentives.

Non-Fungible Tokens (NFTs)

NFTs have revolutionized digital ownership by enabling unique collectibles across art platforms like OpenSea or Rarible. During the carnival period, some platforms associated with XT.com facilitate NFT trades or giveaways—allowing users not only to buy or sell existing NFTs but also participate in exclusive drops linked directly with event activities.

Special Event Tokens

In addition to traditional crypto assets, XT.com issues special tokens specifically for participation in its carnival events. These may include limited-edition coins that offer rewards such as bonuses on trades or eligibility for prize draws—serving both as incentives and commemorative items tied directly into festival activities.

Why Does Asset Diversity Matter During Events Like This?

Offering multiple asset classes enhances user engagement while catering to different risk appetites—from conservative investors favoring blue-chip cryptos like BTC/ETH to more adventurous traders exploring emerging DeFi projects or NFTs. It also encourages portfolio diversification—a key principle supported by financial experts aiming at reducing overall risk exposure.

Furthermore:

- Market Liquidity: High liquidity across various asset types ensures smoother transactions.

- Trading Opportunities: Volatility spikes often accompany large-scale events; having access across multiple asset classes allows traders flexibility.

- Participation Incentives: Many promotions target specific asset groups; understanding which can be traded helps optimize earning potential through competitions or airdrops.

How To Maximize Trading During The Event

To make full use of available assets during the XT Carnival:

- Research Trending Assets: Keep an eye on market trends related not only to mainstream cryptos but also emerging DeFi projects.

- Leverage Promotions: Participate actively in contests involving specific tokens—such as "Trade-to-Earn" campaigns targeting particular pairs.

- Diversify Portfolio: Spread investments across different categories—cryptos + DeFi + NFTs—to mitigate risks associated with volatility.

- Stay Informed About New Listings: Often new tokens are introduced temporarily during festivals; timely participation can lead to profitable trades.

- Be Cautious With Scams: As excitement builds around these events — especially involving high-value transactions — beware of phishing schemes promising fake rewards or malicious links claiming false promotions.

Risks Associated With Trading Assets During Such Events

While opportunities abound during festivals like the XT Carnival—including increased liquidity and promotional bonuses—they come alongside certain risks:

- Market volatility may lead prices into unpredictable swings.

- Fake websites or scam schemes tend proliferate around popular events targeting unsuspecting users seeking quick gains.

- Regulatory scrutiny could tighten if authorities perceive such festivals as promoting speculative behavior without sufficient oversight.

Participants should approach these opportunities responsibly—conduct thorough research before investing significant funds—and remain vigilant against potential scams that often surface amid heightened activity periods.

Summary

The range of tradable assets at the XT Carnival encompasses major cryptocurrencies like Bitcoin and Ethereum; popular DeFi tokens including UNI from Uniswap or SUSHI from SushiSwap; non-fungible tokens representing digital collectibles; along with exclusive event-specific coins issued by XT.com itself—all designed to cater diverse trader interests while fostering engagement through competitions and promotions.

By understanding what is available—and combining strategic research with cautious risk management—participants can leverage this vibrant ecosystem effectively throughout its duration each year while contributing positively toward their broader investment goals within dynamic crypto markets.

JCUSER-IC8sJL1q

2025-06-09 01:42

What assets can I trade during the XT Carnival?

What Assets Can I Trade During the XT Carnival?

The XT Carnival is one of the most anticipated events in the cryptocurrency calendar, especially for traders and investors interested in decentralized finance (DeFi) and digital assets. Organized annually by XT.com, this event offers a unique platform to engage with a wide range of tradable assets, from established cryptocurrencies to innovative tokens and NFTs. Understanding what assets are available during the carnival can help participants maximize their trading strategies and capitalize on promotional activities.

Overview of Assets Available for Trading at XT Carnival

During the XT Carnival, traders have access to an extensive selection of digital assets. This diversity reflects both the broad scope of cryptocurrency markets and XT.com’s commitment to supporting various segments within crypto trading. The main categories include major cryptocurrencies, DeFi tokens, NFTs, and exclusive event-specific tokens.

