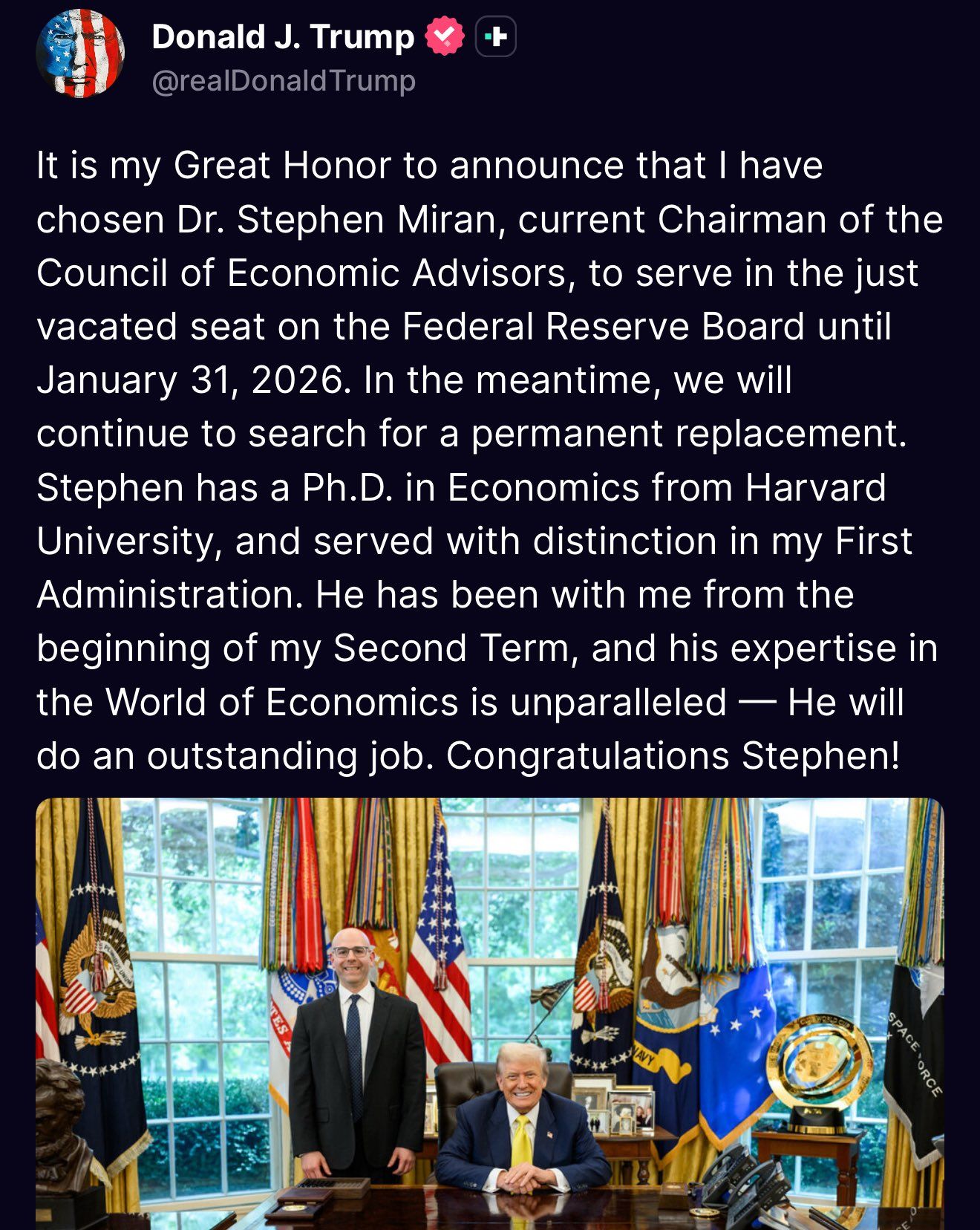

Miran est connu pour son soutien affiché à $BTC, avec son désormais culte : *“#Bitcoin fixes this”*.

Un défenseur du Web3 à la table du FOMC ? Le narratif devient réalité.

#Bitcoin #CryptoPolicy #BTC

Carmelita

2025-08-07 21:15

🚨 Trump propose Stephen Miran, économiste pro-Bitcoin, pour le poste de gouverneur à la Fed.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is Bitcoin (BTC) and Why Is It Significant?

Bitcoin (BTC) is often described as the pioneer of cryptocurrencies, but understanding its core features and recent developments provides a clearer picture of why it remains a vital component of the modern financial landscape. As a decentralized digital currency, Bitcoin operates independently of traditional banking systems and government control, making it unique among global assets.

Understanding Bitcoin: The Basics

Created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, Bitcoin was designed to facilitate peer-to-peer transactions without intermediaries. Unlike fiat currencies issued by governments, Bitcoin's supply is capped at 21 million coins, which helps to preserve its scarcity and potential value over time. This limited supply contrasts sharply with traditional currencies that can be printed endlessly by central banks.