Major Cryptocurrencies

At its core, the event provides opportunities to trade well-known cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). These assets serve as foundational holdings for many traders due to their liquidity and market stability. Besides BTC and ETH, other popular altcoins like Ripple (XRP), Litecoin (LTC), Cardano (ADA), Solana (SOL), Binance Coin (BNB), among others are also available for trading during this period.

DeFi Tokens

Decentralized Finance has become a dominant theme within crypto markets over recent years. The XT Carnival emphasizes this trend by offering access to DeFi tokens from leading protocols such as Uniswap’s UNI token, SushiSwap’s SUSHI token, Aave’s LEND token, Compound’s COMP token, among others. These tokens often experience increased trading volume during events like these due to promotional campaigns or liquidity incentives.

Non-Fungible Tokens (NFTs)

NFTs have revolutionized digital ownership by enabling unique collectibles across art platforms like OpenSea or Rarible. During the carnival period, some platforms associated with XT.com facilitate NFT trades or giveaways—allowing users not only to buy or sell existing NFTs but also participate in exclusive drops linked directly with event activities.

Special Event Tokens

In addition to traditional crypto assets, XT.com issues special tokens specifically for participation in its carnival events. These may include limited-edition coins that offer rewards such as bonuses on trades or eligibility for prize draws—serving both as incentives and commemorative items tied directly into festival activities.

Why Does Asset Diversity Matter During Events Like This?

Offering multiple asset classes enhances user engagement while catering to different risk appetites—from conservative investors favoring blue-chip cryptos like BTC/ETH to more adventurous traders exploring emerging DeFi projects or NFTs. It also encourages portfolio diversification—a key principle supported by financial experts aiming at reducing overall risk exposure.

Furthermore:

- Market Liquidity: High liquidity across various asset types ensures smoother transactions.

- Trading Opportunities: Volatility spikes often accompany large-scale events; having access across multiple asset classes allows traders flexibility.

- Participation Incentives: Many promotions target specific asset groups; understanding which can be traded helps optimize earning potential through competitions or airdrops.

How To Maximize Trading During The Event

To make full use of available assets during the XT Carnival:

- Research Trending Assets: Keep an eye on market trends related not only to mainstream cryptos but also emerging DeFi projects.

- Leverage Promotions: Participate actively in contests involving specific tokens—such as "Trade-to-Earn" campaigns targeting particular pairs.

- Diversify Portfolio: Spread investments across different categories—cryptos + DeFi + NFTs—to mitigate risks associated with volatility.

- Stay Informed About New Listings: Often new tokens are introduced temporarily during festivals; timely participation can lead to profitable trades.

- Be Cautious With Scams: As excitement builds around these events — especially involving high-value transactions — beware of phishing schemes promising fake rewards or malicious links claiming false promotions.

Risks Associated With Trading Assets During Such Events

While opportunities abound during festivals like the XT Carnival—including increased liquidity and promotional bonuses—they come alongside certain risks:

- Market volatility may lead prices into unpredictable swings.

- Fake websites or scam schemes tend proliferate around popular events targeting unsuspecting users seeking quick gains.

- Regulatory scrutiny could tighten if authorities perceive such festivals as promoting speculative behavior without sufficient oversight.

Participants should approach these opportunities responsibly—conduct thorough research before investing significant funds—and remain vigilant against potential scams that often surface amid heightened activity periods.

Summary

The range of tradable assets at the XT Carnival encompasses major cryptocurrencies like Bitcoin and Ethereum; popular DeFi tokens including UNI from Uniswap or SUSHI from SushiSwap; non-fungible tokens representing digital collectibles; along with exclusive event-specific coins issued by XT.com itself—all designed to cater diverse trader interests while fostering engagement through competitions and promotions.

By understanding what is available—and combining strategic research with cautious risk management—participants can leverage this vibrant ecosystem effectively throughout its duration each year while contributing positively toward their broader investment goals within dynamic crypto markets.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JCUSER-F1IIaxXA

2025-06-07 17:28

How does a Bitcoin ETF work?

Error executing ChatgptTask

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Why Is Bithumb Warning Users About Bitcoin Gold?

Bithumb, one of South Korea’s leading cryptocurrency exchanges, has recently issued a warning to its users regarding Bitcoin Gold (BTG). This move has sparked curiosity and concern among traders and investors. To understand the implications fully, it’s essential to explore the background of Bitcoin Gold, the reasons behind Bithumb's cautionary stance, and what this means for the broader crypto community.

Understanding Bitcoin Gold: A Brief History

Bitcoin Gold was launched in October 2017 as a hard fork of the original Bitcoin blockchain. The primary motivation behind BTG was to create a more decentralized mining environment by making it resistant to ASIC (Application-Specific Integrated Circuit) hardware. Unlike traditional Bitcoin mining that relies heavily on specialized equipment, BTG aimed to enable GPU-based mining—allowing individual miners with standard graphics cards to participate more easily.

This vision resonated with many in the crypto community who believed that decentralization is fundamental for maintaining security and fairness within blockchain networks. However, despite its initial promise, Bitcoin Gold has faced numerous challenges over time.

Security Concerns Surrounding Bitcoin Gold

One of the most significant issues associated with BTG is security vulnerabilities. In 2018, BTG suffered a major hacking incident where approximately 17,000 coins were stolen—valued at around $18 million at that time. Hackers exploited weaknesses in its network or wallet infrastructure to carry out this theft.

Such incidents have raised red flags about BTG's security protocols and overall resilience against cyberattacks. For exchanges like Bithumb operating in highly regulated environments such as South Korea—which enforces strict compliance standards—supporting or even listing cryptocurrencies with known security issues can pose substantial risks.

Regulatory Environment Impact on Cryptocurrency Support

South Korea maintains rigorous regulations concerning cryptocurrency trading platforms. The government emphasizes investor protection and anti-money laundering measures while closely monitoring digital assets' compliance status.

In this context, exchanges like Bithumb are cautious about supporting cryptocurrencies that might attract regulatory scrutiny due to past security breaches or ambiguous legal standing. Supporting an asset like BTG—which has experienced notable hacks—could potentially expose them to legal liabilities or reputational damage if users suffer losses linked directly or indirectly from these vulnerabilities.

Market Volatility and Investor Risks

Cryptocurrencies are inherently volatile; prices can fluctuate dramatically within short periods due to market sentiment shifts or external events. For coins like BTG—with relatively lower liquidity compared to mainstream assets—the volatility can be even more pronounced.

Investors holding BTG may face sudden value drops during market downturns or after negative news reports related to security concerns or governance disputes within its community. Such instability makes it less attractive for risk-averse traders seeking safer investment options on platforms like Bithumb.

Community Disputes Affecting Trustworthiness

The development community behind Bitcoin Gold has experienced internal disagreements over governance decisions and future development directions. These controversies sometimes lead to skepticism among users regarding project transparency and long-term viability.

When trust diminishes within a cryptocurrency’s ecosystem due to internal conflicts—or perceived mismanagement—it often results in decreased user confidence across trading platforms supporting that coin—a factor likely influencing Bithumb's decision-making process when issuing warnings about BTG support.

Recent Developments Without Major Security Breaches

As of June 2025, there have been no recent major hacks targeting Bithumb’s holdings specifically related directly to BTC holdings; however, ongoing market trends continue affecting perceptions around BTC-related assets including BTG:

- Fluctuating prices driven by macroeconomic factors

- Regulatory updates impacting how exchanges handle certain tokens

- Community debates influencing project credibility

These elements contribute cumulatively toward cautious stances taken by prominent exchanges such as Bithumb regarding specific cryptocurrencies like BTC-Gold.

Potential Impacts of Bithumb’s Warning on Users & Markets

Bithumb's warning could influence various aspects of trading activity:

User Confidence: Traders might become hesitant about holding or trading BTG through Bithumb if they perceive increased risk.