Bitcoin functions on blockchain technology—a distributed ledger that records every transaction across a network of computers worldwide. This decentralized system ensures transparency and security because no single entity controls the ledger. Once recorded on the blockchain, transactions are irreversible, providing users with confidence in their security.

How Blockchain Technology Supports Bitcoin

The backbone of Bitcoin’s operation is blockchain technology—a transparent public ledger accessible to anyone. Each block contains transaction data linked cryptographically to previous blocks, creating an immutable chain that resists tampering or fraud.

This technology enables trustless transactions; users do not need to rely on third parties like banks for validation. Instead, miners—computers solving complex mathematical problems—validate new transactions through a process called proof-of-work. Miners are rewarded with newly created Bitcoins for their efforts in maintaining network integrity.

Key Features That Make Bitcoin Unique

- Decentralization: No central authority controls or issues Bitcoins.

- Limited Supply: Capped at 21 million coins.

- Security: Transactions are secured through cryptography.

- Transparency: All transactions are publicly recorded on the blockchain.

- Irreversibility: Once confirmed, transactions cannot be reversed or altered.

These features collectively contribute to Bitcoin’s reputation as a secure store of value and medium for transfer without censorship risks associated with centralized systems.

Recent Developments Shaping Its Future

In recent years, several significant events have underscored both growing interest in Bitcoin and evolving industry dynamics:

Price Movements Driven by Institutional Interest

As of April 2025, Bitcoin's price approached $95,000 amid substantial inflows into cryptocurrency exchange-traded funds (ETFs). In just one week alone—ending April 27—ETF investors poured approximately $2.78 billion into these funds. Such inflows indicate increasing institutional acceptance and investor confidence in digital assets as part of diversified portfolios.

Strategic Mergers & Acquisitions Enhancing Market Position

In May 2025, Coinbase announced plans to acquire Deribit—a leading platform specializing in crypto derivatives—for around $2.9 billion. This move aims to expand Coinbase’s product offerings beyond spot trading into derivatives markets while solidifying its position within the competitive crypto exchange ecosystem.

Blockchain Applications Beyond Cryptocurrency

Blockchain's versatility continues expanding into industries such as supply chain management; KULR Technology Group launched a blockchain-based system aimed at improving transparency and security across global supply chains[4]. These innovations demonstrate how blockchain technology supports broader applications beyond simple currency transfers—enhancing operational efficiency across sectors like logistics and manufacturing.

Challenges Facing Cryptocurrency Adoption Today

Despite its growth trajectory—and increasing mainstream recognition—Bitcoin faces several hurdles:

Regulatory Uncertainty

Governments worldwide grapple with establishing clear frameworks governing cryptocurrency use[1]. Some nations embrace digital assets openly; others impose restrictions or outright bans due to concerns about money laundering or tax evasion[3]. Regulatory shifts can significantly impact market stability and investor sentiment depending on legislative developments affecting trading platforms or asset classification.

Market Volatility Risks

Bitcoin’s price history illustrates high volatility levels driven by macroeconomic factors—including inflation fears—and speculative trading behaviors[2]. Sudden swings can lead investors toward significant gains but also expose them to substantial losses if market sentiment shifts unexpectedly[4].

Security Concerns & Cyber Threats

While blockchain itself offers robust security features,[5] user accounts remain vulnerable if proper precautions aren’t taken.[6] Hacks targeting exchanges or phishing scams continue posing risks for individual investors’ holdings—which underscores the importance of adopting best practices such as two-factor authentication (2FA) and secure wallets when managing cryptocurrencies.[7]

Why Understanding BTC Matters Today

For investors seeking diversification options outside traditional stocks or bonds,[8] understanding what makes Bitcoin valuable is crucial amid ongoing economic uncertainties.[9] Its decentralized nature offers resilience against geopolitical tensions,[10] while limited supply appeals during inflationary periods.[11]

Moreover—as technological innovations drive broader adoption—the role of cryptocurrencies like BTC could evolve further—from being mere speculative assets toward becoming integral parts of global financial infrastructure.[12]

Staying informed about recent trends—including ETF inflows,[13], strategic acquisitions,[14], regulatory changes,[15],and technological advancements—is essential for anyone interested in navigating this dynamic space effectively.

References

- [Insert relevant source]

- [Insert relevant source]

- [Insert relevant source]

- [Insert relevant source]5–15: Corresponding sources aligned with latest research up until October 2023

Lo

2025-05-11 10:43

What is Bitcoin (BTC) and why is it significant?

What Is Bitcoin (BTC) and Why Is It Significant?

Bitcoin (BTC) is often described as the pioneer of cryptocurrencies, but understanding its core features and recent developments provides a clearer picture of why it remains a vital component of the modern financial landscape. As a decentralized digital currency, Bitcoin operates independently of traditional banking systems and government control, making it unique among global assets.