Market Dynamics: Negative sentiment stemming from warnings can lead investors toward liquidating their positions faster than usual—potentially causing price declines.

Regulatory Scrutiny: Authorities may interpret such warnings as signals indicating potential issues within certain tokens’ ecosystems—prompting further investigations.

Community Reactions: Supporters of Bitcoin Gold might respond defensively against perceived unfair treatment from major exchanges which could impact future project developments or collaborations.

Understanding these potential outcomes helps investors make informed decisions aligned with their risk appetite while recognizing broader industry trends influenced by exchange policies.

Key Takeaways for Investors:

- Always verify an exchange’s official communications before making trades involving high-risk tokens.

- Be aware that past security breaches significantly influence current regulatory attitudes towards specific cryptocurrencies.

- Diversify holdings across different assets rather than concentrating investments solely in volatile tokens like BTG.

In summary, BithUMB's warning about Bitcoin Gold reflects ongoing concerns surrounding its security history, regulatory environment considerations in South Korea, market volatility risks, and internal community disputes affecting trustworthiness—all critical factors for traders evaluating whether support for such assets aligns with their safety standards and investment goals. Staying informed through credible sources remains essential amid evolving developments within the crypto landscape.

Keywords: bitcoin gold warning bithubb | btg hack history | south korea crypto regulation | cryptocurrency market volatility | crypto community disputes

kai

2025-06-05 07:05

Why is Bithumb warning users about Bitcoin Gold?

Why Is Bithumb Warning Users About Bitcoin Gold?

Bithumb, one of South Korea’s leading cryptocurrency exchanges, has recently issued a warning to its users regarding Bitcoin Gold (BTG). This move has sparked curiosity and concern among traders and investors. To understand the implications fully, it’s essential to explore the background of Bitcoin Gold, the reasons behind Bithumb's cautionary stance, and what this means for the broader crypto community.

Understanding Bitcoin Gold: A Brief History

Bitcoin Gold was launched in October 2017 as a hard fork of the original Bitcoin blockchain. The primary motivation behind BTG was to create a more decentralized mining environment by making it resistant to ASIC (Application-Specific Integrated Circuit) hardware. Unlike traditional Bitcoin mining that relies heavily on specialized equipment, BTG aimed to enable GPU-based mining—allowing individual miners with standard graphics cards to participate more easily.

This vision resonated with many in the crypto community who believed that decentralization is fundamental for maintaining security and fairness within blockchain networks. However, despite its initial promise, Bitcoin Gold has faced numerous challenges over time.

Security Concerns Surrounding Bitcoin Gold

One of the most significant issues associated with BTG is security vulnerabilities. In 2018, BTG suffered a major hacking incident where approximately 17,000 coins were stolen—valued at around $18 million at that time. Hackers exploited weaknesses in its network or wallet infrastructure to carry out this theft.

Such incidents have raised red flags about BTG's security protocols and overall resilience against cyberattacks. For exchanges like Bithumb operating in highly regulated environments such as South Korea—which enforces strict compliance standards—supporting or even listing cryptocurrencies with known security issues can pose substantial risks.

Regulatory Environment Impact on Cryptocurrency Support

South Korea maintains rigorous regulations concerning cryptocurrency trading platforms. The government emphasizes investor protection and anti-money laundering measures while closely monitoring digital assets' compliance status.

In this context, exchanges like Bithumb are cautious about supporting cryptocurrencies that might attract regulatory scrutiny due to past security breaches or ambiguous legal standing. Supporting an asset like BTG—which has experienced notable hacks—could potentially expose them to legal liabilities or reputational damage if users suffer losses linked directly or indirectly from these vulnerabilities.

Market Volatility and Investor Risks

Cryptocurrencies are inherently volatile; prices can fluctuate dramatically within short periods due to market sentiment shifts or external events. For coins like BTG—with relatively lower liquidity compared to mainstream assets—the volatility can be even more pronounced.