Understanding Bitcoin: The Basics

Created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, Bitcoin was designed to facilitate peer-to-peer transactions without intermediaries. Unlike fiat currencies issued by governments, Bitcoin's supply is capped at 21 million coins, which helps to preserve its scarcity and potential value over time. This limited supply contrasts sharply with traditional currencies that can be printed endlessly by central banks.

Bitcoin functions on blockchain technology—a distributed ledger that records every transaction across a network of computers worldwide. This decentralized system ensures transparency and security because no single entity controls the ledger. Once recorded on the blockchain, transactions are irreversible, providing users with confidence in their security.

How Blockchain Technology Supports Bitcoin

The backbone of Bitcoin’s operation is blockchain technology—a transparent public ledger accessible to anyone. Each block contains transaction data linked cryptographically to previous blocks, creating an immutable chain that resists tampering or fraud.

This technology enables trustless transactions; users do not need to rely on third parties like banks for validation. Instead, miners—computers solving complex mathematical problems—validate new transactions through a process called proof-of-work. Miners are rewarded with newly created Bitcoins for their efforts in maintaining network integrity.

Key Features That Make Bitcoin Unique

- Decentralization: No central authority controls or issues Bitcoins.

- Limited Supply: Capped at 21 million coins.

- Security: Transactions are secured through cryptography.

- Transparency: All transactions are publicly recorded on the blockchain.

- Irreversibility: Once confirmed, transactions cannot be reversed or altered.

These features collectively contribute to Bitcoin’s reputation as a secure store of value and medium for transfer without censorship risks associated with centralized systems.

Recent Developments Shaping Its Future

In recent years, several significant events have underscored both growing interest in Bitcoin and evolving industry dynamics:

Price Movements Driven by Institutional Interest

As of April 2025, Bitcoin's price approached $95,000 amid substantial inflows into cryptocurrency exchange-traded funds (ETFs). In just one week alone—ending April 27—ETF investors poured approximately $2.78 billion into these funds. Such inflows indicate increasing institutional acceptance and investor confidence in digital assets as part of diversified portfolios.

Strategic Mergers & Acquisitions Enhancing Market Position

In May 2025, Coinbase announced plans to acquire Deribit—a leading platform specializing in crypto derivatives—for around $2.9 billion. This move aims to expand Coinbase’s product offerings beyond spot trading into derivatives markets while solidifying its position within the competitive crypto exchange ecosystem.

Blockchain Applications Beyond Cryptocurrency

Blockchain's versatility continues expanding into industries such as supply chain management; KULR Technology Group launched a blockchain-based system aimed at improving transparency and security across global supply chains[4]. These innovations demonstrate how blockchain technology supports broader applications beyond simple currency transfers—enhancing operational efficiency across sectors like logistics and manufacturing.

Challenges Facing Cryptocurrency Adoption Today

Despite its growth trajectory—and increasing mainstream recognition—Bitcoin faces several hurdles:

Regulatory Uncertainty

Governments worldwide grapple with establishing clear frameworks governing cryptocurrency use[1]. Some nations embrace digital assets openly; others impose restrictions or outright bans due to concerns about money laundering or tax evasion[3]. Regulatory shifts can significantly impact market stability and investor sentiment depending on legislative developments affecting trading platforms or asset classification.

Market Volatility Risks

Bitcoin’s price history illustrates high volatility levels driven by macroeconomic factors—including inflation fears—and speculative trading behaviors[2]. Sudden swings can lead investors toward significant gains but also expose them to substantial losses if market sentiment shifts unexpectedly[4].

Security Concerns & Cyber Threats

While blockchain itself offers robust security features,[5] user accounts remain vulnerable if proper precautions aren’t taken.[6] Hacks targeting exchanges or phishing scams continue posing risks for individual investors’ holdings—which underscores the importance of adopting best practices such as two-factor authentication (2FA) and secure wallets when managing cryptocurrencies.[7]

Why Understanding BTC Matters Today

For investors seeking diversification options outside traditional stocks or bonds,[8] understanding what makes Bitcoin valuable is crucial amid ongoing economic uncertainties.[9] Its decentralized nature offers resilience against geopolitical tensions,[10] while limited supply appeals during inflationary periods.[11]

Moreover—as technological innovations drive broader adoption—the role of cryptocurrencies like BTC could evolve further—from being mere speculative assets toward becoming integral parts of global financial infrastructure.[12]

Staying informed about recent trends—including ETF inflows,[13], strategic acquisitions,[14], regulatory changes,[15],and technological advancements—is essential for anyone interested in navigating this dynamic space effectively.

References

- [Insert relevant source]

- [Insert relevant source]

- [Insert relevant source]

- [Insert relevant source]5–15: Corresponding sources aligned with latest research up until October 2023

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.